Top Five Cryptocurrencies to Watch: BTC, HYPE, LINK, SUI, DASH

0

0

LINK posted its third consecutive week of consistent decline, dropping by over 6%. The last seven days were some of the most bearish for the asset.

The losses during this period led the asset to its lowest level since August 2024. It plummeted from $10 to $7.2. However, LINK is yet to show any notable change in its trajectory on Monday.

The asset rebounded last week following its plunge and ended the session at $9. At the time of writing, it trades slightly lower.

A look at the global cryptocurrency market cap shows that LINK has yet to surge amid bearish sentiment. The entire sector prints a red candle representing Monday in response to the slight decline.

However, paying close attention to how prices trended over the last two weeks shows that trading conditions may improve in the coming hours. Following the 3-week decline, investors will be more inclined to stage relief rallies over the next six days. Nonetheless, fundamentals may aid or end their bid.

Two such reports are the job openings report on Tuesday and the initial jobless claims on Thursday. The US BLS will also release the employment report and CPI in the coming days.

Away from fundamentals, let’s see how some cryptocurrencies will perform in the coming days.

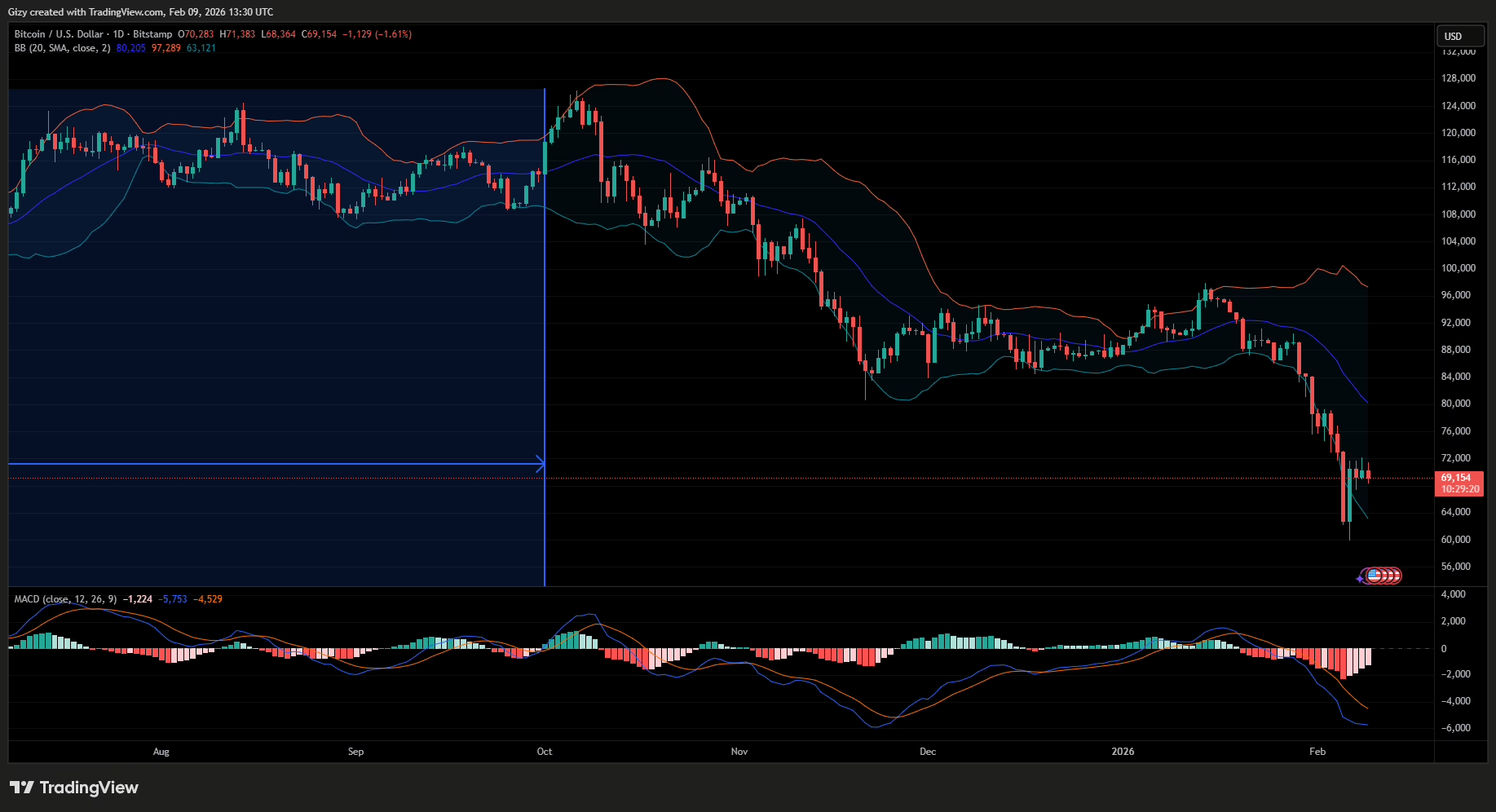

BTC/USD

Bitcoin is down 2% on Monday as the bulls fail to stage further buybacks. It saw slight gains on Sunday but has since failed to extend those gains as traders took profits. As it stands, it may be heading for one of its worst starts if the trend continues.

The apex coin ended the previous week with losses exceeding 11%, marking its third week of consistent decline. Nonetheless, its rocky start to the new session casts a dark, foreboding shadow over price action in the next six days.

Additionally, indicators offer little or no definitive insight into price direction in the coming days. For example, MACD displayed a bearish divergence a few weeks ago and has been in a downtrend. Prices have also stayed near Bollinger’s lower band without rebounding.

