Why is the Crypto Market Up Today?

0

0

The total crypto market cap (TOTAL) and Bitcoin (BTC) reacted positively to the 25 basis points cut in US interest rates. Altcoins enjoyed gains as well led by MYX Finance (MYX) having risen by nearly 40% in 24 hours.

In the news today:-

- The SEC is preparing to allow generic listing standards for crypto ETFs, removing the case-by-case approval requirement. This shift could enable products like an XRP ETF, as the agency redefines which cryptoassets qualify as commodities.

- New York’s Department of Financial Services has directed state-chartered banks and foreign branches to integrate blockchain analytics into compliance programs. The move aims to tighten oversight of crypto-related risks and strengthen monitoring of illicit activity.

The Crypto Market Gains

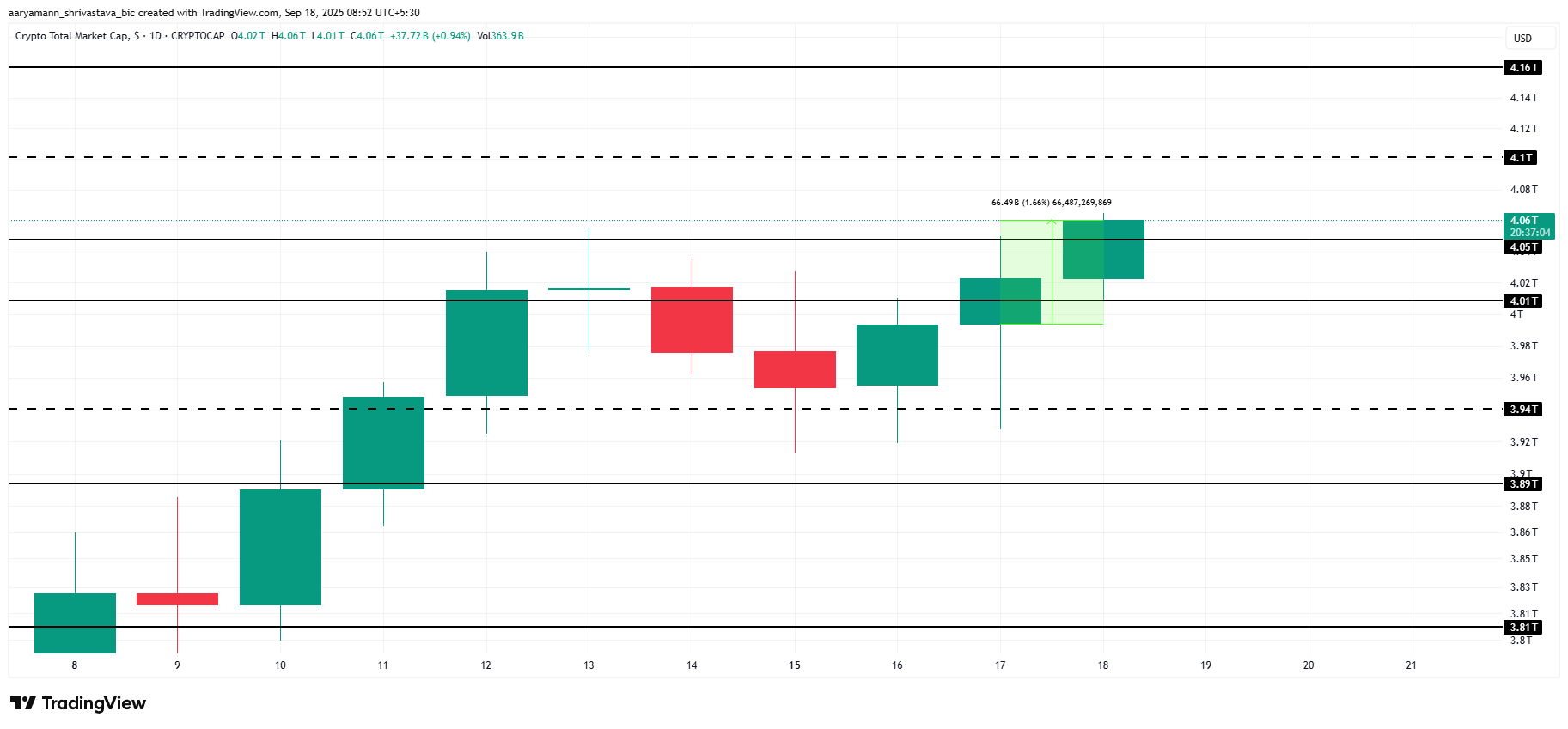

The total crypto market cap surged by $66 billion in the last 24 hours, reaching $4.06 trillion. TOTAL is showing strong momentum and is expected to secure $4.05 trillion as a support level. This would signal sustained investor confidence in the broader cryptocurrency market outlook.

The FOMC’s recent announcement of a 25-basis-point interest rate cut positively impacted digital assets. TOTAL is now eyeing $4.10 trillion as its next resistance. Flipping this barrier into support would strengthen bullish sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Total Crypto Market Cap Analysis. Source: TradingView

Total Crypto Market Cap Analysis. Source: TradingView

However, if the bullish reaction proves short-lived, TOTAL could face renewed selling pressure. A failure to hold $4.05 trillion may lead to a decline to $4.01 trillion or even lower, exposing the market to short-term volatility.

