A snapshot of the global potato market amid ‘nightmare’ polar vortex

0

0

The humble potato is central to the global diet and feeds hundreds of millions of people around the world.

Given its importance, retail demand has remained relatively robust even as costs rise.

At present, the international markets are deeply divided, with different regions being faced with vastly different situations.

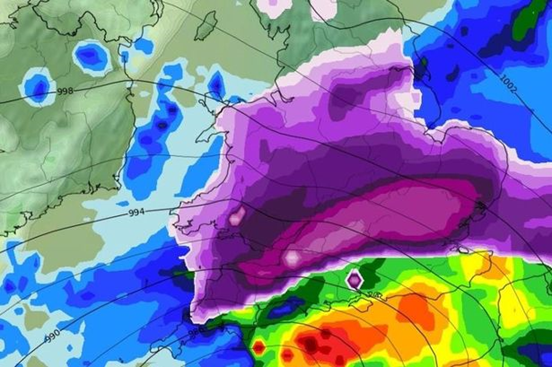

However, things could be rapidly taking a turn for the worse with Ireland’s Met Eireann issuing one of the ‘largest corrections’ on record, as authorities fear that a harsh Arctic chill could be descending on large parts of Europe.

Could this fast emerging weather system continue to thwart the efforts of potato farmers?

Extreme storm chaser and weather writer Marko Korosec concurs that a severe cold wave is about to be unleashed over Europe,

This is a textbook scenario for an intense cold outbreak from the Arctic region into much of Europe…The cold could also extend westward for a few days, as an upper low will dominate most of the European continent next week…With cold spread also towards western Europe, snow is quite likely to follow with the new system. Chances are fresh snow will develop over eastern France, Benelux, and Germany on Monday night.

But first, a quick trip to the United States.

Idaho and Washington thrive

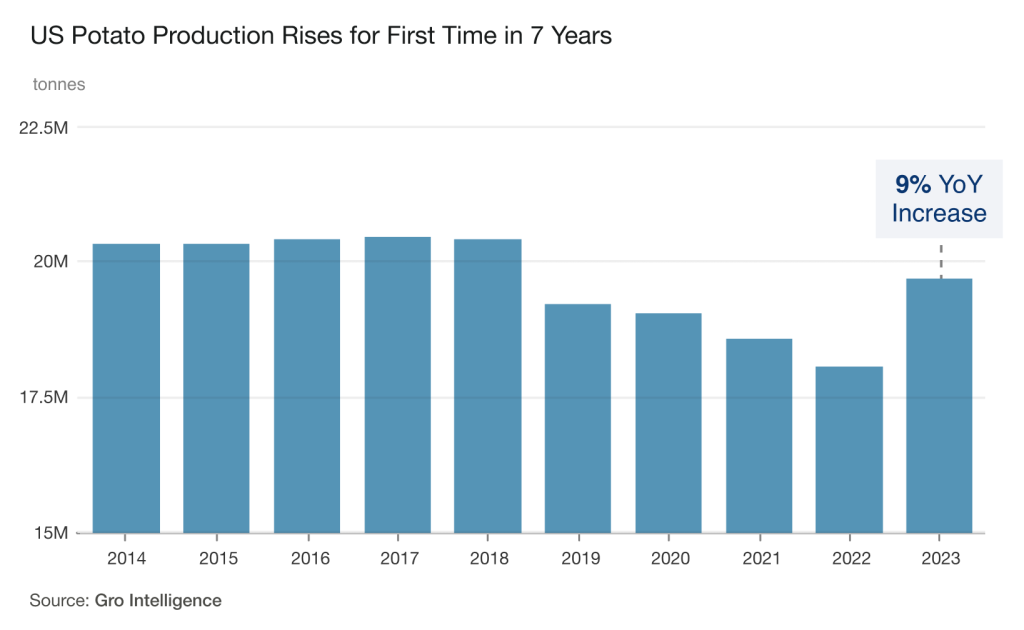

So far, 2023 has proved to be an exceptional year for the American farmer, with potato production up 8.9% YoY, marking the first such increase since 2017.

In the United States, year-to-date, potato farmers have harvested 959,800 acres of crop-sown land, 5.3% higher than the 911,400 acres registered in 2022.

Total production of 19.696 million tons stands at its highest level since 2018.

The surge in harvests is due to a combination of factors including greater sowing area, favourable weather, and improved soil moisture.

Idaho and Washington, the largest and second-largest state producers, together account for approximately 56% of US output.

On an annual basis, yields rose by 5% and 6%, respectively, and are each at their highest levels since 2020.

With potato harvests expected to remain relatively stable until the end of the year, a Gro Intelligence report notes,

…average producer prices for potatoes have dropped sharply since July and are currently down by more than 50% from a year earlier.

