Bitcoin Price Prediction: Analysts Predict $150K as Whales Accumulate and Musk Joins the Fight

0

0

The Bitcoin price is holding near $108,955 as of press time, supported by a renewed wave of confidence in the cryptocurrency market. This week, a combination of high-profile political support and significant corporate acquisitions has injected fresh momentum into BTC, with investors and analysts closely watching for the next big move.

Elon Musk’s endorsement shifts the narrative

Elon Musk, the CEO of Tesla and SpaceX, made headlines by officially endorsing the America Party’s support for BTC adoption. In a statement posted on X, Musk described fiat money as hopeless and positioned BTC as a cornerstone of the party’s fiscal vision ahead of the 2026 midterm elections.

While some critics dismissed the move as a mere soundbite, Musk’s companies already hold nearly 19,800 BTC, valued at over $2.1 billion. This endorsement has reinforced BTC’s credibility as a long-term hedge against inflation and centralized policy risk, and it has helped to shift sentiment in the crypto space toward optimism.

Corporate accumulation fuels the bullish case

The Bitcoin price narrative received another boost as Japan’s Metaplanet announced the purchase of 2,204 BTC for $237 million, making it the fifth-largest corporate holder of Bitcoin with a total of 15,555 BTC. This acquisition leapfrogs Metaplanet ahead of Tesla and CleanSpark, highlighting the growing trend of global firms expanding their Bitcoin treasuries.

Other companies are following suit: France’s Blockchain Group acquired 116 BTC, bringing its total to 1,904 BTC, while the UK-based Smarter Web Company added 226 BTC, now holding 1,000 BTC after an impressive 26,242% year-to-date return.

Technical analysis: key levels in play

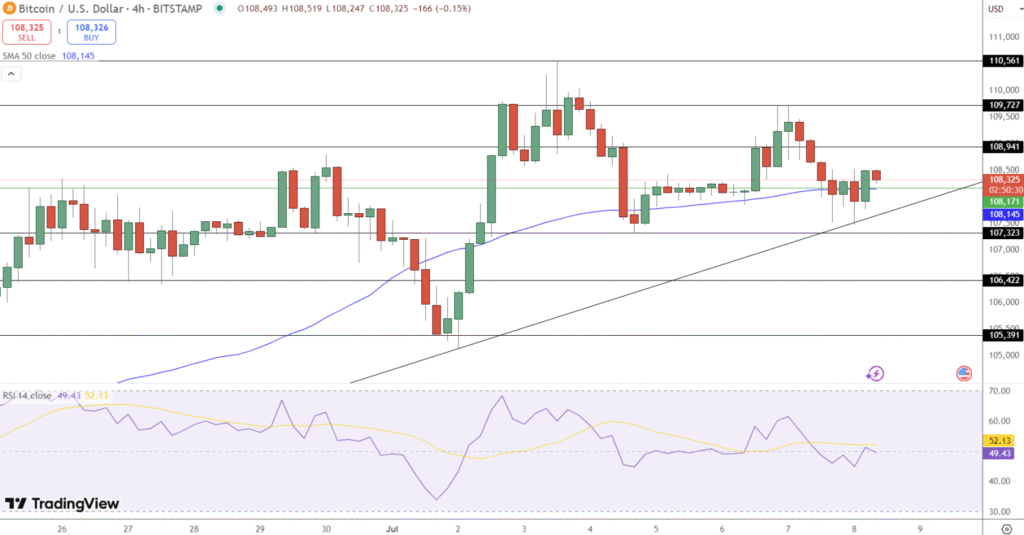

On the technical front, the Bitcoin price is currently bouncing off an ascending trendline, with the 50-SMA at $108,146 providing dynamic support. Resistance remains at $108,941, and the recent price structure—characterized by small-bodied candles and long wicks—indicates a market in a state of indecision.

The relative strength index sits at a neutral 49.60, suggesting that momentum is steady but still searching for direction. A breakout above $108,941 could propel the Bitcoin price toward $109,727 and potentially $110,561, while a loss of support could see it drop to $107,323 or even $106,422.

Institutional conviction remains strong

Despite some analysts warning that early treasury gains are fading, Metaplanet’s continued purchases suggest that institutional conviction remains robust. Strategic accumulations by companies like Strategy and ProCap, as well as smaller firms, are helping to cushion the Bitcoin price during periods of macroeconomic volatility.

