Pump.fun Crash: $436.5M USDC Exit Turns Into A Solana Wake Up Call

0

0

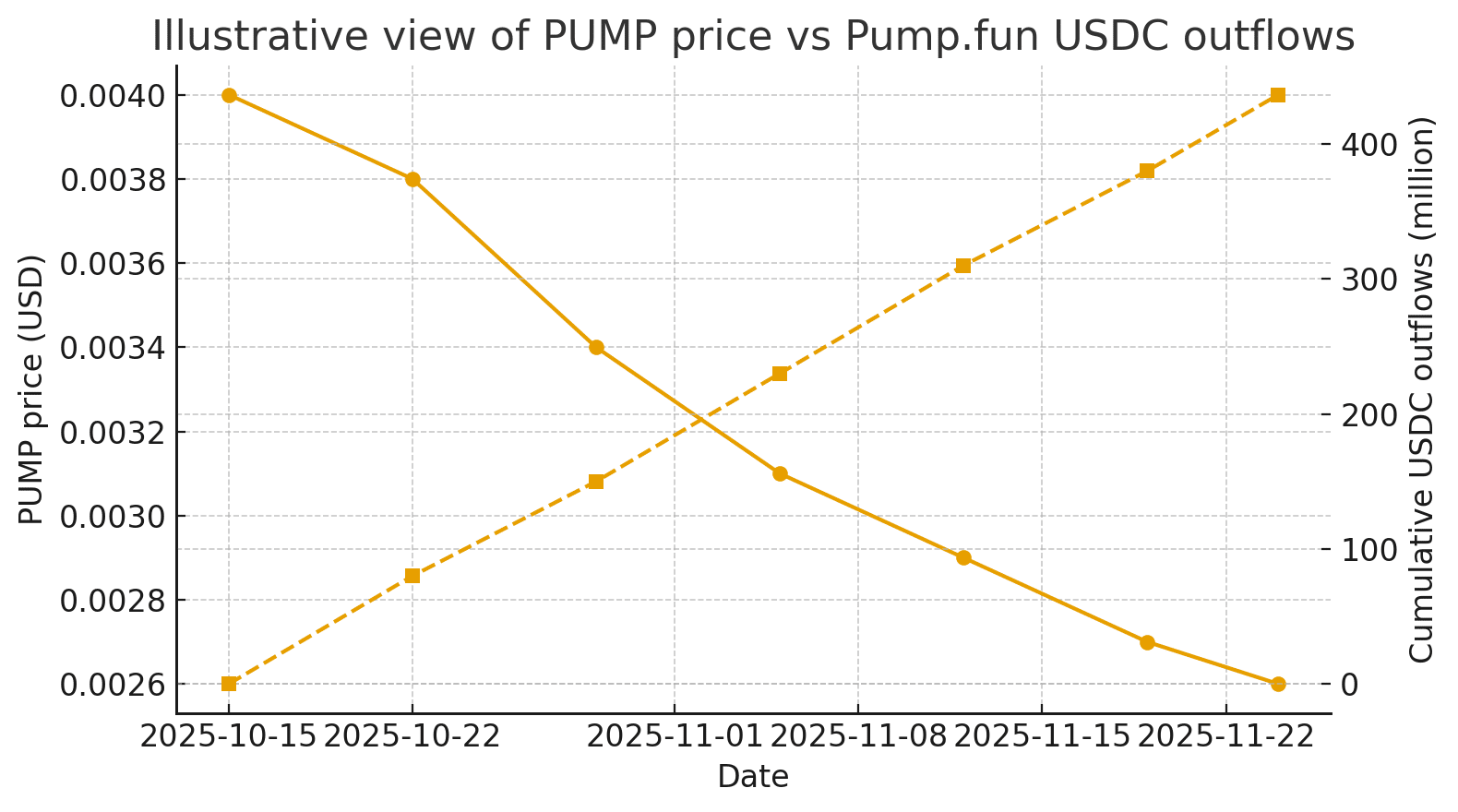

This article was first published on The Bit Journal. The Pump.fun crash starts with a clear on-chain trail. Since 15 October, wallets linked to the Solana meme launchpad have sent about 436.5 million USDC into a major exchange, while roughly 466 million USDC then moved from that venue to a stablecoin issuer. Analysts who follow these flows say the pattern looks like a concentrated cash out, not simple treasury juggling, and it arrives at a time when the project is already under a bright spotlight.

