Bitcoin ETFs See Seventh Consecutive Day of Inflows, BlackRock’s IBIT on Top

0

0

Highlights:

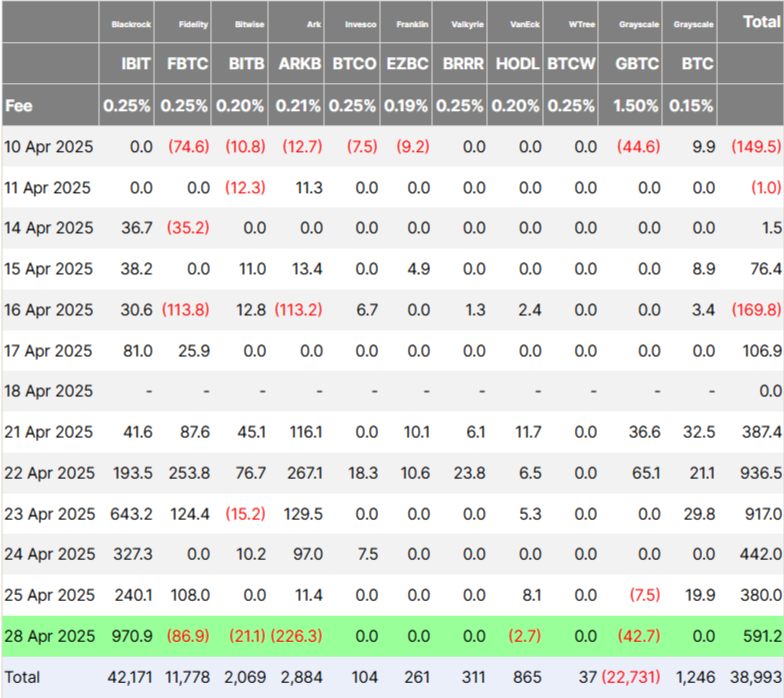

- Spot Bitcoin ETFs attracted $591.2 million, extending their streak of daily inflows to a full week.

- BlackRock’s IBIT attracted $971 million in inflows, while several ETFs saw outflows on Monday.

- South Korea’s People Power Party plans to approve spot crypto ETFs and reform digital asset laws by year’s end.

Spot Bitcoin exchange-traded funds (ETFs) in the U.S. drew $591.2 million in net inflows on April 28, continuing a seven-day streak of investor interest. This steady rise reflects a broader improvement in market sentiment surrounding Bitcoin. As stock markets face volatility and economic uncertainty increases, many are returning to Bitcoin. They view it as a hedge, similar to gold.BlackRock’s iShares Bitcoin Trust (IBIT) saw nearly $1 billion in inflows, marking its second-highest daily intake since inception.

Nearly *$1bil* into iShares Bitcoin ETF today…

2nd largest inflow since Jan 2024 inception.

I still remember when there was "no demand".

— Nate Geraci (@NateGeraci) April 29, 2025

Meanwhile, ARK 21Shares Bitcoin ETF (ARKB) faced outflows of $226.3 million, while Fidelity Wise Origin Bitcoin Fund (FBTC) experienced a $86.9 million exit. Outflows were also recorded in VanEck’s HODL, Bitwise’s BITB, and Grayscale’s GBTC.

Total trading volume for BTC ETFs fell to $2.4 billion on Monday, down from $3.2 billion on Friday. However, overall net inflows continued to rise, reaching $39.02 billion in total—the highest cumulative figure seen since February 24.

