What Crypto Whales Are Buying Ahead of US CPI Reveal

0

0

One day before the US CPI print, crypto whales are showing clear positioning. While Bitcoin stays near highs, it’s mid-cap altcoins that are drawing attention from the top wallets.

Over the past 7 days, tokens like 1inch (1INCH), Chainlink (LINK), and Curve (CRV) have seen fresh accumulation, visible through holder balance spikes and small exchange outflows. Here’s a closer look at where the money’s moving and what it might mean.

1inch (1INCH)

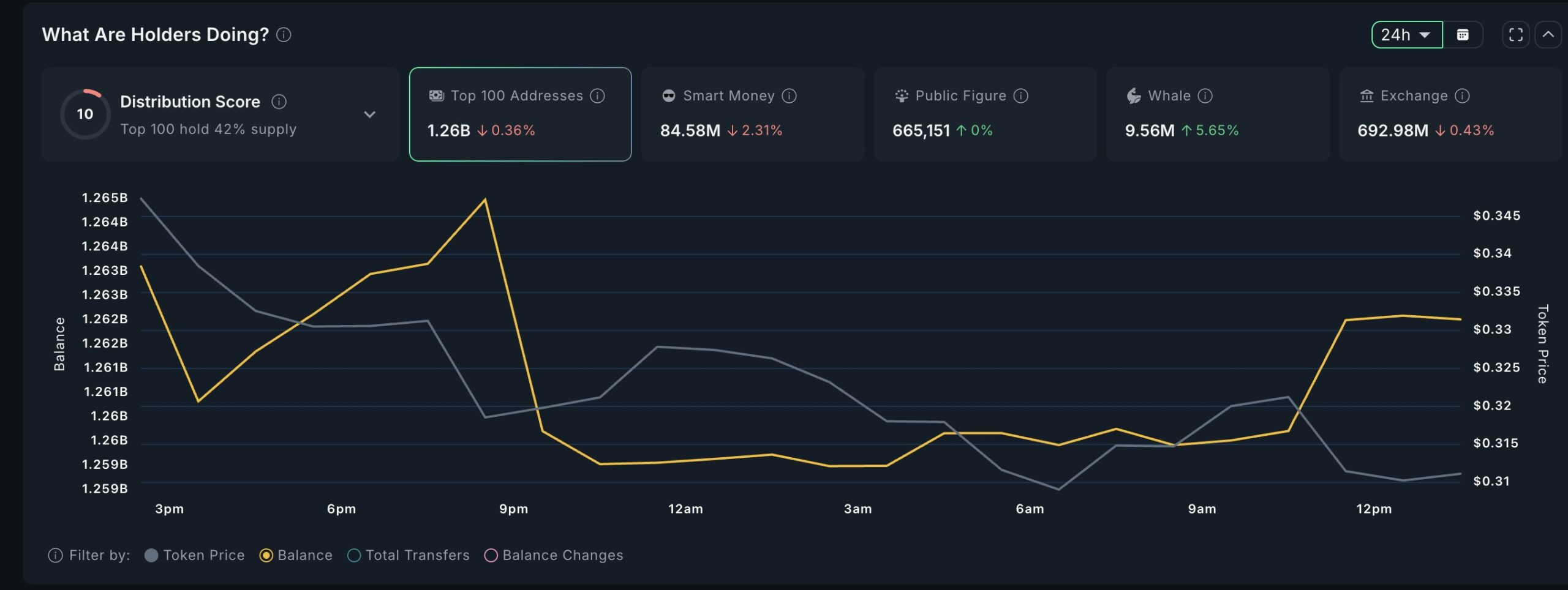

In the last 24 hours, whale holdings for 1inch rose by 5.65%, pushing the total balance held by these wallets to 9.56 million tokens. At the same time, the top 100 addresses still hold about 1.26 billion 1INCH, though their share slightly dipped, hinting at redistribution rather than exits.

1INCH whale activity: Nansen

1INCH whale activity: Nansen

The balance chart shows a steady lift from around midday onwards on July 14, indicating fresh demand while the token price hovered between $0.32 and $0.33. Meanwhile, smart money and exchange balances barely moved, suggesting the action was mainly large wallet accumulation.

