Binance Foundation Concludes Latest Quarterly Burn, Effect On BNB Price?

0

0

BNB coin is considered a deflationary cryptocurrency largely because it has a burning schedule designed to take coins out of supply over time. But what does this mean for the BNB coin in the short and long term?

The Binance Foundation reportedly finalized its latest quarterly burn. According to the official announcement, just over 1.5 million coins worth a little over $1 Billion were taken out of supply during the latest burn.

About 139,289,465.21 BNB remained in supply, which had a market cap of just over $96 Billion at the time of observation.

The latest burn took out roughly 1.15% of the current supply. While this may not seem like much, the deflationary approach ensures BNB is more valuable in the long run which also incentivizes holders. But will the latest burn have an impact on BNB price action in the short term?

BNB Price Action Recap

BNB’s deflationary mechanism has no doubt created an incentive for long-term HODLing. However, it also benefits from organic demand driven by organic utility on the BNB chain, but more on that later.

BNB happened to be among the coins that maintained an overall positive trajectory over the long term.

For context, it exchanged hands at $689 at press time, which was up over 42,000% from its historic lows.

Moreover, BNB price at press time was only around 15% away from its historic all-time high. The cryptocurrency was up by roughly 12% from its lowest price point in the last 2 months.

BNB’s price action was supported by declining sell pressure marked by low spot outflows. It maintained positive flows since June 23rd.

However, the cryptocurrency’s latest upside also resulted in a retest of a descending resistance, which could lead to a bullish breakout.

A bearish pivot could also be on the cards if profit-taking surges. On the derivatives side, open interest achieved a sizable uptick in the last 2 weeks.

It surged by over $70 Million to around $789 Million. However, open interest significantly low compared to its peak in December which surged as high as $1.26 Billion.

BNB Chain DEX Volume on the Verge of New Highs

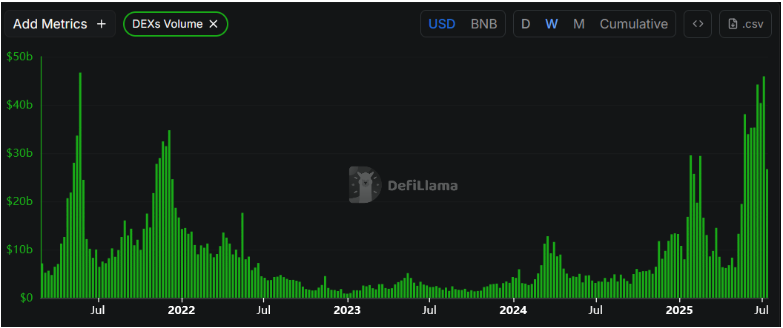

The cryptocurrency market recently experienced a surge in DeFi activity, evident by the robust DEX volumes observed in the last 4 weeks.

Interestingly, a huge percentage of those volumes occurred on the Binance smart chain. According to DeFiLlama, the BSC handled over $182 Billion in DEX volumes in the last 30 days.

This meant it was the leading chain by DEX volumes. Ethereum came in second at just over $54 Billion during the same period.

DEX volume on the BSC has experienced an aggressive surge since May. For context, weekly DEX volume surged as high as $45.91 Billion between June 30th and July 6th. This marked the second-highest weekly DEX volume in the network’s history.

The last time that DEX volume was higher was during the third week of May 2021. This meant that the volumes taking place on the BSC recently were similar to volumes observed during the peak of the previous major bull run.

Surging DEX activity on the BSC also meant that BNB experienced noteworthy demand driven by organic network activity.

Transaction activity on the network also surged since May, retesting levels seen at the height of the 2021 bull run.

BSC clocked 114.45 million transactions in the second week of June, marking the highest historic weekly transaction count.

However, transaction activity cooled down significantly in the first week of July, during which it dropped to the 93 million TXs range. This cooling off could have a similar impact on demand for BNB.

The post Binance Foundation Concludes Latest Quarterly Burn, Effect On BNB Price? appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.