DOGE Quo Vadis: ETF Nears and Whales Trade Aggressively

0

0

Dogecoin is entering a decisive phase as the possibility of launching the first ETF from REX-Osprey stirs up the market. Meanwhile, on-chain data shows whales are both selling off and aggressively accumulating.

Caught between institutional expectations and unpredictable volatility, DOGE faces a breakout opportunity and carries significant risks for investors.

Expectations for the DOGE ETF

The Dogecoin (DOGE) market has recently heated up, as REX Shares hinted that the REX-Osprey DOGE ETF could debut as early as next week. REX-Osprey filed its DOGE ETF registration with the SEC earlier this year.

“Looks like Rex is going to launch a Doge ETF via the 40 Act a la $SSK next week based on below tweet combined w how they just filed an effective prospectus. Doge looks like first one to go out, but the pros also includes on there are Trump, XRP and Bonk so poss those too at some point, we’ll see,” shared a Senior ETF Analyst at Bloomberg.

This is the first time an ETF product directly tied to DOGE has been publicly discussed. If the REX-Osprey DOGE ETF is approved, it would raise expectations for institutional capital inflows into the memecoin, potentially driving future price growth.

Is DOGE Boming?

Recent DOGE on-chain data reveals two opposing trends unfolding simultaneously.

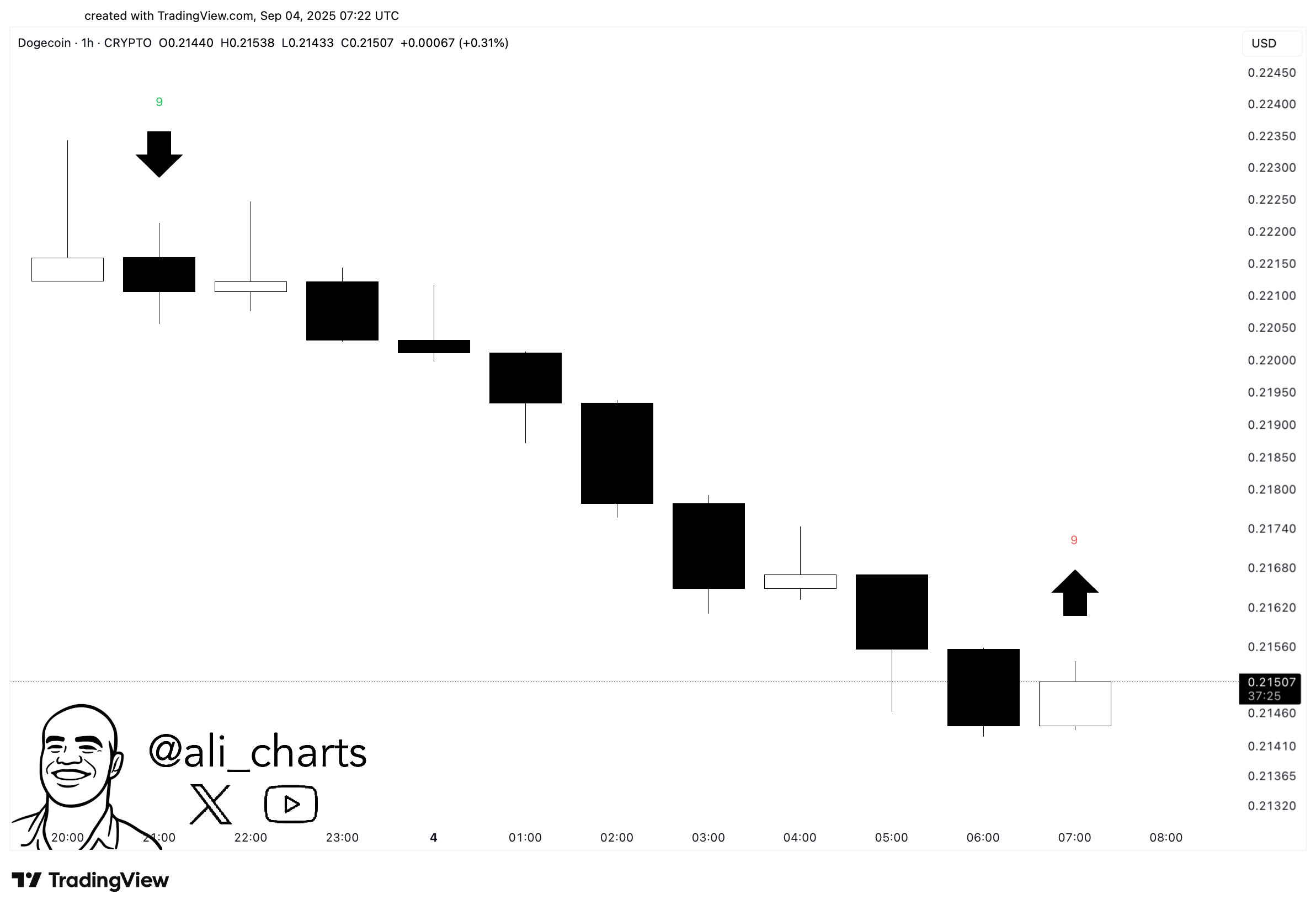

On one hand, according to analyst Ali, the TD Sequential indicator recently topped out, but now it is flashing a buy signal for DOGE.

TD Sequential indicator. Source: Ali on X

TD Sequential indicator. Source: Ali on X

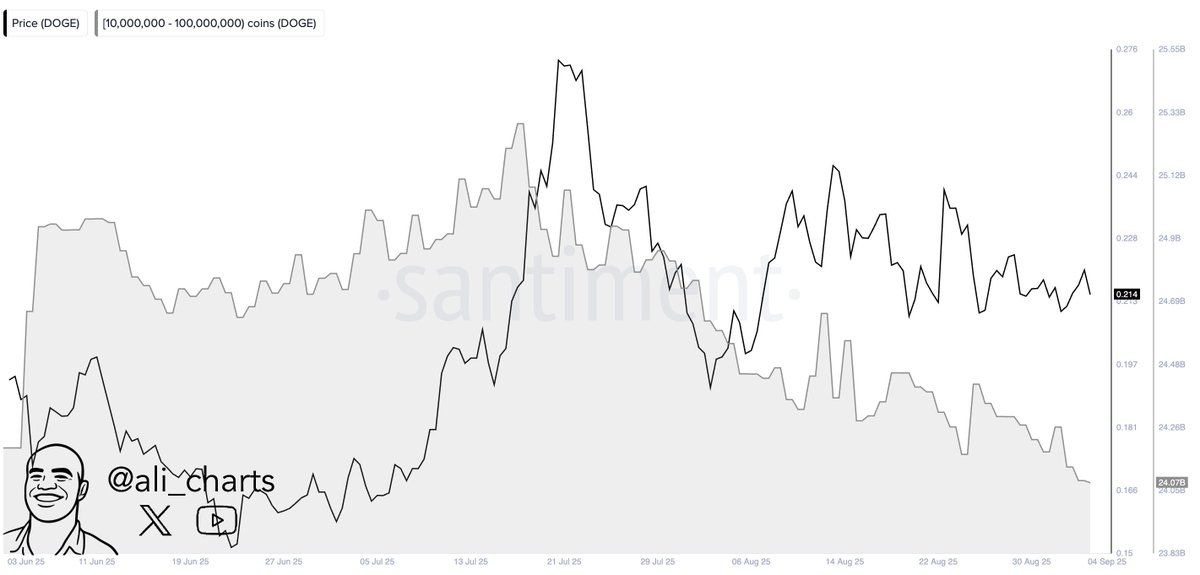

On the other hand, Ali also observed that whales appear to have sold around 200 million DOGE within just 48 hours. This reflects a divided market state: some large wallets are exiting, while technical demand is emerging.

