Bitcoin and Ethereum ETFs Struggle with Heavy $1.4B Weekly Outflow

0

0

Highlights:

- Bitcoin and Ethereum ETFs experience weekly net outflows exceeding $1 billion.

- BlackRock Bitcoin ETF led the losses chart with over $600 million net outflows.

- Ethereum ETFs lost $237.73 million, led by Grayscale.

Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs) recorded combined weekly net outflows of $1.4 billion, as investors’ confidence in the products wavers. According to the renowned on-chain ETF tracker, SosoValue, Bitcoin ETF lost $1.17 billion last week, while Ethereum ETFs forfeited $237.73 million.

From August 18 to August 22 (ET), Bitcoin spot ETFs recorded a net outflow of $1.17 billion last week, led by BlackRock’s IBIT with $615 million in outflows. Ethereum spot ETFs saw a net outflow of $238 million, ending a 14-week streak of net inflows.https://t.co/YcNXWVZGwE pic.twitter.com/U7BspSGBEH

— Wu Blockchain (@WuBlockchain) August 25, 2025

BlackRock Leads BTC ETFs Outflows Surge

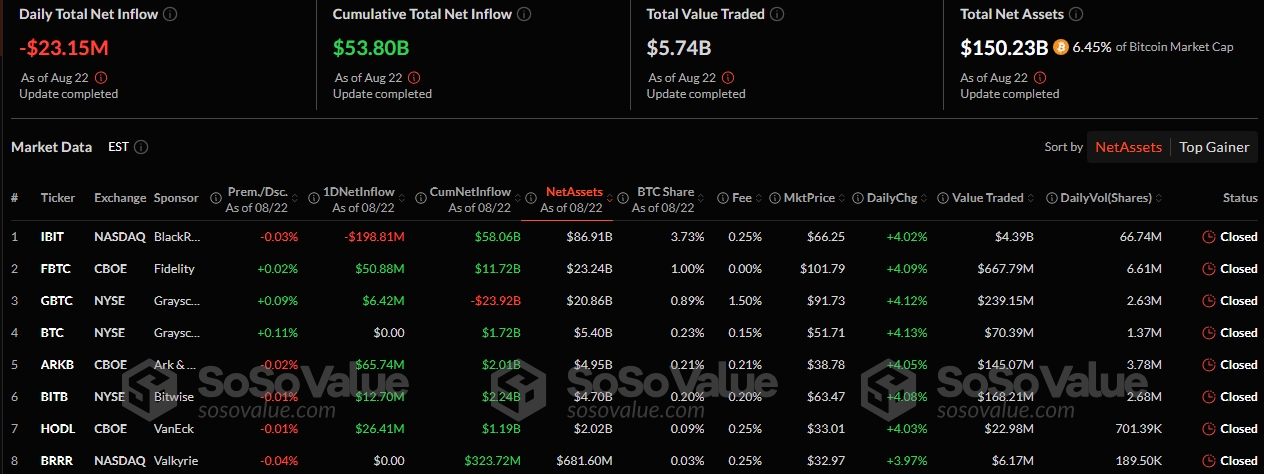

Between August 18 and August 22, Bitcoin ETFs recorded only losses, led by BlackRock Bitcoin ETF (IBIT), ending a two-week run of net inflows. Notably, IBIT saw cash inflows on four occasions but no flows on August 19. Overall, IBIT had $615 million in net outflows last week.

Aside from IBIT, other ETFs that recorded losses were Fidelity Bitcoin ETF (FBTC), ARK 21Shares Bitcoin ETF (ARKB), Grayscale Bitcoin ETF (GBTC), and Bitwise Bitcoin ETF (BITB). These products forfeited $235.3 million, $182.3 million, $118.1 million, and $60.8 million, respectively.

As a result of last week’s losses, Bitcoin ETFs’ total net inflows, value traded, and net assets recorded slight declines. These metrics are worth $53.80 billion, $19.55 billion, and $150.23 billion, respectively. Moreover, the total net assets now represent roughly 6.45% of Bitcoin’s $2.237 trillion market capitalisation.