The only pronounced metric is the relative strength index, which broke below 30 last week and rebounded. It is currently at 31 and may slip below 30 again if the price downtrend persists. Nonetheless, dropping below the mark will see the apex coin become oversold; a rebound is near.

In summary, RSI suggests that BTC will not experience the same massive decline it had last week. If further decline happens, it will maintain the same low. Conversely, previous price movements hint at an attempt $75k in the event of further increases.

HYPE/USD

HYPE ended the previous week as one of the top gainers, up more than 6%. The 1-day chart shows that it was off to a good start, surging over 8% last Monday and peaking at $38.3 the next day.

However, the opposite is taking place at the time of writing. It is down by almost 3% and is struggling to hold prices above $31.

The Bollinger Bands suggest the asset may be mostly bearish over the next 6 days. A closer look at the chart shows that the rejection at its previous high happened outside the bands. Further decline is almost assured following the breakout.

HYPE’s next target will be the middle band at $29. However, previous price movement indicates that the mark is weak. A drop to $28 is more likely. Adding to the likelihood of a further downtrend is the impending bearish crossover in the MACD.

LINK/USD

Following three weeks of consistent decline, LINK shed another 2% on Monday. It’s off to a bad start, suggesting that the bears are still in control.

The latest decline follows the notable pullback on Friday, during which the asset rebounded from $7.2 to $9. However, a closer look at the chart shows it grappled with slight selling pressure afterward. As a result, it failed to continue above the mark.

At the time of writing, LINK trades at $8.58, indicating that the mark still stands. Its current stay below the barrier raises the probability of another dip to $7.

Nonetheless, the relative strength index suggests that a rebound is more likely. It trends at 29 as of the time of writing, indicating that the asset is oversold and due for buybacks. If that happens, LINK will break above the resistance. However, previous price movements point to notable selling congestion at $10.

