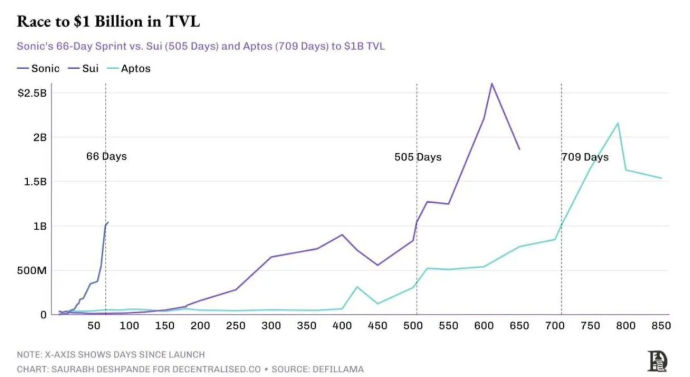

$S price outlook: Sonic attains $1B TVL milestone faster than Sui and Aptos

0

0

Cryptocurrencies struggled in the past sessions as macroeconomic developments, including Trump’s trade war, dented the appetite for risk assets.

However, Sonic defied the bearish trends with consistent total value locked (TVL) growth.

Sonic’s TVL skyrocketed past $1 billion in April (data extracted from DeFiLlama), reflecting massive growth in 2025 (so far).

That saw it outshining established projects Sui and Aptos, which took 505 and 709 days, respectively, to cross the $1 billion TVL landmark.

The massive TVL increase indicates immense investor interest in the Sonic project.

Moreover, that suggests confidence and trust in the asset’s future potential.

These developments have switched attention to native coin $S, which appears poised for historic breakouts.

Notably, Fantom confirmed plans to rebrand to Sonic in late 2024 to improve scalability, user experience, and security.

Sonic’s rapid growth in bearish markets

While most DeFi ecosystems struggled with declining activity amid prolonged bearishness, Sonic Labs stood out.

The project’s EVM compatibility, developer-friendly fees, and speedy transactions ensured consistent growth in the past few months.

Sonic’s impressive features attracted massive cash flows despite broad market downtimes, propelling its TVL past $1 billion in about two months.

Strategic collaboration, including the Alchemy Pay partnership, keeps Sonic afloat.

The rapid adoption indicated confidence in Sonic technology regardless of market uncertainty.

$S price outlook

Sonic’s native coin trades at $0.4786 after an over 3% uptick in the past 24 hours.

The alt reflects changing trends amid a buyer resurgence, hinting at potential breakouts.

Sonic’s expanding ecosystem supports $S long-term growth.

Its low fees, EVM compatibility, and high throughput make it a lucrative option for individuals using platforms like Solana and Ethereum.

The increased TVL indicates developers migrating to Sonic.

Such migrations will boost $S’s staking and gas fee utility.

Furthermore, Sonic displays resilience despite broad market weakness.

$S could witness swift rallies upon broad-based surges as capital enters leading DeFi ecosystems.

Moreover, traders and investors often choose assets with rapid adoption and robust fundamentals.

The impressive TVL growth might catalyze FOMO to propel the altcoin’s performance.

These factors suggest imminent breakouts for Sonic.

Nevertheless, enthusiasts should watch for potential elements that could delay the anticipated price surge.

$S price displays weakness despite the impressive total value locked surge.

The declining trading volume indicates faded interest in the alt.

Some participants could stay cautious until breakout confirmations.

Also, asset manager Grayscale recently removed Sonic from its updated watch list, triggering debates about the asset’s institutional appeal.

Moreover, Sonic requires continuous innovation to dethrone rivals like Polygon, Solana, and Arbitrum and dominate the DeFi space.

Sonic’s unique functionalities and technology boost its competitiveness.

Nevertheless, the project should retain investor trust and consistent capital inflows to survive the evolving market.

Meanwhile, the prevailing ecosystem outlook paints a bullish picture for Sonic and its native coin, $S.

The post $S price outlook: Sonic attains $1B TVL milestone faster than Sui and Aptos appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.