Crypto Market Today: Key Moves in BTC, ETH, XRP, BNB

0

0

This article was first published on The Bit Journal.

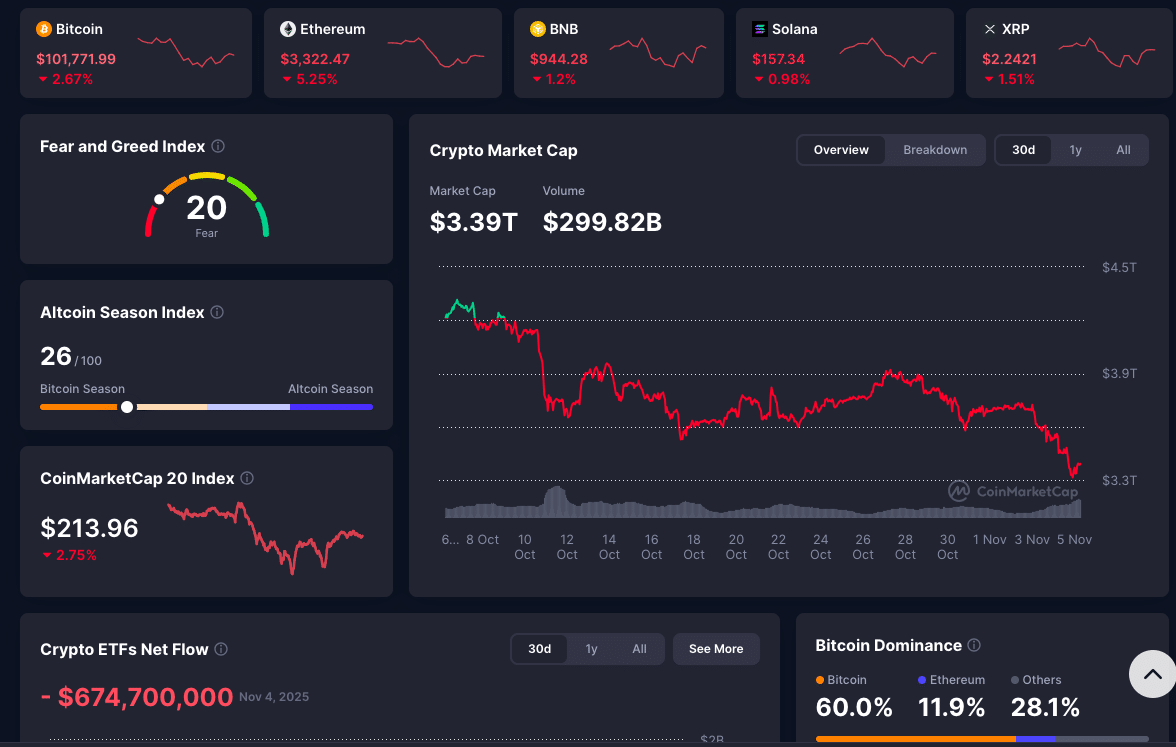

The crypto market has experienced another drastic wave of forced liquidation events. According to real-time data, over $2.1 billion in futures positions were liquidated in a single 24-hour window as Bitcoin dropped below $100,000 before retracing back up. The overall crypto market cap also fell 4.5% to roughly $3.39 trillion during the same interval.

What Triggered the Crypto Market Liquidation

The crypto market liquidation was caused by a sharp drop in major crypto asset prices, especially Bitcoin. The market saw Bitcoin trade below $100,000 for the first time since June.

According to CoinGlass data, liquidations rose 88% in one day to $2.1 billion. U.S. listed crypto ETFs also added to the stress. Spot BTC ETFs saw $577 million in redemptions and spot ETH ETFs $219 million.

A combination of high leverage, thin liquidity, big price drops, and institutional outflows triggered this crypto market liquidation. As one analyst put it, liquidations across the entire network in 24 hours exceeded $2 billion, longs lost $1.63 billion and shorts $400 million.

This was not an isolated event as it spread across derivative products, ETFs and spot markets.

Crypto Market Liquidation: Which Assets Were Affected and Why

The crypto market liquidation was not uniform across all assets. As of press time, Bitcoin was $101,771 (down 2.67%), Ethereum $3,322 (down 5.25%), XRP $2.24 (down 1.52%) and BNB $944 (down 1.2%)

Sources reported leveraged longs being forced to close due to falling prices and a lack of margin, which accelerated the crypto market liquidation.

ETFs also amplified the effect. Bitcoin ETFs saw $1.34 billion in redemptions over 4 days. Institutional liquidity reduction added to the pressure.

The Fear and Greed Index was in “extreme fear” territory. Investors were very bearish during the crypto market liquidation.

In short, the crypto market liquidation was broad, fast, and caused by structural stress points: leverage, sentiment, and institutional capital flows.

Derivatives, Leverage, and Liquidation

A notable part of the crypto market liquidation is the derivatives space, where futures, perpetuals and leveraged positions amplify moves.