Ethereum ETFs Erase Long-Standing Inflows Streak

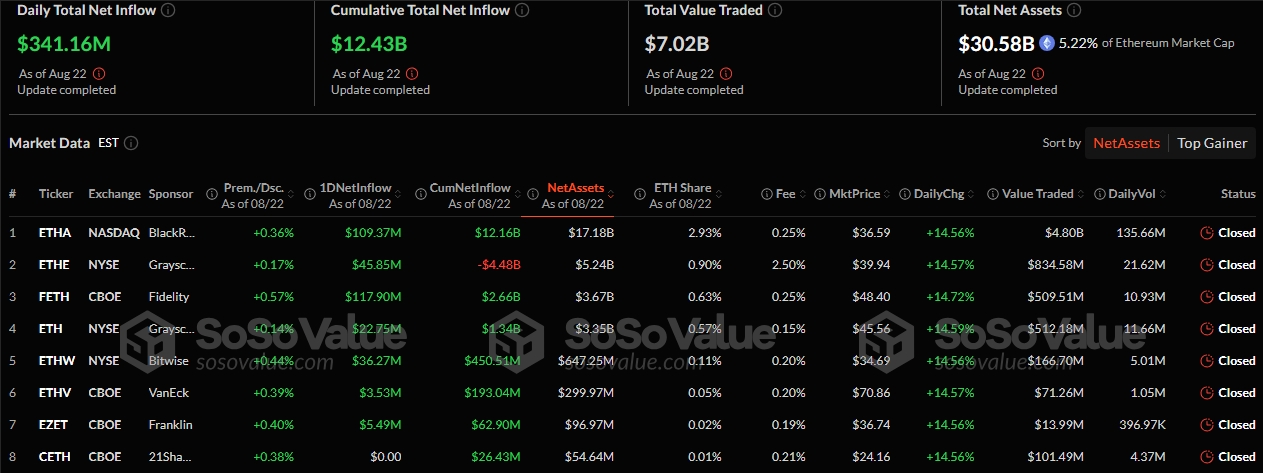

Before last week’s net outflows, the last time Ethereum ETFs recorded weekly net outflows was on May 19. Notably, on May 15, the commodities recorded one of the most significant weekly net inflows worth $2.85 billion. Unlike Bitcoin ETFs, Grayscale Ethereum ETF (ETHE) experienced the highest weekly net outflows, valued at about $88.9 million.

Other Ethereum ETFs that recorded outflows last week included Fidelity Ethereum ETF (FETH) and Grayscale Mini Ethereum ETF (ETH). These ETFs lost $79.7 million and $50.4 million, respectively. BlackRock Ethereum ETF (ETHA) contributed only $8.3 million to last week’s net outflows. Cumulative metrics showed that Ethereum ETFs’ total net inflow since inception was $12.43 billion. Total value traded and net assets were $7.02 billion and $30.58 billion, respectively.

BTC and ETH Record Slight Drops as Bitcoin and Ethereum ETFs Struggle with Outflows