DOGE whale activity. Source: Ali on X

DOGE whale activity. Source: Ali on X

From a technical perspective, several analysts point to bullish signals for DOGE. One X account observed during the 3-day timeframe showed that DOGE bounces and consolidates, pushing for a breakout above local downtrend resistance.

Meanwhile, another analyst monitoring the weekly timeframe presented a more optimistic scenario, suggesting DOGE could target the $1–$1.4 range if the breakout succeeds.

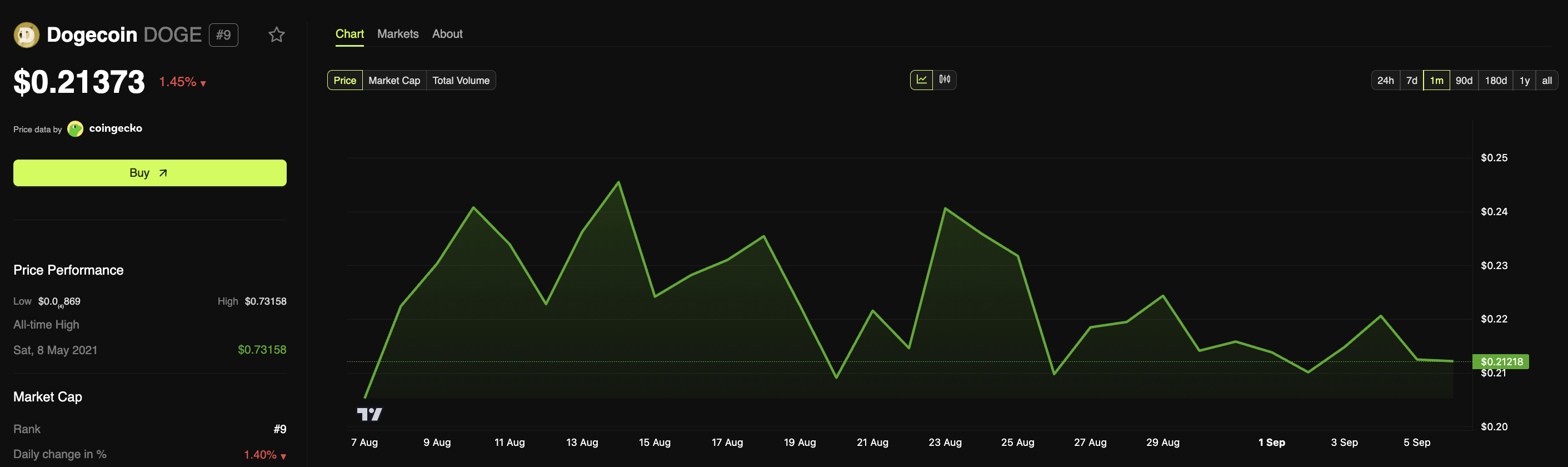

DOGE price action. Source: BeInCrypto

DOGE price action. Source: BeInCrypto

Data from BeInCrypto Market shows DOGE trading at $0.213-$0.216 at 9:00 am UTC. To reach the above levels, DOGE would need a significant surge from its current accumulation phase. While this may be overly optimistic, it continues to attract attention, given the potential approval of the REX-Osprey DOGE ETF.

However, history shows that the SEC’s review process for crypto-related products often takes time and carries the risk of delays. Therefore, the current reaction of the DOGE market is more of an expectation than a guarantee, especially since Dogecoin is also included in the reserves of some companies. The recent whale sell-offs may also be explained by “selling the news” — taking short-term profits amid FOMO-driven retail inflows.

In conclusion, DOGE currently stands at the intersection of institutional expectations and whale-driven volatility. If the ETF is approved, the medium-term impact would be increased liquidity and improved valuation prospects for Dogecoin.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.