Ripple CEO Says Circle IPO Signals Imminent U.S. Stablecoin Regulation

0

0

Ripple CEO Brad Garlinghouse believes Circle’s highly anticipated IPO isn’t just a financial milestone; it’s a turning point in the push for comprehensive stablecoin regulation in the United States.

Speaking at the Apex 2025 event in Singapore, Garlinghouse told attendees that the Circle IPO showcases investor appetite and signals growing regulatory readiness. According to him, momentum in Washington is finally turning the tide in favor of the digital asset industry.

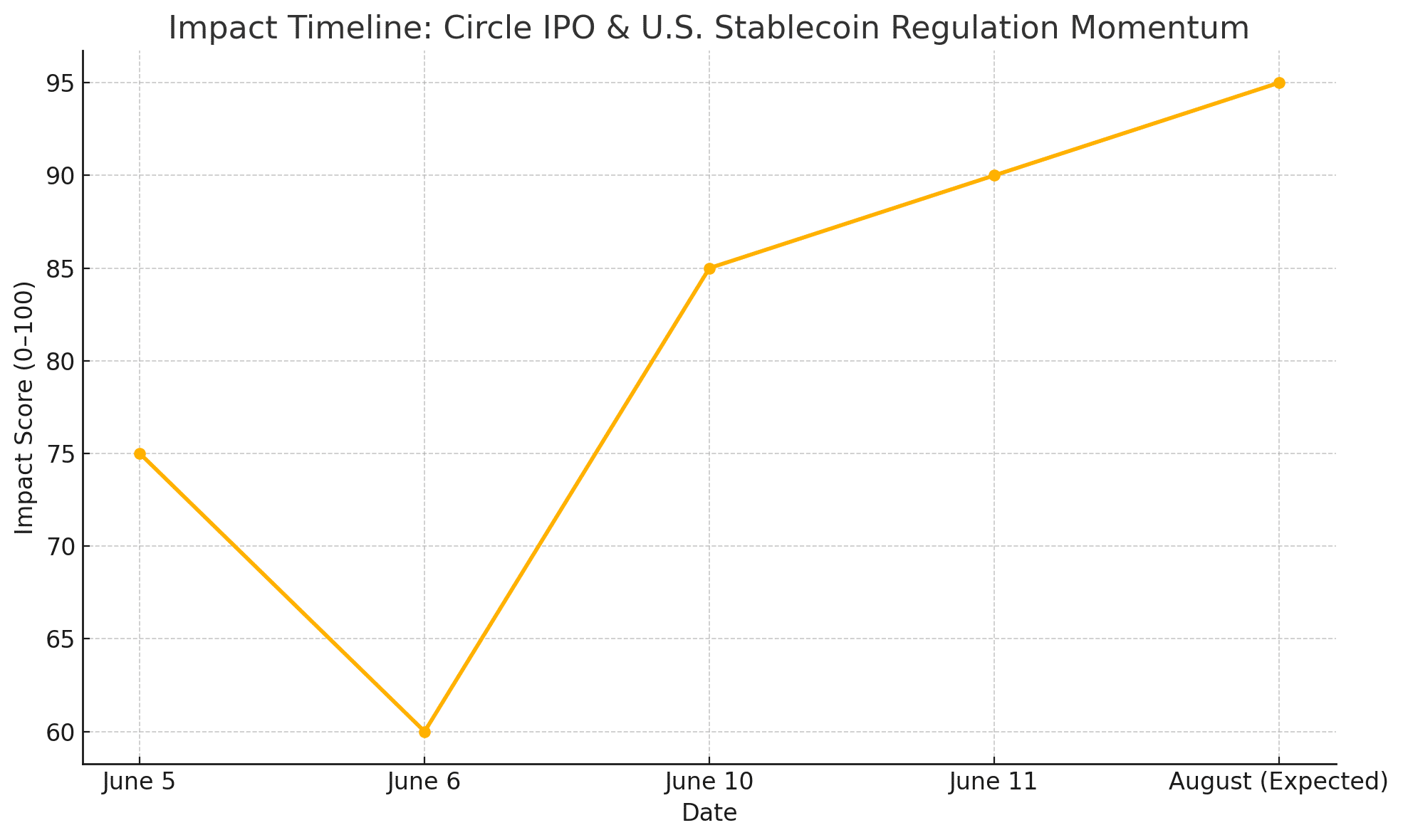

“Circle’s IPO is more than a stock market debut. It reflects increasing confidence that the U.S. will finalize a stablecoin regulatory framework—likely before Congress’s August recess,” said Garlinghouse.