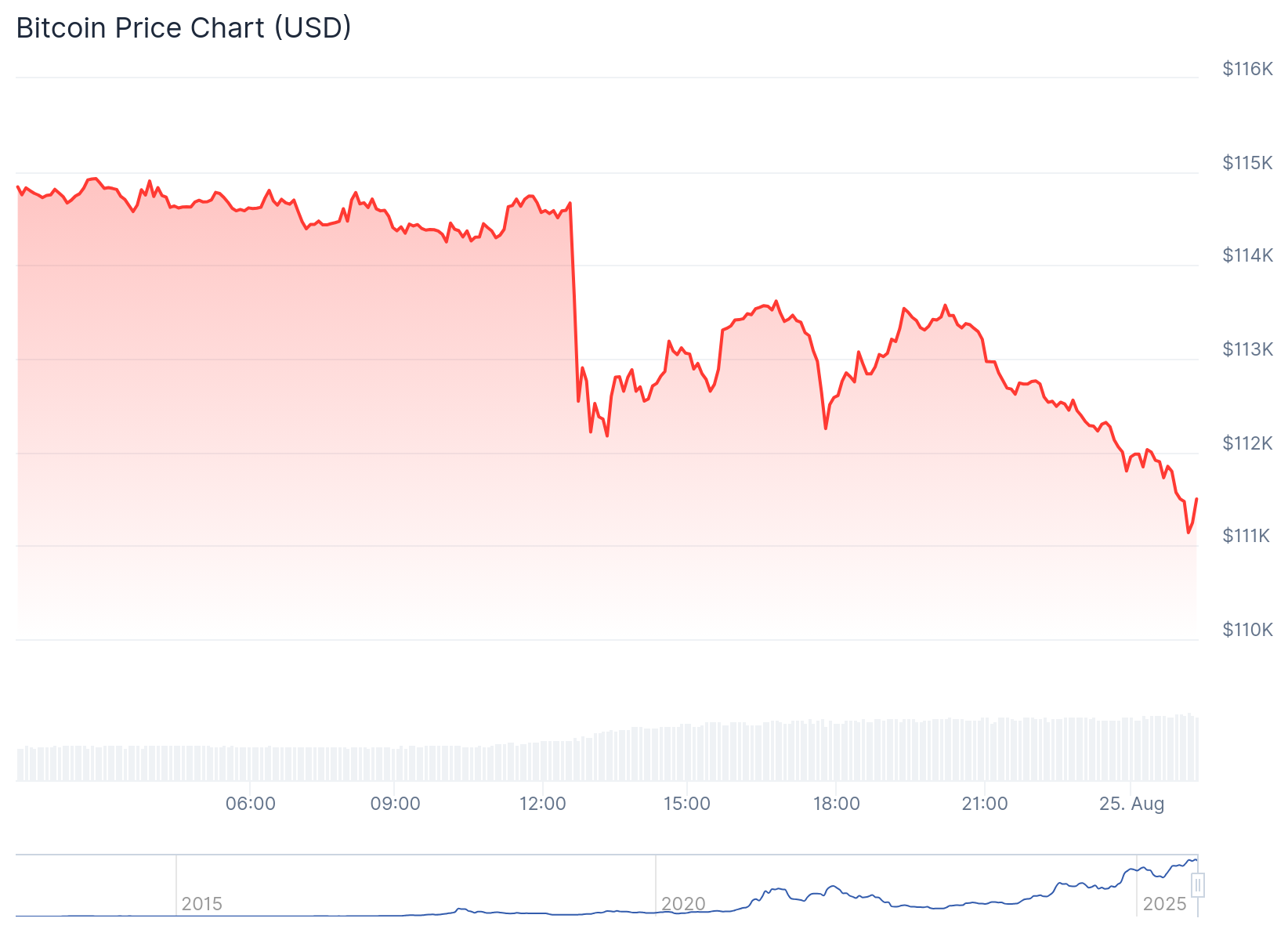

At the time of writing, Bitcoin is down 2.8% in the past 24 hours, trading at $111,700, with price extremes fluctuating between $111,799 and $114,994. BTC’s extended-period price change variables also showed declines, highlighting an unimpressive market outlook for the world’s most valuable cryptocurrency. For context, Bitcoin dropped 3.4% 7-day-to-date, 8.4% 14-day-to-date, and 4.9% month-to-date.

