Crypto Market Feels the Chill as Tether Growth Freezes

0

0

June has witnessed a noticeable slowdown in the growth of the Tether stablecoin supply, signaling a tightening of liquidity within cryptocurrency markets.

A recent study by Copper, a crypto custodian, highlighted that the stablecoin’s month-on-month supply expansion was less than 1.5% as of June 24, marking a significant reduction from the over 5% growth observed in April and May.

Decline in Tether Trading Volume

Fadi Aboualfa, head of research at Copper, commented on the situation, noting that the subdued liquidity influx into the crypto markets is occurring amid downward pressures on Bitcoin and Ethereum, with altcoins showing little potential for a significant rally in the near term.

In a stark contrast to earlier in the year, Tether’s trading volume has plummeted from its all-time high of $767.22 billion on March 11 to just $53.55 billion by June 24.

This decline comes even though Tether boasts a market capitalization of $113 billion. The slower growth rate of USDT’s supply is indicative of diminished financial inflows into the cryptocurrency markets.

The Bitcoin market itself has not been immune to these challenges, with substantial daily capital outflows. Copper’s analysis indicates that more than $540 million was withdrawn from the market in the last week alone.

Over the last 30 days, the price of Bitcoin has fallen by more than 10%, dropping from approximately $68,000 to about $62,000.

Aboualfa further elaborated on the market dynamics, pointing out that despite the direct correlation between market flows and Bitcoin’s price, the current situation does not reflect a bullish demand but rather a hesitance among investors to sell their holdings at a discount, even amid crash fears.

Impact of ETFs on Bitcoin’s Price

Moreover, since the introduction of exchange-traded funds (ETFs) in January, Bitcoin’s price has risen by 37%. Despite this, Aboualfa maintained that Bitcoin is still trading within a reasonable range of its holdings, suggesting there is still scope for downward price movements.

The broader macroeconomic landscape also continues to exert pressure on the crypto markets. A report from ETC Group dated June 25 indicated that traditional financial markets have begun to downgrade their global growth expectations.

This reassessment is largely due to consistently disappointing U.S. economic data. The Bloomberg US ECO Surprise Index, which measures the disparity between actual macroeconomic data and forecasts, has reached its lowest point since 2019.

This metric confirms a widespread acknowledgment of a deteriorating macroeconomic climate, which could pose further challenges for Bitcoin’s price stability.

Tether’s Strategic Shift

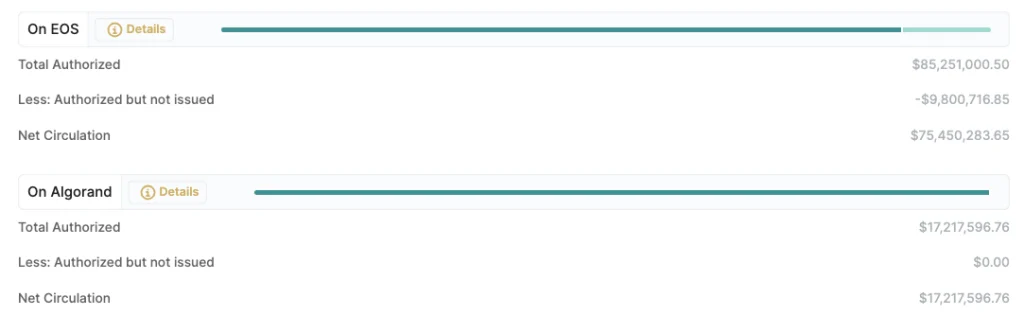

In a strategic shift, Tether has announced that it will cease the issuance of new USDT tokens on several more blockchains, including Eos and Algorand, starting June 24. This decision was disclosed in a blog post by the company.

Over the next 12 months, Tether will continue to redeem USDT on these blockchains as usual, with potential further changes to be evaluated and announced subsequently.

Tether explained that the decision to discontinue minting on Eos and Algorand aligns with its broader strategy to maintain balance within its ecosystem.

The company emphasized that it conducts thorough evaluations of each network’s security architecture to ensure the safety, usability, and sustainability of the blockchain.

The aim is to allocate resources optimally to enhance security and efficiency while fostering innovation. Tether assured its community that the transition would be meticulously executed to minimize disruption, reaffirming its commitment to delivering a seamless user experience.

Despite these changes, Eos and Algorand collectively account for less than 0.1% of the total USDT supply. As Tether continues to phase out support on certain blockchains, it remains active in integrating new networks, including The Open Network (TON).

Since introducing TON-based USDT in April 2024, Tether has minted approximately $500 million worth of these stablecoins, representing about 0.44% of the total circulating supply.

The very first Tether tokens were issued on the Bitcoin blockchain through Omni back in October 2014, and Tether has since discontinued minting USDT on three blockchains in August 2023, including Kusama, Bitcoin Cash SLP (Simple Ledger Protocol), and the original USDT blockchain, the Omni Layer Protocol.

The post Crypto Market Feels the Chill as Tether Growth Freezes appeared first on Coinfomania.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.