The remarks come amid heightened scrutiny of the GENIUS Act, a bill currently moving through the U.S. Senate that could lay down clear federal standards for stablecoin issuance, reserve requirements, and consumer protections.

Why Circle’s IPO Matters for the Entire Crypto Industry

Circle’s debut on the New York Stock Exchange caused a stir, with its shares surging over 167% in the first hours of trading. The move valued the USD Coin (USDC) issuer at more than $18 billion, confirming its status as one of the most significant players in the stablecoin sector.

Ripple’s Garlinghouse emphasized that Circle’s IPO success adds urgency to the need for formal, national-level regulation, especially as the U.S. faces competition from jurisdictions like the European Union, Hong Kong, and South Korea, where clear frameworks are already in place.

Garlinghouse also dispelled rumors of a possible merger between Ripple and Circle, declining to comment when asked directly.

Global Push for Stablecoin Clarity

Other global leaders are not waiting for Washington to act. Hong Kong recently introduced a licensing regime for stablecoin issuers, while South Korea’s new Digital Asset Basic Act allows local companies to issue regulated stablecoins, pending approval from its financial authorities.

This international progress only adds to the pressure on the U.S. to finalize and pass the GENIUS Act, which many see as the cornerstone of an American digital finance policy.

“Regulatory headwinds are becoming tailwinds,” Garlinghouse noted. “We’re seeing bipartisan support and a true desire to provide clarity—not just enforcement.”

Institutional and Retail Confidence Rising: Ripple

Circle’s IPO was also a barometer for investor sentiment. Both institutional investors and retail traders piled in, signaling renewed confidence in crypto infrastructure companies.

According to Barron’s, this level of participation suggests that traditional investors are becoming more comfortable with blockchain companies, especially those that operate under transparent and auditable frameworks.

Ripple, which is also exploring public market options, has long championed a regulatory-first approach to crypto, which aligns with the market’s increasingly cautious stance following years of legal uncertainty and failed projects.

Conclusion

Brad Garlinghouse’s comments underline what many in the industry have hoped for: Regulatory clarity is no longer a distant dream but a policy priority. With Circle’s IPO making waves and bipartisan support for the GENIUS Act gaining traction, the U.S. may finally be ready to embrace stablecoins as legitimate financial instruments.

If passed by August, this regulatory shift could redefine the future of crypto in America, putting transparency, compliance, and innovation on equal footing.

FAQs

What is the GENIUS Act?

The GENIUS Act is a proposed U.S. bill that would regulate stablecoins at the federal level, requiring issuers to maintain fiat reserves, undergo regular audits, and register with U.S. agencies.

Why is Circle’s IPO considered a milestone for regulation?

By going public, Circle now faces rigorous disclosure and reporting standards, demonstrating that stablecoin firms can operate transparently—something regulators often demand.

Is Ripple planning a merger with Circle?

Brad Garlinghouse declined to comment, indicating that Ripple remains focused on its regulatory strategy and cross-border payment initiatives.

Glossary

Stablecoin – A cryptocurrency pegged to a stable asset like the U.S. dollar, used for payments and trading.

GENIUS Act – A proposed federal bill that aims to regulate stablecoin issuers in the United States.

IPO (Initial Public Offering) – The first time a private company sells shares to the public.

USDC (USD Coin) – A stablecoin issued by Circle, backed 1:1 by the U.S. dollar.

Tailwinds – Market or regulatory conditions that support industry growth.

Sources and References

Read More: Ripple CEO Says Circle IPO Signals Imminent U.S. Stablecoin Regulation">Ripple CEO Says Circle IPO Signals Imminent U.S. Stablecoin Regulation

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.