Uniswap Volume Crashes Canada’s GDP—Analyst Eyes $15 UNI Rise

0

0

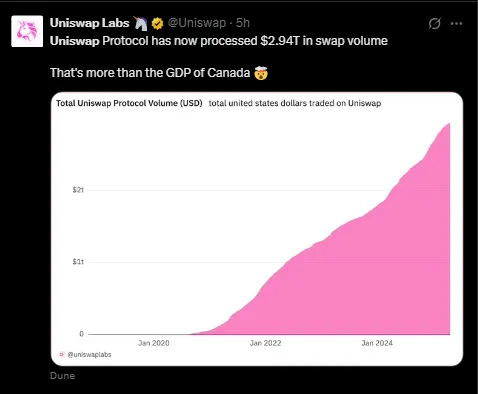

On April 23, 2025, Uniswap Labs announced that the Uniswap protocol had processed $2.94 trillion in swap volume since its 2018 launch, surpassing Canada’s 2023 GDP of $2.142 trillion.

This figure, representing the total value of token swaps across thousands of assets pairs, marks a historic moment for decentralized finance (DeFi).

Canada’s GDP reflects a robust G7 economy, yet Uniswap’s decentralized platform has outstripped it, highlighting the transformative potential of blockchain-based trading.

Uniswap’s Rise Since 2018

Founded by Hayden Adams in November 2018, Uniswap pioneered the automated market maker (AMM) model, enabling users to swap ERC-20 tokens directly from their wallets.

Unlike centralized exchanges, Uniswap operates without intermediaries, relying on smart contracts for liquidity and pricing.

This innovation drove its growth, with the DeFi boom from summer 2020 to late 2022 pushing swap volume past $1 trillion.

By April 2025, continued user adoption and trading activity tripled that figure to $2.94 trillion, per Uniswap Labs. The protocol’s ability to handle such volumes demonstrates its scalability.

UNI’s Price Analysis

Uniswap’s native token, UNI, is riding this wave. As of this writing, UNI traded at $6.03, a 7% increase in 24 hours, according to CoinMarketCap.

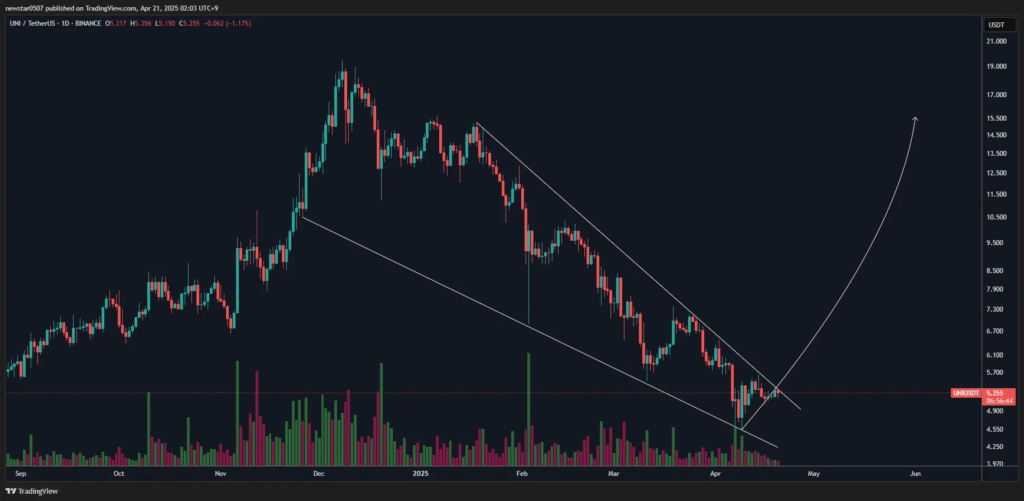

Crypto analyst CW, posting on X, predicts UNI could hit $15, a 150% gain, citing a breakout from a descending wedge pattern above $5.255.

This technical setup, where price escapes converging downtrend lines, often signals bullish reversals. UNI’s 50-day simple moving average (SMA) of $6.59, supports a positive medium-term trend.

The descending wedge breakout is a key driver of CW’s optimism. Formed by down sloping trendlines, this pattern indicates weakening selling pressure and buyer resurgence.

UNI’s move above $5.255 confirms the breakout, positioning it for potential gains. The broader crypto market bolsters this outlook.

Despite Ethereum’s decline from $4,000 to below $1,700, DeFi tokens like UNI are benefiting from renewed investor interest.

Why does this Matter?

Uniswap’s $2.94 trillion milestone is more than a number—it’s a challenge to centralized finance. Operating without offices or CEOs, Uniswap offers transparency, 24/7 access, and unlimited liquidity, contrasting with traditional systems’ gatekeepers.

This resonates with users seeking financial control, as evidenced by Uniswap’s user base growth since 2018. The milestone counters skeptics who dismiss crypto as speculative, showing DeFi’s ability to scale and process trillions trustlessly.

Uniswap’s success aligns with growing institutional interest in crypto. Bitcoin ETFs, holding $36 billion in net inflows since launch, per SoSoValue, reflect TradFi’s embrace of digital assets.

Uniswap’s model could attract similar capital, especially as DeFi platforms innovate. However, risks remain. The crypto market’s volatility—exemplified by Ethereum’s 60% drop—poses challenges.

Uniswap Founder Issues Warning on Ethereum’s Focus on L1

Recently, Uniswap founder Hayden Adams issued a stark warning: Ethereum, the backbone of 60% of DeFi’s activity, risks ceding its lead to Solana if it doesn’t prioritize layer 2 (L2) scaling.

Adams’ post on X ignited fierce debate among developers and investors, spotlighting a high-stakes race between Ethereum’s layered approach and Solana’s streamlined layer 1 (L1). Is Ethereum’s DeFi dominance slipping? Let’s break it down.

According to Adams, Ethereum’s community should stay committed to its L2 scaling roadmap, a strategy in place since 2020. ““Ethereum has been working towards an L2-centric/horizontal scaling roadmap for 5+ years,” he wrote.

“You want to throw this away at the final stretch because of what reason?” He warned that without focus, Ethereum could lose its grip on DeFi, where it hosts $48 billion in TVL.

Adams contrasted Ethereum’s path with Solana’s. He praised Solana’s team and vision, noting its L1 optimizations—faster transactions and lower fees—make it a strong DeFi contender.

The post Uniswap Volume Crashes Canada’s GDP—Analyst Eyes $15 UNI Rise appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.