Exchange-Traded Funds Inflows Rise as BTC Price Gains Momentum

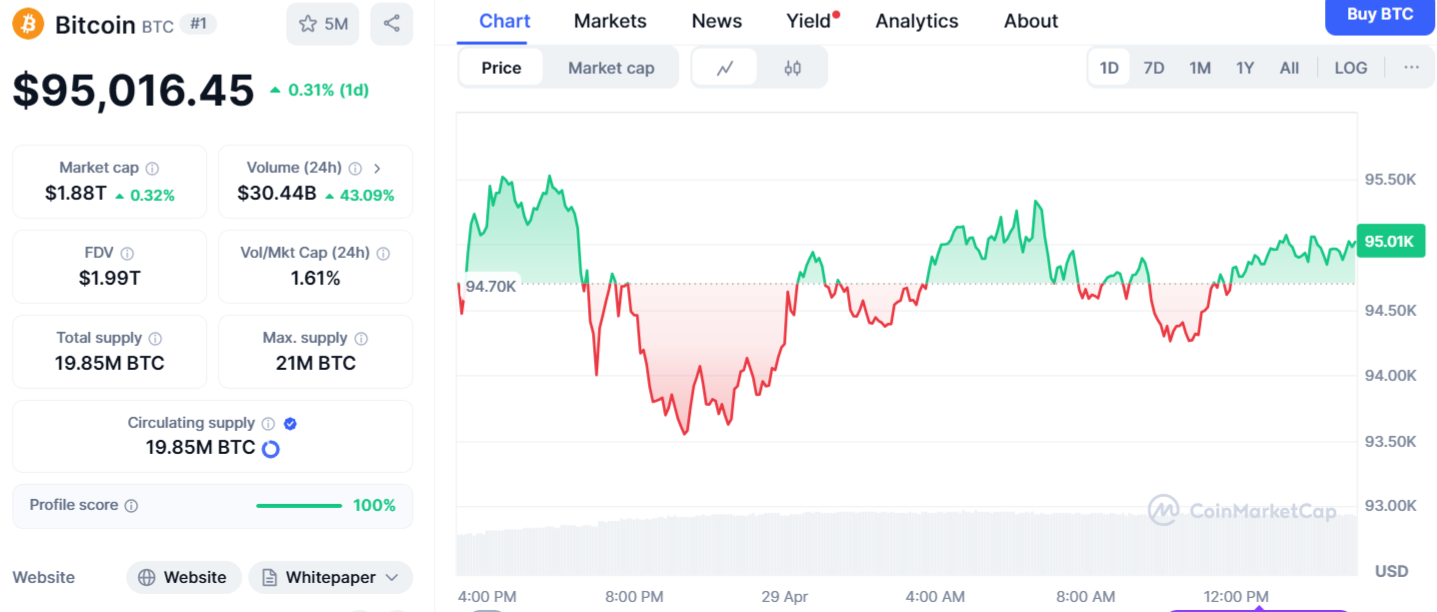

Spot Bitcoin ETFs experienced $3 billion in weekly inflows last week, marking the largest inflow since November of the previous year. Bitcoin rose by 0.31% over the past 24 hours, trading at $95,016.45.

Geoffrey Kendrick from Standard Chartered expects Bitcoin to climb to $120,000 by the second quarter of 2025 and potentially hit $200,000 before the year ends. He attributes this outlook to growing ETF inflows, large-scale accumulation by major holders, and a shift in capital away from U.S.-based assets.

Standard Chartered expects BTC rally to ~$120k in Q2. pic.twitter.com/gsNvx20wAK

— Sjuul | AltCryptoGems (@AltCryptoGems) April 28, 2025

On the other hand, spot Ether ETFs continued their inflow streak for a third day, bringing in $64 million. Ether slipped by 0.03% to trade at $1,792.

SkyBridge Capital Founder Anthony Scaramucci stated that Bitcoin is seeing increased demand due to its role as a hedge. He mentioned that BlackRock had observed institutions waiting for proof that Bitcoin could act as a hedge. Scaramucci highlighted that Bitcoin’s rise, amid declining confidence in the U.S. dollar, led to significant capital inflows into Bitcoin ETFs.

South Korea’s People Power Party Eyes Spot Crypto ETF Approval

With U.S. ETFs gaining traction, South Korea’s People Power Party plans to approve spot crypto ETFs and ease banking restrictions by year-end. They also aim to revise digital asset laws. This comes after President Yoon Suk Yeol was impeached, leading to a snap election on June 3.

BREAKING:

SOUTH KOREA PLANS TO APPROVE SPOT CRYPTO ETF TRADING LATER THIS YEAR. pic.twitter.com/bs351F0IpV

— Ash Crypto (@Ashcryptoreal) April 29, 2025

During Monday’s emergency response committee meeting at the National Assembly, Rep. Park Soo-min highlighted the urgent need for approval, pointing to the U.S. SEC’s January approval of spot Bitcoin ETFs as a key reason. The party also outlined plans to formalize corporate and institutional investor involvement in the crypto market by the end of the year. If the PPP succeeds, non-profits will be permitted to trade crypto starting in Q2. This will also enable broader participation from approximately 3,500 corporations and investment firms in the crypto space.

Soo-min said:

“It is very restrictive for citizens if they cannot trade cryptossets through the bank of their choice. [The current rules] have solidified monopolies on the market. [Our approach] will also open the door to competition between exchanges.”

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.