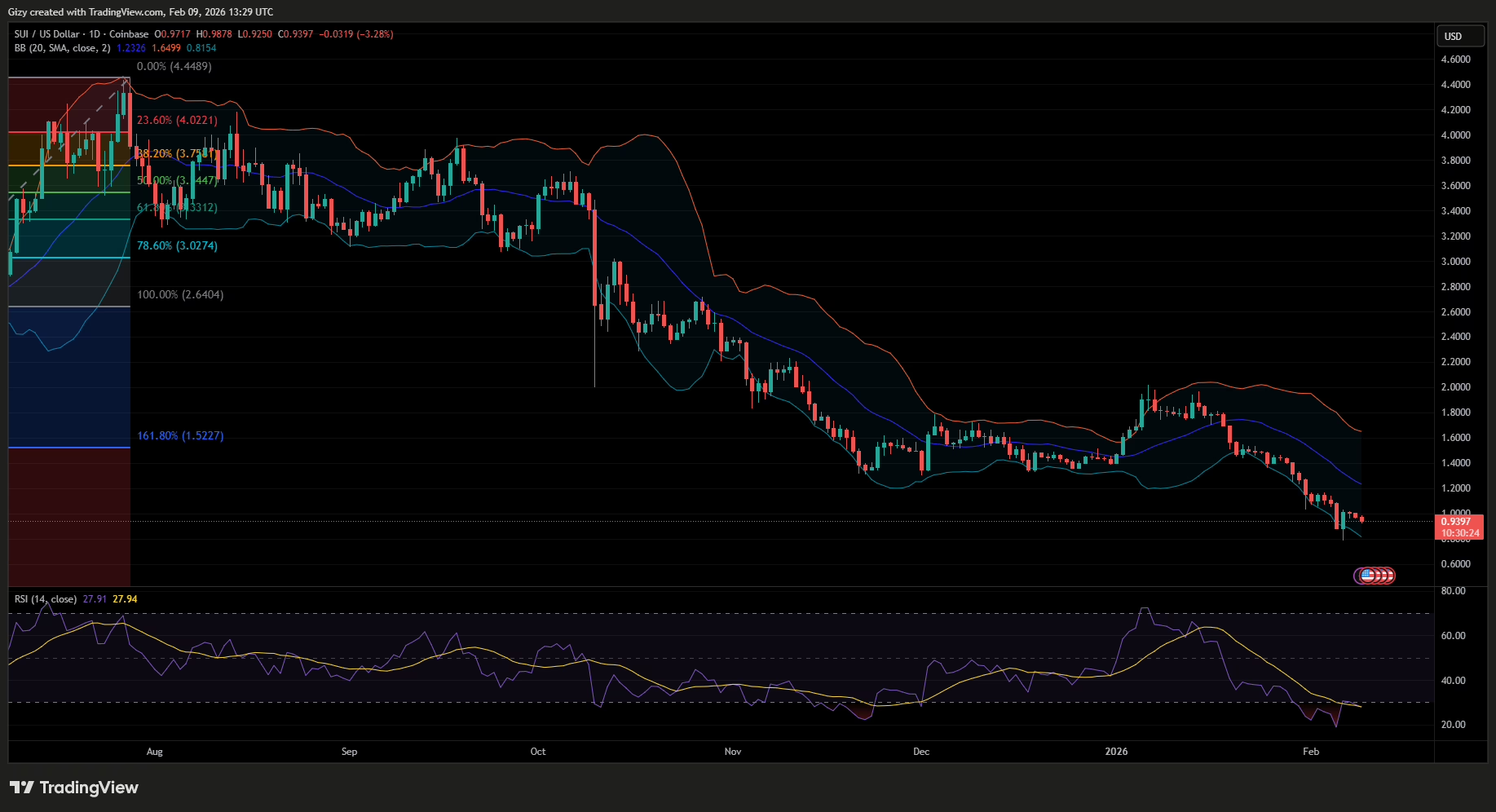

SUI/USD

On Friday, SUI dropped to a low of $0.78 before rebounding with a 15% surge. It erased more than half the losses it incurred the previous day, marking the largest green of the week.

However, the 1-day chart shows the downtrend resumed the next day, and the asset has since been in decline. A bearish close on Monday will mark its third consecutive day of downturn.

Currently down by over 3%, the coin rebounded, but the pullback is not significant. Nonetheless, a closer look at price action during the previous week reveals that, like LINK, Sui is grappling with notable selling congestion slightly above $1.

The asset is trading at $0.94, suggesting a higher risk of a further plunge below $0.80. However, RSI suggests a rebound may occur soon, as it is trending at 27. With SUI oversold, bulls may stage buybacks. It remains to be seen if they’ll decisively flip $1 this time. Nonetheless, breaking above the mark will guarantee an attempt at $1.10.

