ASTER Whale Transfers $9.1M to Binance, Stirring Market Speculation

0

0

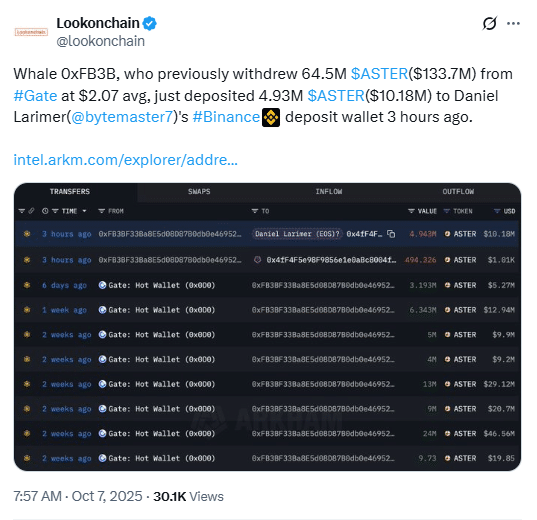

According to recent blockchain activity, an ASTER whale has caught the market’s attention after moving 4.93 million ASTER tokens, worth about $9.17 million, into a Binance-linked wallet.

Each token traded around $1.86, and the size of the transfer has sparked plenty of chatter across the crypto community. Many traders are now wondering what could be happening behind the scenes and whether this move signals something bigger ahead.

Big Moves Behind the Curtain

Whale Walks Into Binance

Wallet 0xFB3B, known for executing some of the most significant on-chain transactions, recently transferred 4.93 million ASTER (approximately $9.17 million) to a Binance-linked address. This same wallet had earlier withdrawn about 64.5 million ASTER, valued close to $120 million, from Gate.io.

The move has drawn intense attention from analysts and traders who see it as a potential sign of a liquidity reshuffle or quiet buildup rather than a sudden sell-off.

Also Read: Aster Whale Activity Surges With $2.5B Spot Volume and $32B Perp Flow

Accumulation Trend Signals

This ASTER whale doesn’t seem to be acting alone. On-chain data reveals that other large holders have also been active, collectively accumulating more than $100 million worth of ASTER over the past few weeks, which accounts for roughly 7% of the entire circulating supply.

Approximately 15 related wallets have transferred 68.25 million ASTER out of Aster DEX, while wallet 0xFB3B alone withdrew another 50 million ASTER, worth nearly $92 million, from Gate.io in just two days.

These transactions suggest whales are positioning for the long term rather than short-term flips, a pattern that often reflects growing confidence in the project’s fundamentals.

Why This Matters

Liquidity, Not Just Noise

When big holders move tokens to exchanges like Binance, traders often worry about potential sell-offs. But recent ASTER whale activity aligns more with accumulation than dumping. The steady inflows suggest it could be a liquidity adjustment or preparation for staking rather than an exit move.

Strategic Signaling

The link to figures such as Daniel Larimer and other investment entities has caught market attention. Some analysts believe the whale may be positioning itself ahead of upcoming project milestones or ecosystem updates, hinting at strategic coordination rather than short-term profit-taking.

Price & Market Indicators

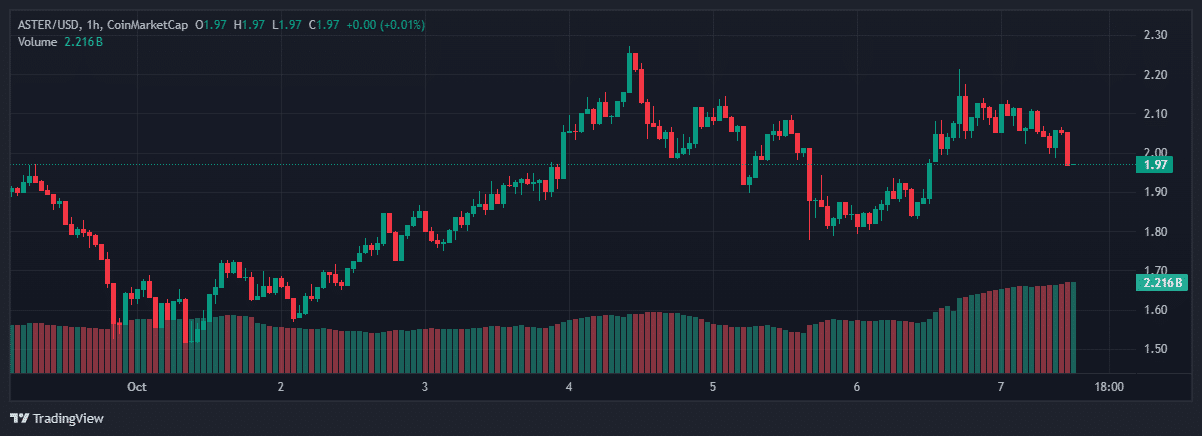

Currently, ASTER is trading at around $1.86 with a market capitalization of approximately $3.17 billion, and daily volumes exceed $1.28 billion. Prices have increased by 5% over the past week, which is notable for renewed market interest.

Continue to move tokens to exchanges, and some minor volatility to follow. However, if these transfers connect to development updates or long-term liquidity plans, this might mark the beginning of a stronger uptrend for ASTER.

What To Watch Next

| Indicator | Why It Matters |

|---|---|

| Further deposits from ASTER whale addresses | Could signal sell pressure or coordinated strategy |

| Roadmap & dev updates from ASTER team | Might explain whale confidence or leak hidden cues |

| On-chain flows vs. exchange withdrawals | To see whether accumulation is long term or exit play |

| Price reaction around $2.30-$2.50 resistance | If broken, could fuel more interest |

Conclusion

Based on the latest research, ASTER whale activity is not a random ripple; it’s a tell. With multiple large addresses accumulating millions, we may be witnessing coordinated plays ahead of big moves. Stay alert. Watch your wallets, monitor exchange flows, and keep refining your timing, because in the world of crypto, whales don’t swim aimlessly.

For expert insights and the latest crypto news, visit our platform.

Summary

A massive whale, holding a vast amount of ASTER tokens, transferred $10 million worth of ASTER tokens into a wallet connected to Binance, sparking speculation among various segments of the cryptocurrency world. Analysts are now holding their bets to see whether it is a sell-off or a tactical liquidity move, as whale activity typically signals significant market changes.

Glossary

- Whale: Large token holder who usually has sufficient power to affect the market sentiment.

- On-chain data comprises transaction-related information and wallet flows visible across the entire blockchain.

- Current Supply: All the tokens presently on active circulation.

- Liquidity: The ability for a token to be bought or sold easily without large price swings.

- Staking / Accumulation: Holding tokens either to support the network or because you’re expecting long-term gain.

FAQs About ASTER Whale

Q: Why does one ASTER whale move matter?

Because a single large holder can affect liquidity, market psychology, and price direction especially if tied to influential wallets.

Q: Could this move be just a wash (i.e., token rotation)?

Yes, it might be internal portfolio repositioning or staging for staking rather than immediate selling.

Q: Should retail traders follow unthinkingly?

No. Whale moves offer clues, not guarantees. Use risk controls and validate with multiple indicators.

Q: How many ASTER tokens are in circulation?

Approximately 1.6577 billion tokens as of now.

Read More: ASTER Whale Transfers $9.1M to Binance, Stirring Market Speculation">ASTER Whale Transfers $9.1M to Binance, Stirring Market Speculation

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.