Pepe Price Rallies 3% as Bulls Eye 115% Gains If $0.00001183 Barrier Gives Way

0

0

Highlights:

- The price of Pepe has soared 3% to $0.0000098, with strong support at $0.0000089 after a 37% decline from recent highs.

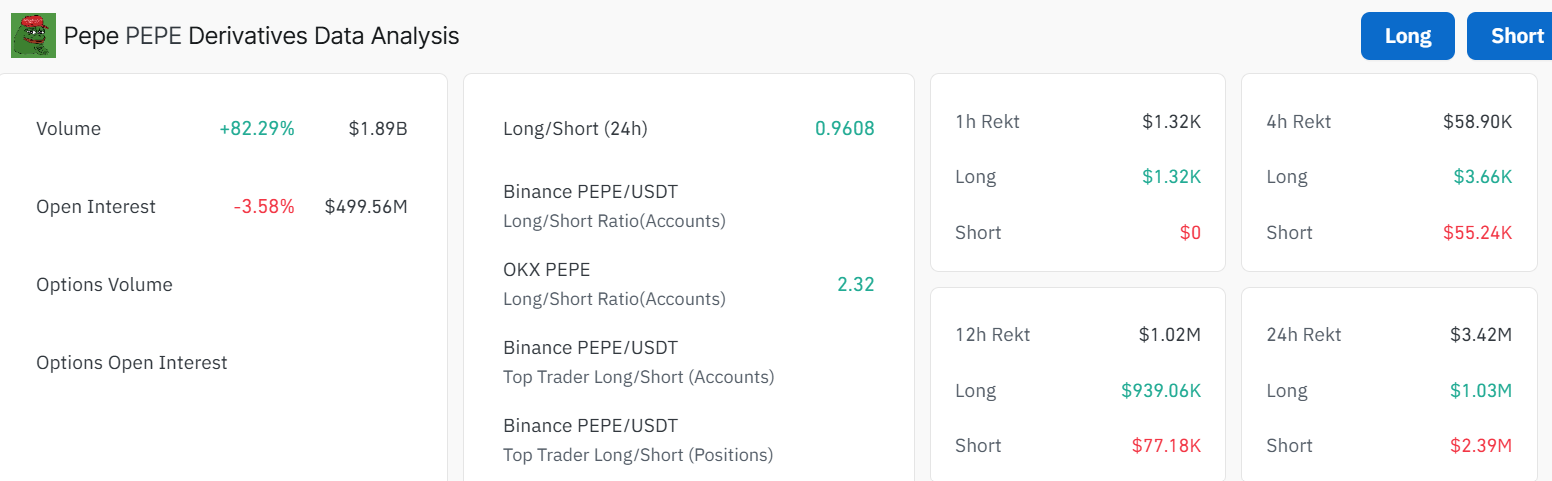

- Daily trading volume up by 139% to $818M, while derivatives volume hit $1.89B with bullish liquidation bias.

- If PEPE crosses the $0.00001183 MA, bulls could drive it to $0.000021, a potential 115% rally.

The Pepe price has rallied 3% today to $0.0000098 mark in the past 24 hours. Accompanying the price movement is its daily trading volume, which has increased 139% to $818 million in the same period.

Pepe Price Finds Strong Support After a Prolonged Downtrend

The PEPE/USD daily chart indicates a significant negative trend within a downward parallel channel. It has declined by about 37% from its recent high of 0.000015 to trade at 0.000009844. However, the bulls have established a strong support at the $0.0000089 mark, giving them the strength for an upside movement. It is approaching the 50-day Moving Average (0.00001183) and the 200-day Moving Average (0.00001161), thereby indicating a potential directional breakout in the near future.

The Relative Strength Index (RSI) is presently at 44.98, which is a neutral momentum with a little inclination on the bearish side. There are also indications of declining bearish pressures on the MACD histogram, with the MACD line meeting the signal line abruptly. It is possible that the MACD line may signal a momentum change. Traders are now at liberty to buy more frog-themed tokens, which may ignite further upside.

On-chain derivatives analysis reveals a mixed yet clearly bullish trading activity. The trading volume of Pepe price over the last 24 hours increased by 82.29% to a record of $1.89 billion. However, the open interest has decreased marginally by 3.58% to 499.56 million. This suggests that major units are being liquidated, while new investments are entering the market. The last 24-hour long/short ratio is 0.9608, indicating nearly equal positioning.

The liquidation statistics also show a trader war, with 3.42 million rekt over the last 24 hours. The lion’s share of which (2.39 million) comprised short positions. The long positions, valued at $1.03 million, were found to have been liquidated. Nonetheless, the high ratio of short liquidations to longs absolves the argument that a bullish trend is slowly emerging, even though the Pepe price is technically low.

Pepe Bulls Eye $115% Gains In the Medium Term

With the PEPE price being tightly bound in a descending channel that is contracting and has been technically stable, the next sessions may be critical. The sharp uptick in trading volume and derivatives exacerbates the interest and volatility that traders may experience. In the event bulls win back and maintain a price above the 50-day MA at 0.00001183, a breakout rally would be on the cards. This will result in Pepe’s price target of $0.000021 in the medium term, representing approximately 115% gains.

Nevertheless, it is also important to keep in mind that RSI is below 50, and a downward trend on open interest indicates a watchful market. Moreover, the 50-day and 200-day MAs pose immediate resistance zones cushioning against further upside. If these levels prove too strong, the Pepe price may find support in the $0.0000085-$0.0000083 range.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.