SUI Price Surges 9% as 21Shares Files for Spot SUI ETF with SEC

0

0

Highlights:

- 21Shares files for Spot Sui ETF to offer direct access to SUI tokens.

- The SUI ETF will mirror SUI’s market price without involving staking or leverage.

- 21Shares partners with the Sui network to capitalize on growing institutional interest and demand.

On April 30, 21Shares, a crypto investment firm, submitted an S-1 registration statement to the United States Securities and Exchange Commission (SEC) for the launch of the Spot Sui exchange-traded fund (ETF) in the United States. The proposed ETF aims to give direct access to SUI, the main token of the Sui network. As per the filing, Coinbase will hold the tokens, while the fund’s daily value will follow a benchmark index that tracks SUI’s spot market price.

We’ve filed with the SEC for a SUI ETF in the U.S. — a first step in expanding exchange-traded access to SUI.@SuiNetwork https://t.co/06X49EaiFN

Materials provided herein are intended solely for educational purposes only. These materials should not be construed as… pic.twitter.com/dgFpgybwSZ

— 21Shares US (@21shares_us) May 1, 2025

The fund will not stake its SUI tokens, meaning it won’t earn rewards from network activity. It also won’t use leverage, derivatives, or other complex tools. Instead, the goal is to follow the price of SUI in U.S. dollars as closely as possible. All share transactions will be handled in cash, not through token transfers. This structure provides investors with an easy and straightforward method to gain access to SUI.

The 128-page filing doesn’t say which U.S. exchange the new 21Shares SUI ETF will trade on. It also lacks a ticker symbol. “There is no certainty that there will be liquidity available on the exchange or that the market price will be in line with the NAV [net asset value] or the principal market NAV at any given time,” the filing states.

Recently, 21Shares joined others in trying to launch an SUI ETF. Last month, Cboe BZX also submitted a filing with the SEC to list the Canary Capital SUI ETF.

21Shares Expands ETFs and Forms Strategic Partnership with Sui

21Shares has been expanding its ETF offerings in the United States. Recently, it filed for spot crypto ETFs featuring assets like Dogecoin (DOGE) and Polkadot (DOT). The company also offers spot Ethereum (ETH) and Bitcoin (BTC) ETFs in partnership with Ark Invest.

In addition to the ETF filings, 21Shares has established a strategic partnership with the Sui network. This collaboration seeks to capitalize on the increasing global interest in the Sui ecosystem. Duncan Moir, President of 21Shares, mentioned that their early research on Sui suggested it could become one of the top blockchains, and now that theory seems to be proving true at Sui’s Basecamp event. He also pointed out that their approach is driven by both conviction and investor demand, with their roadmap with Sui reflecting these factors.

The partnership will involve product collaborations, research, and other initiatives, reflecting growing institutional interest in Sui. It emphasized Sui’s speed, scalability, and its role in tokenizing real-world assets, including stablecoins and DeFi.

SUI Price Rises 9%

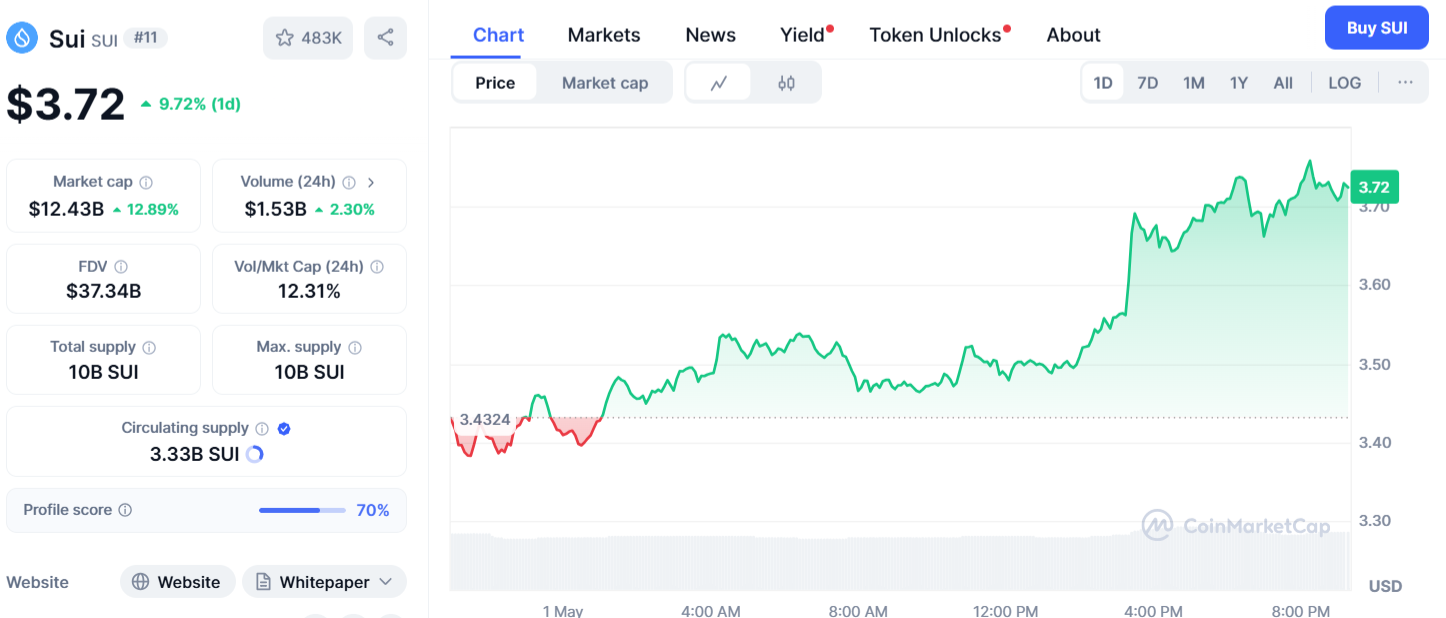

SUI is the 13th largest cryptocurrency, with a market cap of $12.43 billion, according to CoinMarketCap. Following the news, SUI saw a notable price surge. At the time of writing, it was trading at $3.72, marking a 9.72% increase over the past 24 hours.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.