XRP Officially Joins Nasdaq Crypto ETF as SEC Approves Broader Listings

0

0

Asset manager Hashdex revealed the expansion of its Crypto Index ETF on US exchanges has been approved. As a result of the recent changes to the listing rules made by the U.S. Securities and Exchange Commission (SEC), major cryptocurrencies such as XRP, Solana, and Stellar are now part of the ETF.

This development represents a significant milestone in the evolution of Crypto ETFs and creates new avenues for investment in digital assets.

Hashdex Expands Crypto Index ETF with Major Cryptocurrency Additions

Hashdex’s Crypto Index ETF, which trades on the Nasdaq as NCIQ, now holds five cryptocurrencies: Bitcoin, Ethereum, XRP, Solana and Stellar. This latest Crypto ETF is a representative of growing demand for diverse crypto-investment products.

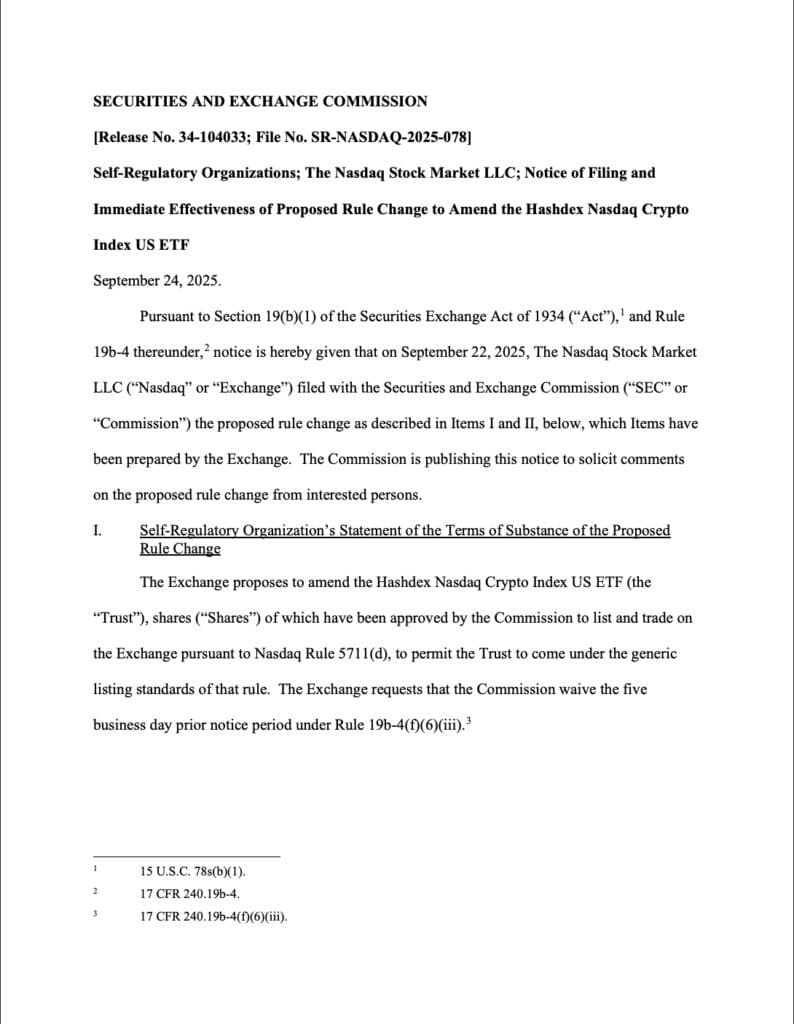

SEC’s approval of the newly proposed generic listing rules in September has streamlined the process for approving crypto ETFs. Previously, including a cryptocurrency in ETFs has been challenging.

Also Read: The Great Crypto Rotation: How ETFs, RWAs, and Stablecoins Ended the Classic Four-Year Cycle

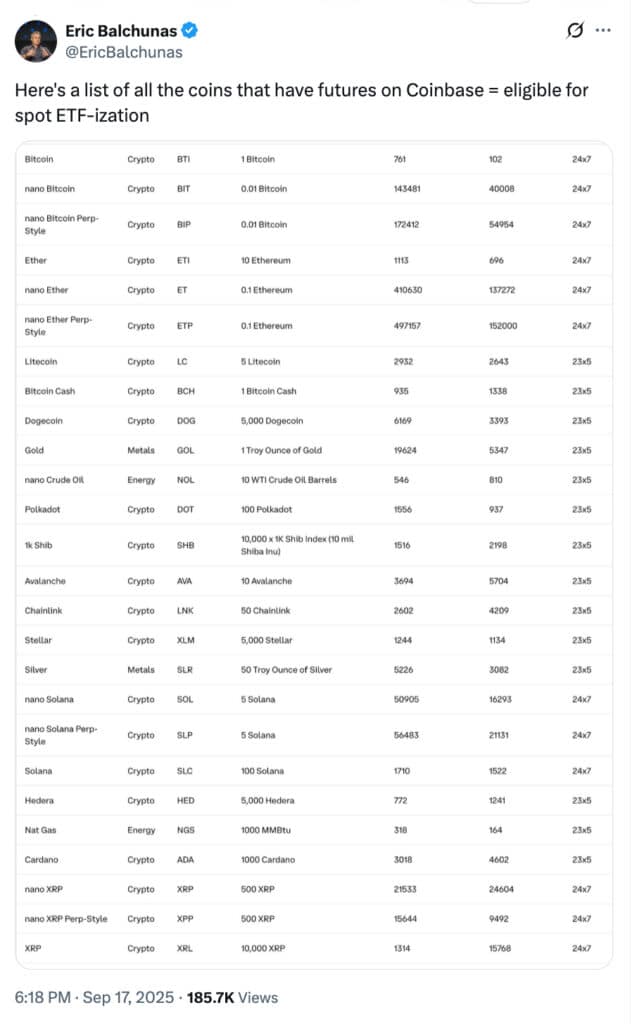

However, this is set to be more straightforward subject to meeting certain requirements, for example being categorized as a commodity or having futures contracts.