As leveraged longs lose value, margin calls trigger automatic selling of positions, which in turn pushes prices further down in a cascade. Reports showed about $1.2 billion in BTC and ETH longs got wiped out during this event.

CoinGlass data shows open interest across futures contracts dropped about 6% to $141 billion in the 24 hour window. The decline in open interest is both forced closes and reduced new positioning.

Another layer is the interplay with ETF flows. With spot ETFs seeing outflows, institutional players may reduce exposure or hedge positions via derivatives, adding to the selling pressure. Leverage is a force multiplier in the crypto market liquidation event.

Institutional Flows, ETFs and What They Did

Data from tracking sources shows spot Bitcoin ETFs saw $946 million in outflows for the week ended early November, while Solana funds saw $421 million in inflows.

These flows suggest several things: big funds reducing exposure to Bitcoin due to macro uncertainty; rotation of capital to other crypto segments (e.g. Solana), reduced liquidity in flagship crypto assets which makes them more vulnerable during stress periods.

Similarly, the alignment of macro factors (e.g. strong US labor data, Treasury yields rising, Fed rate cut expectations retreating) killed risk appetite.

Experts noted trading volumes went up while sentiment was down amid ETF redemptions.

Projected Crypto Market Scenarios For the Coming Weeks

| Asset | Bull Case | Base Case | Bear Case |

|---|---|---|---|

| Bitcoin (BTC) | Accumulation around $98K-$102; if ETF flows resume and Fed pauses, could retest $115K. | Consolidates $95K-$105K as open interest stabilizes; and macro clarity awaited. | ETF redemptions and weak risk appetite could send BTC to $92K support. |

| Ethereum (ETH) | Rising gas fees and staking deposits; recovery to $3,900 if DeFi confidence builds. | Range-bound $3,200-$3,500 amid ETF outflows; yields still attract institutions. | Below $3,200; ETH could slide to $3,000; hurting DeFi sentiment. |

| XRP (XRP) | Whale accumulation at $2.30; above $2.55 targets $2.80 with ETF momentum. | Sideways $2.20-$2.50; stable throughput despite low volume. | Drop below $2.20 risks $2.00 if Ripple ETF narrative weakens. |

| BNB (BNB) | Token burns and ecosystem upgrades could lift price to $1,050. | Consolidates $900-$970 as funding rates normalize. | Low liquidity and soft altcoin demand may drag to $850. |

Conclusion

This liquidation has several implications for the short term. The breaking of support levels, especially Bitcoin’s drop below $100,000 raises questions about how far the correction will go. Some technical analysts are warning of further downside to $93,000 if support doesn’t hold.

The reduction in open interest and high leverage may mean a period of consolidation as the market digests this liquidation. Some see this as a reset”rather than full blown capitulation.

Historical seasonal behavior says November is one of the better months for crypto rebounds. But seasonal tailwinds can’t override structural stress alone.

Traders and market watchers need to observe the liquidity, open interest, sentiment indicators and macro signals to see if the market finds a floor or extends the decline.

Glossary

Liquidation: forced closure of a leveraged position when margin or collateral falls below required levels; often triggering or accelerating price drops.

Open interest: total value of outstanding derivative contracts (futures or options) that have not been settled; a decrease in open interest means less participation or deleveraging.

ETF (Exchange-Traded Fund): a regulated investment fund that tracks the value of an asset or index, allowing institutional and retail investors to get exposure to that asset through a traditional investment vehicle.

Leverage: borrowing or margin usage to amplify exposure to an asset; more leverage means more gains but also more losses and liquidation risk.

Support level: price range where buying pressure historically emerges to prevent further drops; breaking below support means accelerated drops.

Liquidity: ease to buy or sell at stable prices; low liquidity means more vulnerability to big moves and forced liquidations.

Frequently Asked Questions About Latest Crypto Market Liquidations

What caused the latest crypto market liquidation?

The liquidation was caused by a big drop in major crypto prices (Bitcoin below $100,000; record liquidations in futures markets and continuous ETF outflows, meaning forced selling met weaker underlying demand.

Does this liquidation mean the crypto bull run is over?

Not necessarily. Some see this as a moment of deleveraging and taking profit rather than the end of the trend. Whether it’s a deeper drop depends on liquidity, support levels and institutional flows.

Which asset classes were hit the most?

Bitcoin and Ethereum were the hardest hit but many other assets dropped sharply. The derivatives space (futures, perpetuals) and institutional vehicles (ETFs) were the epicenter.

What should market watchers be watching now?

Key metrics are open interest trends, ETF inflows/outflows, support levels for major assets, volume and liquidity conditions and macro data like interest rates and risk-asset sentiment.

Read More: Crypto Market Today: Key Moves in BTC, ETH, XRP, BNB">Crypto Market Today: Key Moves in BTC, ETH, XRP, BNB

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.