US inflation cools, but tariffs pose threat in coming months, says ING

0

0

Inflation in the US dropped in February, but the market reaction remained muted.

Concerns persist that tariff-related price increases by companies may elevate inflation readings during the summer months, according to the ING Group.

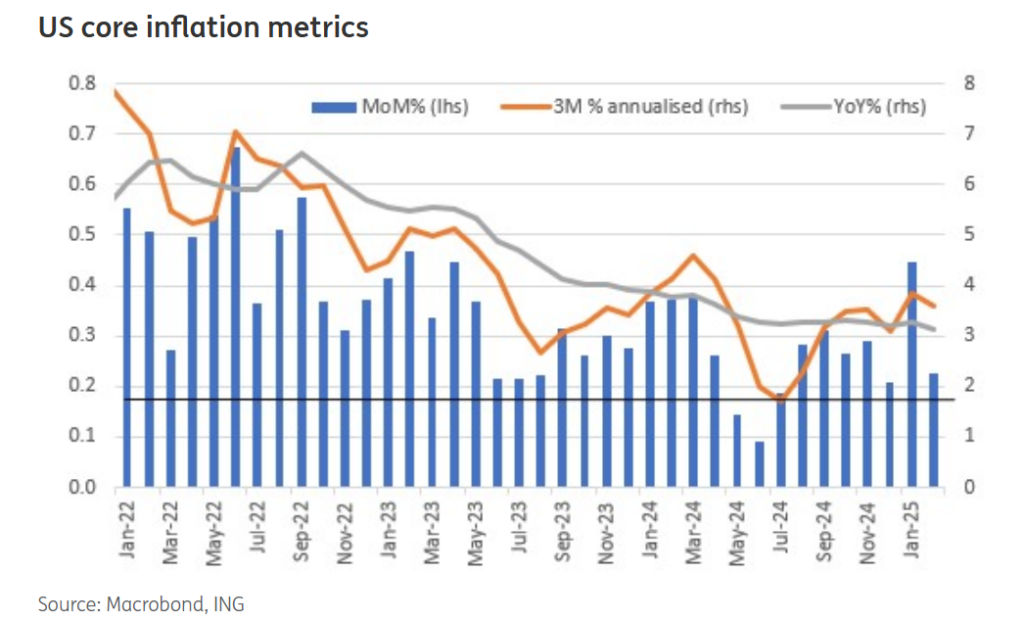

The February US consumer price inflation data was lower than expected, with both headline and core inflation at 0.2% month-on-month, compared to consensus predictions of 0.3%.

The annual rate of headline inflation decreased to 2.8% from 3%, and core inflation decreased to 3.1% from 3.3%.

“The details are less rosy though with a substantial 4% MoM drop in air fares the main factor driving the softer inflation readings,” James Knightley, chief international economist at ING, said in a report.

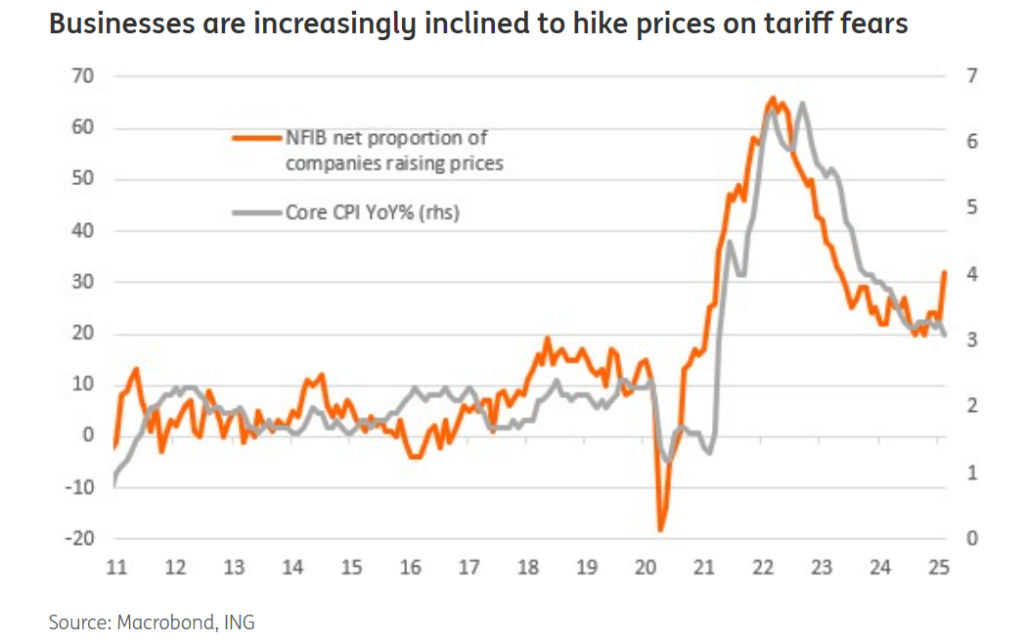

Tariff threat could reinvigorate the inflation threat

“Moreover, we are wary of anecdotal evidence of firms pre-emptively raising prices ahead of potential tariffs – pricing of longer-term contracts has to take account of potential input cost increases right now,” Knightley said.