Despite a 5.65% surge in whale holdings, the 1INCH price dipped by nearly 8% day-on-day, suggesting whales may be positioning early ahead of expected on-chain volume spikes, rather than chasing short-term gains.

Crypto whales may be rotating into 1inch as a bet on DEX activity surging if CPI drops and risk-on sentiment returns, boosting on-chain trading volumes.

Chainlink (LINK)

From July 10 onward, LINK saw a 6.19% increase in whale holdings, now sitting at 2.84 million tokens. The most notable surge came between July 11 and 12, with a visible jump in balance just before the token price hit local highs near $16.

Crypto whales buying LINK: Nansen

Crypto whales buying LINK: Nansen

Top 100 addresses now hold 654.73 million LINK, up slightly from earlier in the week. Exchange balances dropped 1.51%, supporting the view that LINK is moving to self-custody or cold wallets. The price of LINK surged almost 18% over the past week, which shows that crypto whales have been accumulating.

This hints at renewed optimism.

Curve DAO (CRV)

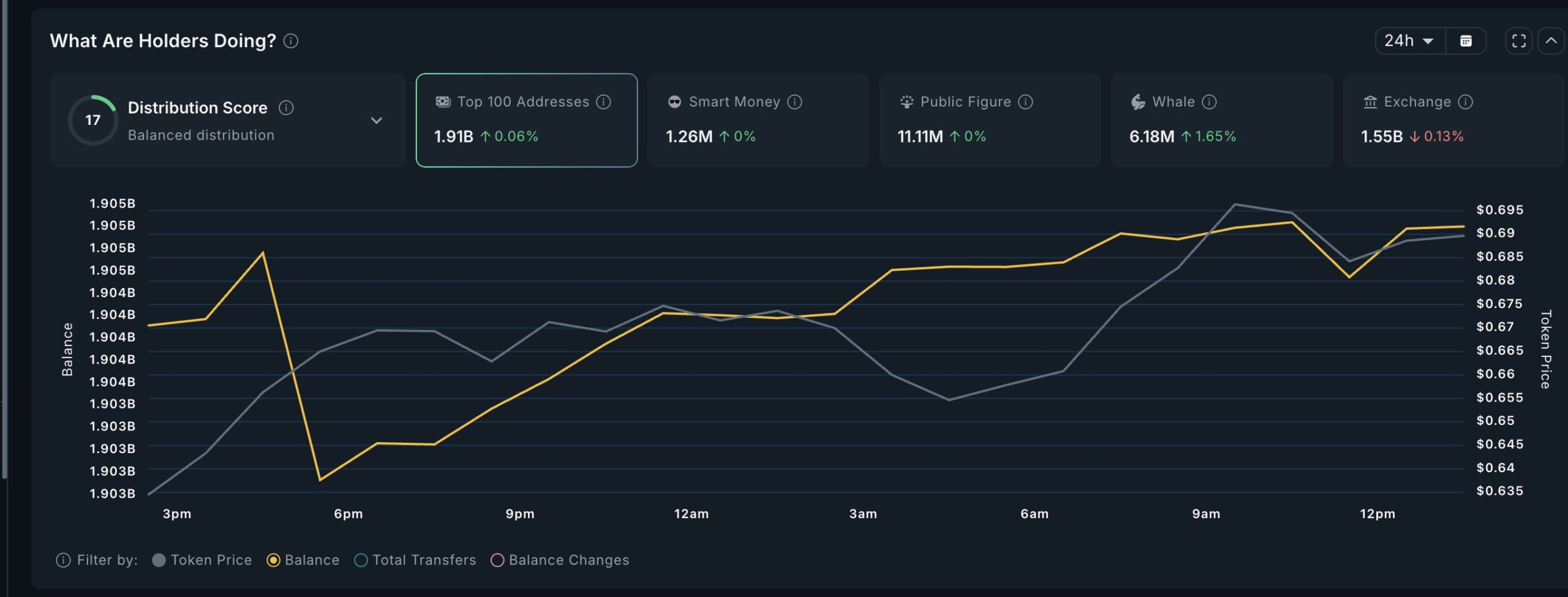

CRV’s crypto whale wallets added 1.65% more tokens, taking total holdings to 6.18 million. Though the shift is small, the pattern is consistent across the last 24 hours; the yellow balance line shows a steady climb throughout the night and into the morning of July 14.