From blockbuster token sale to Pump.fun crash fears

The scale of the Pump.fun crash becomes clearer when the starting point is remembered. PUMP was sold to the public at 0.004 dollars with no vesting and a fully diluted valuation of 4 billion dollars. The sale pulled in hundreds of millions within minutes, turning the token into one of the most watched meme plays of the year. Now live market data shows PUMP near 0.0026 dollars, down more than twenty percent on the week, with a market cap in the high nine figure range and many buyers already underwater.

Pump.fun sits at the center of Solana meme trading rather than at the fringes. Research on decentralized exchange activity shows that the platform has carried daily volume between roughly 100 and 320 million dollars through much of 2025, with one recent day above 1 billion dollars as meme speculation surged again. Inside that fast-moving environment, the Pump.fun crash reads less like a random dip and more like a clear shift from blind enthusiasm to wary curiosity.

Why markets read it as a trust problem

Critics argue that the Pump.fun crash is less about one red candle and more about trust. A launchpad that has earned hundreds of millions in fees now appears to be moving very large sums off chain without a detailed public plan for how value returns to token holders. Supporters answer that serious businesses must move funds between wallets, exchanges, and banks, and that treasury transfers alone do not prove abuse. For now, the absence of a clear statement from the team gives the darker reading more oxygen.

Media investigations and official warnings already surround the brand. Long form reports have linked founders to earlier rug pulls and have documented disturbing live streams used to push speculative coins. Regulators in several countries now label parts of the ecosystem high risk or have opened legal action against related activity. When that background meets the story of the Pump.fun crash, it shapes how newcomers see Solana itself and underlines that culture and governance risk ride on top of every meme rally.

What investors can learn from the Pump.fun crash

For investors, the lesson after the Pump.fun crash is to treat meme infrastructure with the same discipline used for blue chip assets. Price, volume, and social buzz are useful, but they sit beside slower indicators.

Who controls the treasury, how large it is versus market cap, how fast team wallets move when revenue rises, and whether protocol income links clearly to token holder benefit often decide who survives the next cycle and who ends up as a cautionary headline. Those details are less exciting than a viral chart, but they matter far more once a narrative breaks.

Frequently Asked Questions

What triggered talk of a Pump.fun crash

Public focus grew when a chain of analysts highlighted more than 436.5 million USDC flowing from team-linked wallets to a large exchange and then to a stablecoin issuer just as the PUMP price fell sharply. The timing made it hard for traders to treat the transfers as a neutral back-office move.

Is this event proof that fraud occurred

On chain data confirms that very large transfers and likely sales took place. It does not, by itself, prove fraud. The lack of a detailed, timely explanation is what leads some observers to assume the worst and to fold the Pump.fun crash into a longer pattern of questionable behavior.

Glossary

Treasury

The pool of assets controlled by a project or foundation and used to fund development, operations, and ecosystem incentives.

On chain data

Information that lives on a blockchain, including transfers, balances, and protocol actions, and that can be reviewed with public tools such as explorers and analytics dashboards.

Decentralized exchange

A trading venue that uses smart contracts instead of a central operator to match orders and settle trades while users keep custody of their funds in personal wallets.

References

Read More: Pump.fun Crash: $436.5M USDC Exit Turns Into A Solana Wake Up Call">Pump.fun Crash: $436.5M USDC Exit Turns Into A Solana Wake Up Call

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.