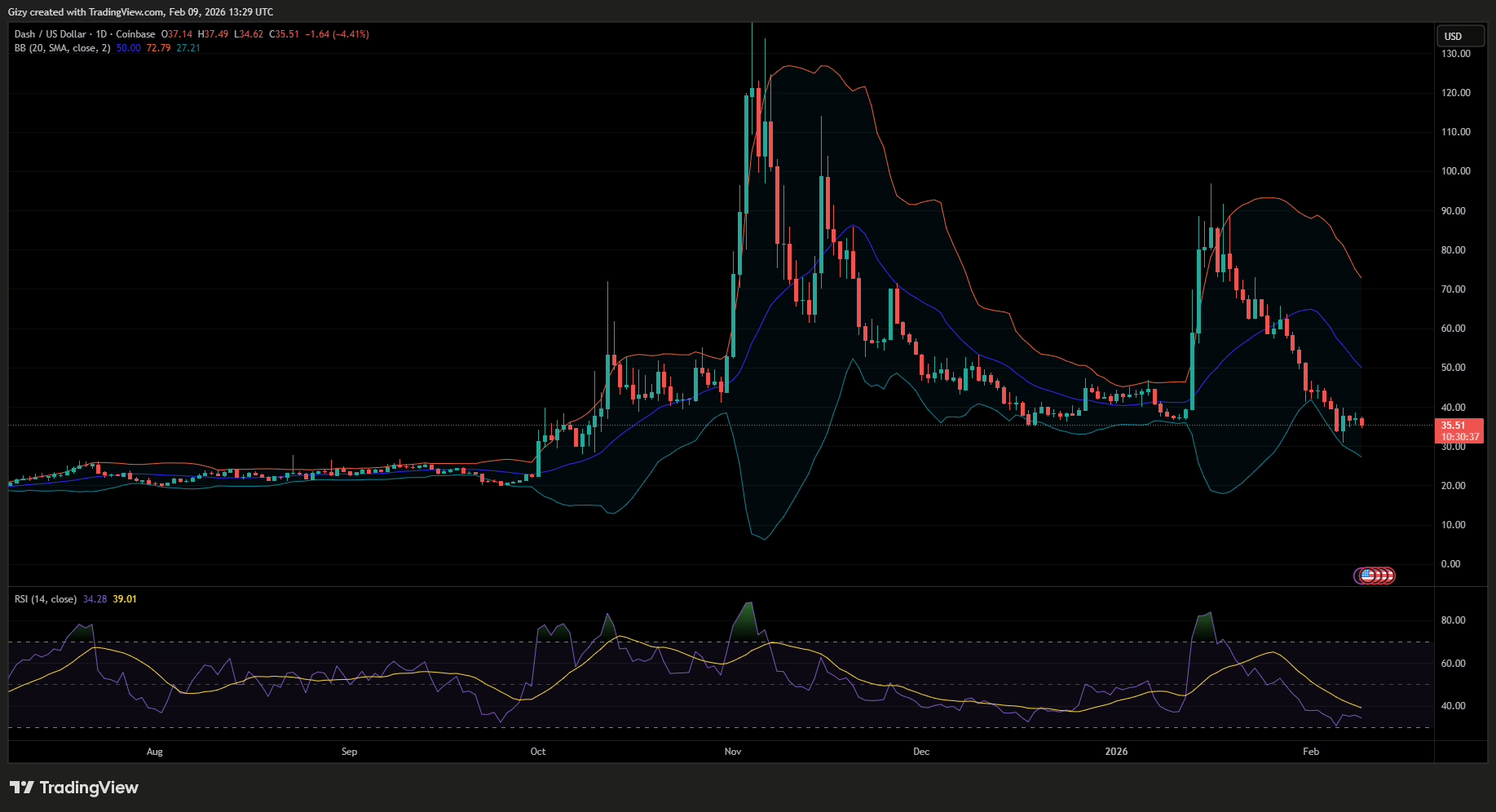

DASH/USD

DASH registered losses of more than 15% last week. Like LINK, this was its third consecutive week of consistent decline. Nonetheless, the PNL for the session masks the full extent of its drop.

On Friday, it retraced to a low of $30, which was unsurprising as a previous outlook noted that it would see massive retracements. The asset pulled back some losses afterward, and a new trend is unfolding.

A closer look at the chart shows that the altcoin has been rangebound over the last two days. If it fails to surge higher in the coming hours, Monday will mark the third day in this trend. Nonetheless, it would also mean that it is gearing up for a breakout.

DASH rebounded off bollinger’s lower band a few days ago. It may continue upward in the coming days. In that case, it will attempt $45 within the next six days. Conversely, it may retest the previous week’s low if trading conditions remain the same.

The post Top Five Cryptocurrencies to Watch: BTC, HYPE, LINK, SUI, DASH appeared first on CoinTab News.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.