Crypto whales and CRV accumulation: Nansen

Crypto whales and CRV accumulation: Nansen

The top 100 wallet holdings increased slightly by 0.06%, suggesting large holders are gradually re-accumulating. CRV’s price climbed toward $0.69, up almost 7% day-on-day, in line with the whale accumulation patterns.

Curve specializes in stablecoin swaps, offering low fees and deeper liquidity: traits that attract big money looking for a hedge when inflation data is due, like the U.S. CPI release tomorrow.

Honorary Mention: SPX6900 (SPX)

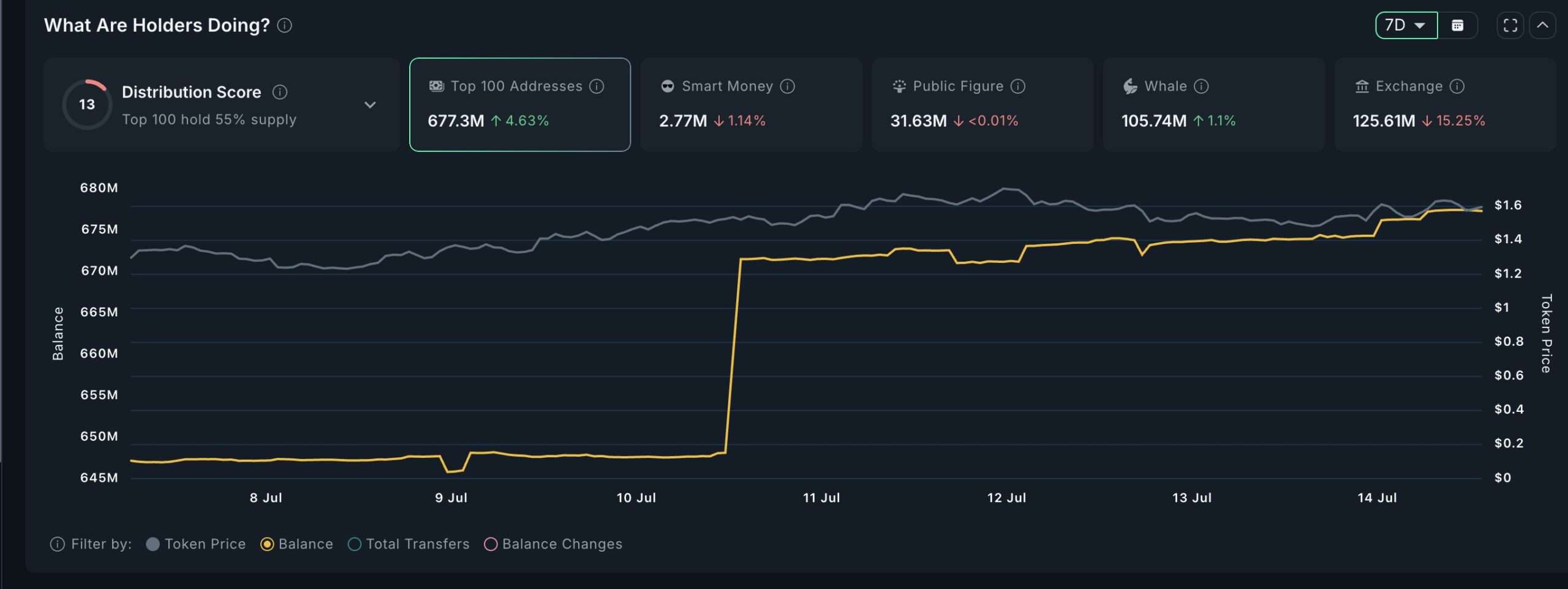

The SPX6900 token, often viewed as the sector index for meme coins, showed a 1.1% rise in crypto whale holdings, and top 100 wallets added 4.63% more tokens this week. While smaller in scale compared to the others, the directional flow adds weight to the broader meme coin rotation narrative.

The token price moved closer to $1.60, and the inflow pattern from July 10–13 shows coordinated entry points.

SPX whale activity: Nansen

SPX whale activity: Nansen

Even with CPI-driven caution, this quiet uptick in SPX hints that some traders are still betting on the meme coin supercycle to continue, especially if inflation data favors risk-on sentiment.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.