The NFIB survey on Tuesday reported a 10-point increase in the proportion of businesses raising prices, and the Fed’s Beige Book also noted this trend last week.

The spending power of consumers could be negatively impacted by tariff uncertainty and price increases.

This could lead to weaker consumer sentiment and reduced spending, according to ING.

Knightley added:

They may also mean that the lack of clarity on the trading environment and the threat of reciprocal tariffs weighs on corporate sentiment, holding back on investment and hiring until there is greater clarity – hence the growing talk of potential recession.

However, the economy is currently expanding and creating jobs. Due to the possibility of increased inflation, ING does not anticipate the Fed cutting rates before September.

Housing costs could slow dramatically later in the year

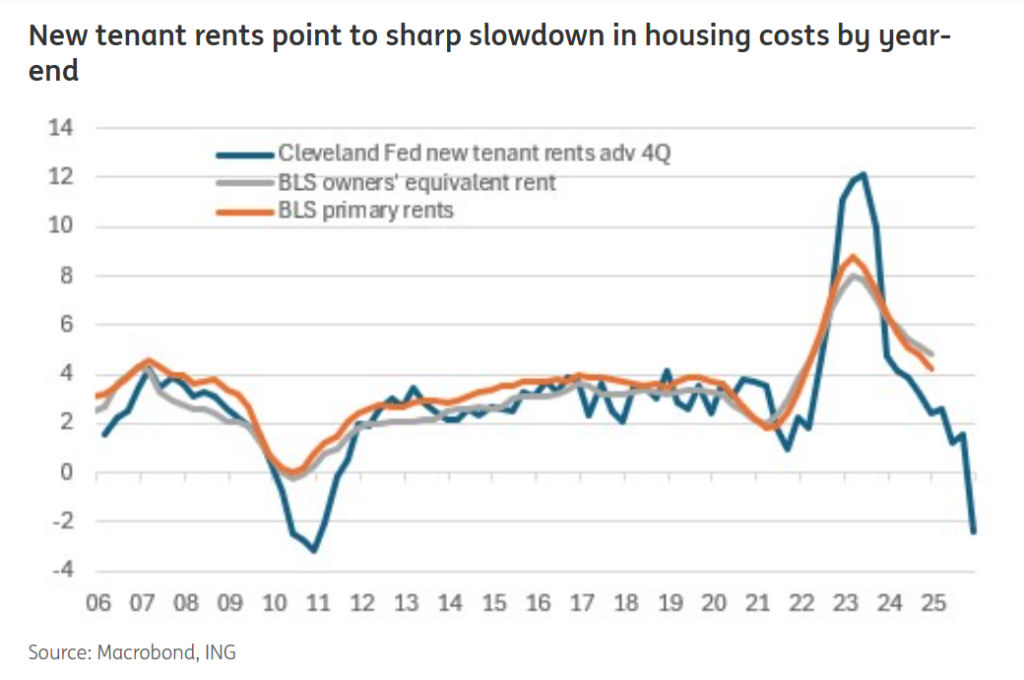

However, ING said it was monitoring new tenant rents closely, as the Cleveland Federal Reserve bank reports a rapid decline.

The effect of tariffs on inflation could be significantly mitigated if CPI housing measures cool later in the year as a result of this.

Let’s delve deeper into the implications of the statement that housing constitutes over 40% of the core inflation basket.

Given the substantial weight of housing in the calculation of core inflation, any shifts in the housing market will significantly impact the overall inflation rate.

If the economy were to show signs of weakness, it could trigger a cascade of effects in the housing market.

A weakening economy often leads to job losses, reduced consumer confidence, and decreased spending.

These factors can lead to a decline in demand for housing, which could, in turn, lead to lower housing prices or at least a slowdown in the rate of housing price increases.

Fed’s monetary easing path

A slowdown in housing price increases would directly contribute to a lower core inflation rate.

If this coincides with other signs of economic weakness, it could create a scenario where the Federal Reserve sees the need to cut interest rates more rapidly than previously anticipated.

Lower interest rates make borrowing cheaper, which can encourage businesses to invest and consumers to spend.

In the context of the housing market, lower interest rates can make mortgages more affordable, potentially boosting demand and supporting housing prices.

Therefore, if the economy does show signs of weakness and the housing market cools down, the Fed could be pressured to implement more rapid rate cuts as early as the end of this year and into early 2026, according to ING.

The post US inflation cools, but tariffs pose threat in coming months, says ING appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.