Bitcoin Crosses Another Barrier

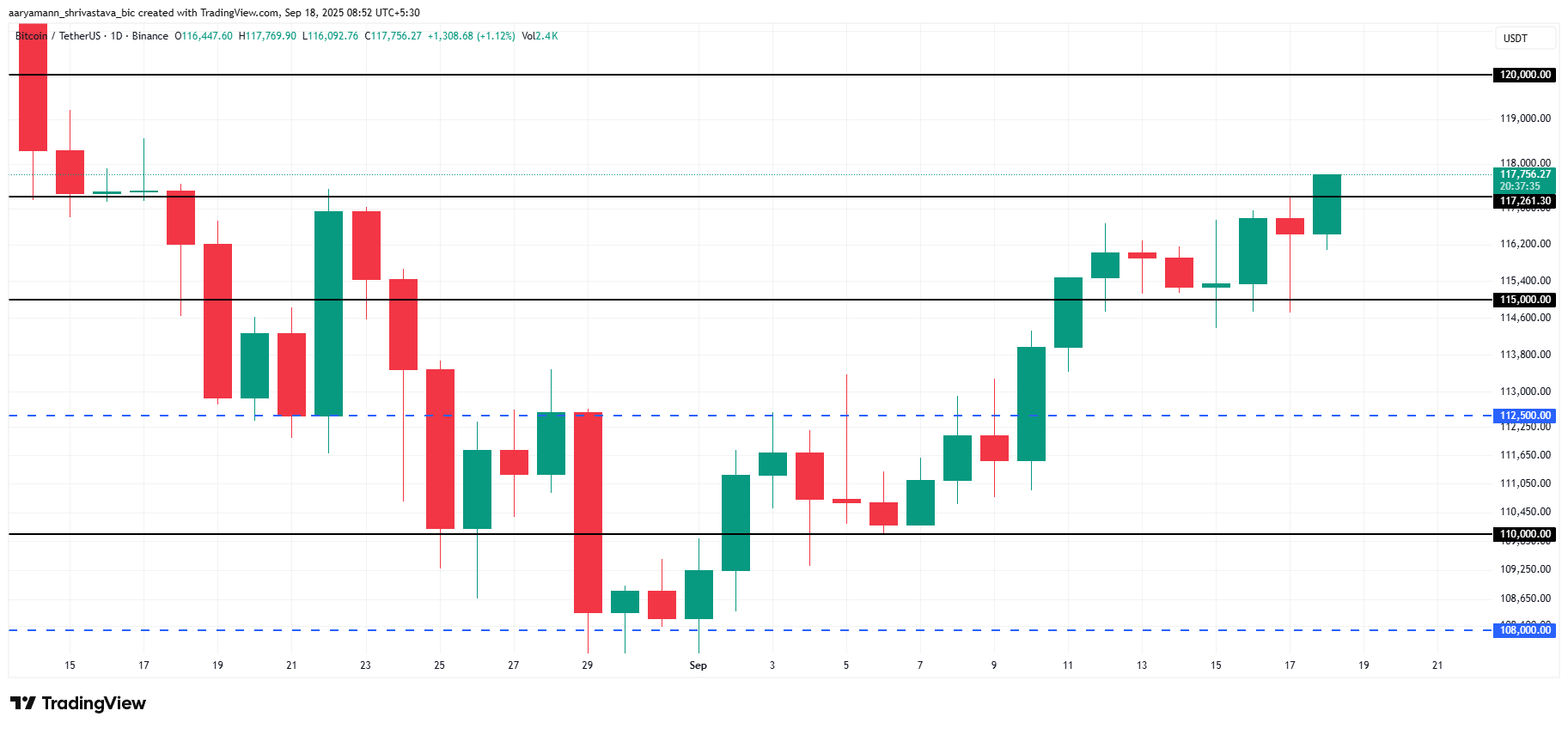

Bitcoin’s price is trading at $117,756, holding above the crucial $117,261 support level. Securing this threshold will be essential for BTC to sustain its bullish momentum. A confirmed hold here could reinforce investor confidence.

The next major target for Bitcoin is $120,000. Successfully breaching and flipping this resistance into a support floor would mark a significant milestone. Doing so would strengthen bullish sentiment and potentially enable BTC to extend its rally toward $122,000, bringing it closer to its all-time high.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, if Bitcoin loses support at $117,261, it risks entering a correction phase. A failure to hold this level could push BTC down to $115,000 or even $112,500. Such a reversal would invalidate the bullish outlook.

MYX Finance Becomes The Leader

MYX price surged nearly 40% in the last 24 hours, becoming the day’s best-performing altcoin. This rally has pushed the token closer to its all-time high of $19.98, fueling optimism among traders who now view MYX as one of the strongest assets in the market.

To reach a new peak, MYX will require consistent investor demand and heightened capital inflows. Strong participation from market participants could provide the necessary momentum for MYX price to climb higher.

MYX Price Analysis. Source: TradingView

MYX Price Analysis. Source: TradingView

However, if profit-taking accelerates, MYX may retrace its gains. A decline could send the altcoin down toward $14.46 or even $11.52, erasing recent progress. Such a move would invalidate the bullish outlook and highlight risks tied to short-term volatility in the altcoin market.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.