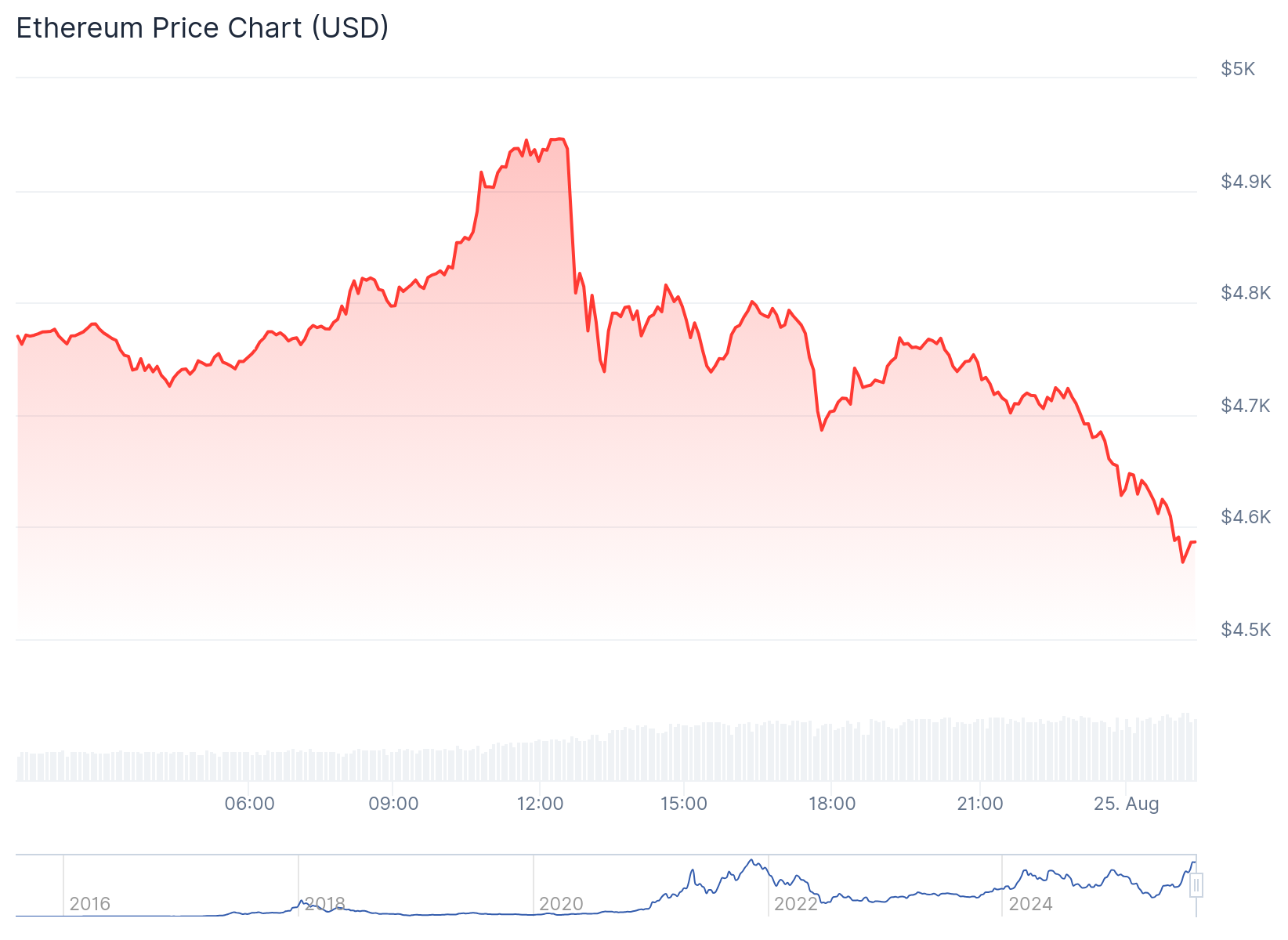

Despite attaining a $4,946.05 all-time high (ATH) a few hours ago, ETH has since retraced following a 3.2% decline in the past 24 hours. The asset is changing hands at $4,680 with a $567.5 billion market cap. In the past week, Ethereum has surged 7.9% with price extremes oscillating between 4,080.65 and $4926.09.

Amid growing market uncertainties, Lookonchain has tracked investors’ activities involving Bitcoin and Ethereum investments. According to the on-chain tracker, some investors have sold Bitcoin to buy ETH, while some have done the reverse. An example is the Bitcoin OG dumping Bitcoin for Ethereum.

Lookonchain reported:

“In the past 5 days, they’ve deposited ~22,769 BTC ($2.59 billion) to Hyperliquid for sale, then bought 472,920 ETH ($2.22 billion) spot and opened a 135,265 ETH($577 million) long.”

In a different tweet, Lookonchain reported that Matrixport, a Singapore-based company, is selling Ethereum and using the proceeds to acquire Bitcoin. The on-chain tracker noted that Matrixport bought 2,354.6 BTC worth $272 million from Binance and OKX.

Looks like #Matrixport is selling $ETH for $BTC.

In the past 2 hours, they've withdrawn 2,354.6 $BTC($272M) from #Binance and #OKX.https://t.co/3yEpMF2arG pic.twitter.com/hrO3UjIROy

— Lookonchain (@lookonchain) August 23, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.