Supply dynamics: Hodlers hold the line

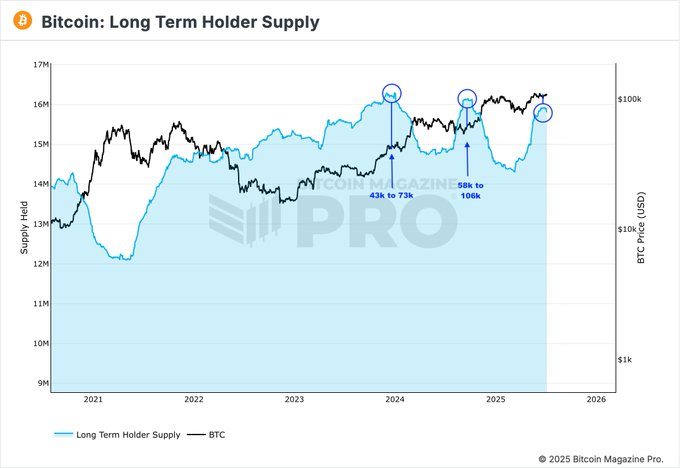

According to CrediBULL Crypto, over 80% of all Bitcoin that will ever exist is currently being held by long-term investors, often referred to as hodlers. This is a significant milestone, as the only two times in Bitcoin’s 15-year history when this percentage was higher were before major price surges.

When steadfast investors hold the majority of the circulating supply, the Bitcoin price tends to move up aggressively at the first sign of new demand. With excess supply now back in the hands of long-term holders, the stage is set for another potential impulse.

Trade setup: What traders are watching

For traders, the current setup offers clear entry and exit points. According to the analyst, a buy entry above $108,950 on a strong bullish candle is recommended, with targets at $109,727 and $110,561.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| July | $109,213.61 | $130,955.60 | $152,697.59 |

41.2%

|

| August | $102,544.14 | $113,042.96 | $123,541.77 |

14.2%

|

| September | $104,342.23 | $106,889.47 | $109,436.71 |

1.2%

|

| October | $100,199.17 | $99,887.50 | $99,575.82 |

-7.9%

|

| November | $100,711.21 | $100,299.36 | $99,887.50 |

-7.7%

|

| December | $102,623.18 | $100,973.85 | $99,324.51 |

-8.2%

|

A stop-loss should be placed below $108,100. As long as the trendline holds and the price stays above the 50-SMA, bulls maintain short-term control over the Bitcoin price.

Musk’s endorsement and the America Party’s embrace of BTC could have far-reaching implications for US crypto regulation. The symbolic support from one of the world’s most influential entrepreneurs may prompt lawmakers to reconsider how digital assets are treated in future economic strategies.

Conclusion

With institutional buying on the rise, political support growing, and supply increasingly locked away by long-term holders, the conditions appear ripe for the next major Bitcoin price rally. Many analysts are speculating whether the next impulse could push the asset toward the $150,000 mark. As the market awaits the next move, all eyes remain on the key support and resistance levels that will determine the short-term trajectory of the Bitcoin price.

Summary

BTC price is holding steady near $108,341, buoyed by renewed confidence from both political and corporate spheres. Elon Musk’s endorsement of the America Party’s pro-Bitcoin stance and major acquisitions by companies like Metaplanet have injected fresh momentum into the market.

Technical indicators show key support and resistance levels, while institutional conviction remains strong. With over 80 percent of Bitcoin held by long-term investors, analysts are watching for a potential rally that could push the price toward new highs.

Frequently Asked Questions (FAQ)

1- What is driving the current Bitcoin price?

A mix of political endorsements, such as Elon Musk’s support, and significant corporate acquisitions are driving the current Bitcoin price.

2- How much Bitcoin does Metaplanet hold?

Metaplanet now holds 15,555 BTC, making it a major influence on bitcoin price trends.

3- What technical levels are important for Bitcoin price right now?

Key levels include support at the 50-SMA ($108,146) and resistance at $108,941.

4- Could Bitcoin price reach $150,000?

Many analysts believe that, given current supply dynamics and institutional interest, the Bitcoin price could reach or even surpass $150,000 in the next major rally.

Appendix: Glossary of Key Terms

Bitcoin Price – The current market value of one bitcoin, typically quoted in US dollars.

HODL – A slang term in the crypto community meaning to hold onto bitcoin rather than sell, even during volatility.

SMA (Simple Moving Average) – A technical analysis tool that shows the average price of Bitcoin over a specific period.

Resistance Level – A price point where selling pressure tends to prevent the bitcoin price from rising further.

Institutional Accumulation – The process of large organizations or companies purchasing and holding significant amounts of bitcoin.

RSI (Relative Strength Index) – An indicator used in technical analysis to measure the speed and change of price movements.

Reference

CryptoNews – cryptonews.com

Read More: Bitcoin Price Prediction: Analysts Predict $150K as Whales Accumulate and Musk Joins the Fight">Bitcoin Price Prediction: Analysts Predict $150K as Whales Accumulate and Musk Joins the Fight

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.