SEC’s Impact on the Growth of Crypto ETFs

The SEC’s updated regulations have facilitated Crypto ETF expansion by allowing eligible cryptocurrencies to be listed more quickly. This rule change is expected to significantly reduce approval timelines for future ETFs.

Cryptocurrencies must meet new criteria to qualify for ETF listings, including compliance with the US Intermarket Surveillance Group’s financial surveillance standards.

Industry experts predict that the Crypto ETF market will experience rapid growth due to these relaxed regulations. As a result, crypto ETFs are likely to see broader participation from institutional investors, who previously faced barriers when it came to digital asset investments.

Hashdex’s Strategic Crypto ETF Move

Hashdex adding to its ETF positions underlines the willingness of firms to adjust to market developments. Adding XRP, Solana and Stellar diversifies the fund’s digital assets exposure to offer investors other investment targets.

The fund’s wide portfolio diversity helps with risk reduction and provides stability in the incredibly volatile world of crypto. With these changes, Hashdex is becoming a major player in the ever-growing Crypto ETF space and taking advantage of new regulations paying more respect to investors.

SEC’s Evolving Role in Crypto ETF Approvals

And the trickle-down effect goes all the way up to SEC Chairman Paul Atkins, who has helped bring about the new regulatory landscape of crypto-friendly investment. He leads an SEC organization that has instituted some changes to make the approval of Crypto ETFs more efficient.

These developments are art of a larger campaign to develop a more adaptable and resilient regime for digital assets. A key recommendation from Atkins is the “innovation exemption,” allowing crypto companies to test new technologies under relaxed standards.

The U.S. Crypto Regulatory Shift

The evolving regulatory stance in the U.S. has created a friendlier environment for crypto-related financial products. In 2025, the SEC made significant strides in reducing regulatory barriers for crypto companies.

By fostering a more supportive environment, the SEC has laid the foundation for a surge in Crypto ETF expansion. The regulatory updates signal that U.S. regulators are beginning to embrace the growing demand for digital finance and the role of Crypto ETFs in this space.

The Future of Crypto ETFs

The future for Crypto ETFs seems to be a promising one as more and more cropto funds are likely to come in. The SEC’s readiness to approve funds such as Hashdex’s and other crypto ETFs with multiasset exposure is a signal that the market for digital assets is gaining greater acceptance within mainstream finance.

Investors will enjoy with a wider offering automatic funds following different cryptocurrencies. With the SEC approving process more streamlined now, the lanes are open for several new Crypto ETFs that will be rolled out in years to come.

Conclusion

The Crypto ETF expansion is an important milestone for the digital asset investments. As Hashdex and other companies build out their ETF portfolios, investors have easier access to more types of cryptocurrencies.

The SEC’s dynamic of its regulation and the increased engagement in digital finance will serve to support the future expansion of Crypto ETFs. It will give different types of investors access to new kind of investment.

Also Read: Pantera Warns Solana ETF Could Ignite Institutional Inflows by Q4 2025

Summary

Hashdex has expanded its Crypto Index US ETF to include XRP, Solana, and Stellar, alongside Bitcoin and Ethereum. This expansion follows the SEC’s new generic listing standards, which simplify the process for adding cryptocurrencies to ETFs.

As the regulatory landscape evolves, more crypto-related funds are expected, offering investors greater access to diverse digital assets. The Crypto ETF expansion signals a significant shift in the financial market, bridging traditional finance with the growing digital asset space.

Appendix: Glossary of Key Terms

Crypto ETF: A fund that records the price of cryptocurrencies, offering investors exposure without taking ownership of them.

SEC: A regulatory agency with responsibility for markets.

Futures Contracts: Deals to purchase or sell an asset on a specific date and price in the future.

Diversification: Dividing an investment across a range of different securities to limit risk.

Nasdaq: A world-wide stock market that usually accommodates tech as well as research based companies.

Ticker Symbol: A series of characters that identifies a security traded on an exchange.

Frequently Asked Questions About Crypto ETFs Expansion

1- What is a Crypto ETF expansion?

A Crypto ETF expansion refers to the inclusion of additional cryptocurrencies in an existing exchange-traded fund, providing broader exposure to digital assets for investors.

2- How the SEC affects Crypto ETFs.

The new listing rules introduced by the SEC make it less complicated for crypto ETFs to be approved and increases the possibility of digital assets getting listed in an ETF such as Portfolios.

3- Why is Hashdex growing its Crypto ETF?

The Crypto ETF of Hashdex is growing in that investors will get access to a bigger diversity, and use crypto investments.

4- What’s Next For Crypto ETFs?

The future of Crypto ETFs seems positive, with regulations getting better and demand growing, more investment in the crypto sector should rise.

Read More: XRP Officially Joins Nasdaq Crypto ETF as SEC Approves Broader Listings">XRP Officially Joins Nasdaq Crypto ETF as SEC Approves Broader Listings

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.