How CME XRP Futures Cross $18B Milestone in Just Four Months

0

0

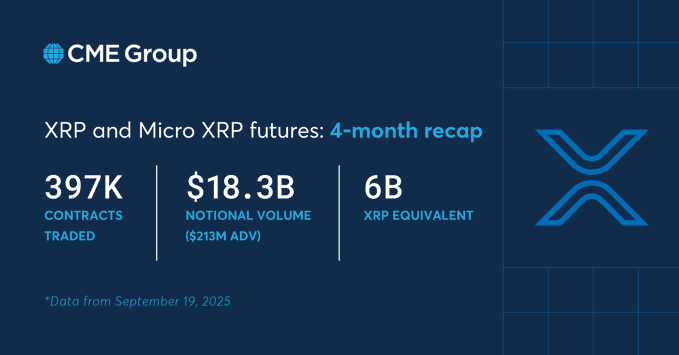

The CME XRP futures market has witnessed exponential growth. CME, the world’s leading and most diverse derivatives marketplace. XRP futures have already traded $18.3 billion in volume, just 4 months after its launch.

This rapid rise highlights how XRP is gaining increasing interest among institutions. It also represents a major new phase in digital-asset trading.

CME XRP Futures: A Key Asset for Institutional Traders

CME Group introduced XRP futures earlier this year, driven by rising demand from institutional clients. These futures have quickly established XRP as a key asset for hedging and speculation in regulated markets.

This is an impressive turnover considering that the amount of 18.3 billion stands for a whopping 6 billion XRP, which again shows quite an attractive liquidity of this market. This increase is indicative of the growing demand for professional traders to get exposure to XRP.

Hedge funds, asset managers and proprietary trading firms are swarming to CME’s platform, lured by the marketplace’s reputation as a reliable and regulated environment.

CME Group: A Gateway to Traditional Finance

The CME Group has been an important bridge between traditional finance and the cryptocurrency world. XRP, as a source of liquidity and investment for institutional investors, offers not only leveraged trading but also facilitates hedging through its futures contracts.

Also Read: Ripple and BlackRock Partnership Strengthens XRP Price Prediction for 2025

With CME’s service, traders can take long or short positions in relation to XRP employing various trading methods such as outright contracts and block trades. This kind of flexibility allowed CME XRP futures to gain the favor of institutional players.

Rising Liquidity in XRP Futures

As of Sept. 19, CME XRP futures had reached 397,000 contracts worth $18.3 billion in notional value. The average daily volume is $213 million, demonstrating great demand and liquidity in the XRP futures market.

CME’s regulated system means it is transparent and has reliable pricing, just what professional traders want. The value is effectively determined by the CME CF XRP-Dollar Reference Rate, creating more confidence for institutional customers.

Expansion of XRP Products: Introducing Options

CME Group is not stopping at futures. On September 17, the company announced it would launch options on XRP and Solana futures, pending regulatory approval. These options will be available in both standard and micro contracts, with expiries every business day, month, and quarter.

Giovanni Vicioso, CME’s global head of cryptocurrency products, highlighted that this expansion builds on the strong growth of XRP futures. Options offer traders more ways to hedge and speculate, attracting both institutional and retail investors.

Institutional Demand for Diversified Crypto Instruments

The introduction of XRP options follows a similar trend in institutional interest for various crypto products. Investors are looking to hedge more broadly as well, and having XRP options in addition to Bitcoin and Ethereum futures already available meets this demand.

The increasing use of XRP futures and options suggests a change in the way institutional investors perceive digital assets. XRP is emerging as an essential part of every long-term portfolio – next to Bitcoin, Ethereum and other digital assets.

Whale Activity and Market Speculation

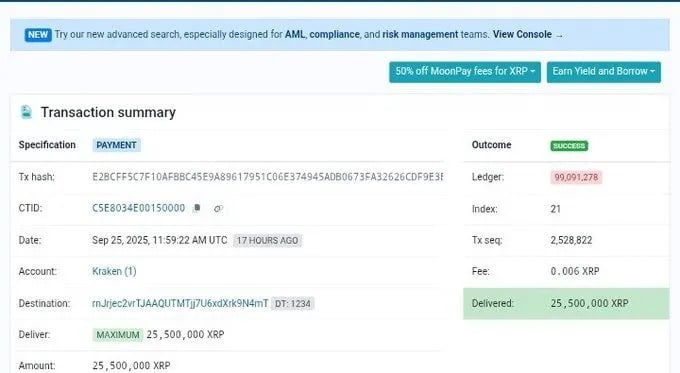

A major XRP transaction has also drawn attention in the market. A whale moved 25.5 million XRP, worth $71.8 million, from the Kraken exchange to an unknown wallet.

Such large movements often spark speculation, with some seeing it as a sign of long-term confidence in XRP, while others worry about liquidity issues.

The movement of XRP off exchanges is typically viewed as a bullish sign, as it indicates that investors are holding the assets in cold storage for the long term, rather than selling. This type of market behavior further underscores the growing trust in XRP as a digital asset.

Conclusion

CME XRP Futures Spikes to $18.3 Billion in Volume. Over 273K Contracts. The explosive growth of CME’s XRP futures has a strong momentum that brings them to $18.3 billion in trading volume.

Growing adoption of XRP derivatives by CME Group, including option products, positions the exchange to be a leading player in the realm. As institutional demand for XRP grows, the digital asset is becoming more mainstream and is now on the radar of traditional finance participants.

Also Read: XRP Officially Joins Nasdaq Crypto ETF as SEC Approves Broader Listings

Summary

XRP futures on CME Group are experiencing a whopping $18.3 billion in volume, which signals an increasing institutional demand for XRP. With such a meteoric rise it makes sense that XRP holds significant value in terms of hedging and speculation too.

The new products from CME, which already offered options, bolster its position in crypto derivatives. XRP is becoming an institutional darling and a must-have for traditional finance portfolios, marking an evolution of the perception of digital assets by mainstream investors.

Appendix: Glossary of Key Terms

XRP Futures: Financial contracts which enables speculating on the price of XRP without owning the coin.

CME Group: The biggest derivatives exchange in the world, providing regulated trading platforms.

Institutional Investors: Major financial organizations, including hedge funds and asset managers, who are buying into crypto.

Hedging: The practice of counterbalancing an investment or risk, in this case with mirror-image positions in the market.

Liquidity: How easy it is to buy or sell an asset without affecting its price.

Options Contracts: Agreements that allow the holder the right (but not the obligation) to buy or sell an asset.

Proprietary Firms: Private firms that buy and sell for themselves rather than client accounts.

Frequently Asked Questions About CME XRP Futures

1. What are CME XRP futures?

CME XRP futures are contracts that allow traders to speculate on the price of XRP without owning the cryptocurrency directly. These contracts are traded on CME’s regulated platform.

2. How much trading volume have CME XRP futures generated?

CME XRP futures have generated $18.3 billion in trading volume within just four months of launch.

3. What other products does CME offer for XRP?

In addition to futures, CME Group is launching options on XRP futures, providing more ways for traders to hedge and speculate.

4. Why is institutional demand increasing for XRP futures?

Institutional investors are attracted to XRP futures because they provide exposure to the asset without direct ownership, along with risk management and leverage in a regulated environment.

Read More: How CME XRP Futures Cross $18B Milestone in Just Four Months">How CME XRP Futures Cross $18B Milestone in Just Four Months

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.