Potatoes USA noted that retail sales for the tuber remained strong in Q3 2023, coming in 9.5% higher than the corresponding period in the previous year.

Given the surpluses, Mcdonald’s (NYSE: MCD) launched a ‘Free Fries Friday’ promotion throughout the country which shall last until the end of 2023.

In addition, US exports are reportedly 6% higher YoY while imports have slowed by 20% during the July-to-September period.

Dollar sales were up most significantly for canned categories (45.1%), frozen potatoes (31.8%), and instant potatoes (17.1%).

Although dollar sales were 32.9% higher for ten-pound packs of fresh potatoes, volumes declined by 3%.

Despite some drought-like conditions, even Canada is estimated to see an increase in annual potato production in 2023.

European markets

In contrast to the North American geography which has been blessed by highly conducive growing conditions in 2023, Europe is struggling under the weight of hostile weather patterns and excessive soil moisture.

In Ireland, being a key staple, potato sales have reportedly remained relatively robust, while tough growing and harvesting conditions resulted in falling yields and a high proportion of wastage.

The recent increases in potato prices as published by The Irish Farmers Association (IFA) are shown below.

However, if farmers were looking forward to ‘some dryer weather this week…open a window for some harvesting’, the sudden appearance of the Arctic cold wave is threatening to derail those plans.

Further, in its report dated the 22nd of November 2023, the IFA also noted that in Holland, 5% of all potato seeds were still underground, while 20% of the crop remains unharvested, reflecting the severity of the conditions.

Sub-optimal harvesting in Dutch growing regions is likely to persist without an interval of approximately ten days of dry weather.

At the time of writing, the Mintec Benchmark Prices for Dutch processing Potatoes were trading at €190 (~£165) per metric ton, up over 65% MoM.

Germany, France and Belgium

As per FAOSTAT, Germany, France, and Belgium which are the sixth, eighth, and twentieth largest producers in the world, together accounted for 24.2 metric tons of global output in 2021.

According to Tridge, a data company in the agri-food space, France ($726 million, equivalent to ~£576 million) was the top potato exporter in the world in 2022, followed by the Netherlands ($424 million) and Germany($404 million).

Belgium was in the top ten, but is also the largest importer.

However, with continuing heavy rainfall in the coastal growing regions and the potential of an unexpected cold wave, a significant portion of the collective 3.5-4 million tons of potatoes that remain to be harvested in Germany, France and Belgium, may be compromised.

Belgium’s Fontane potatoes price has increased 100% MoM and stands at €200 per metric ton.

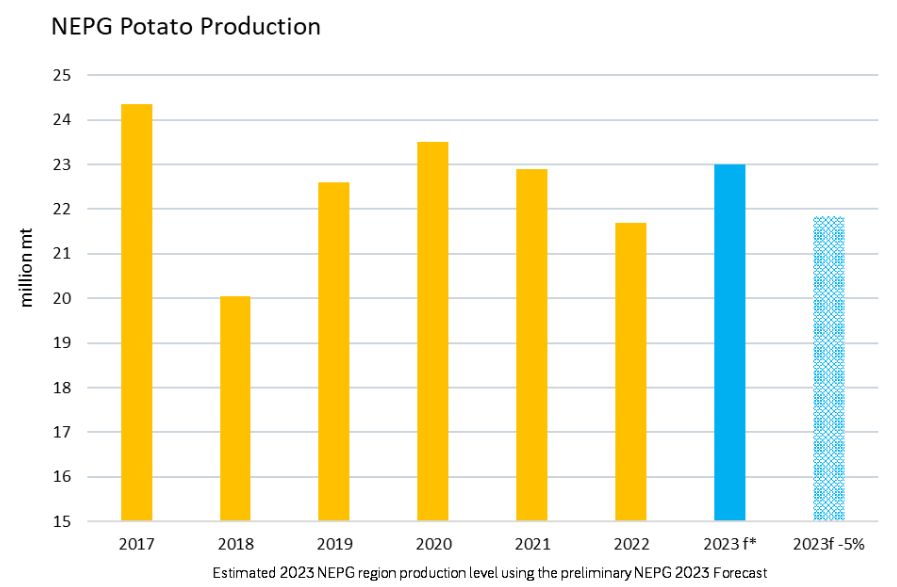

Throughout Europe, yields are expected to be atleast 5-10% lower than the North-Western European Potato Growers (NEPG) September forecast of 23 million tons.

England

Earlier today, Mintec’s Harry Campbell wrote that on an annual basis, select potato prices in England had risen between 65% and 135%, depending upon the variety.

Unfortunately, due to excessive wetness, the already tight market has seen much of the output spoil, with some industry participants noting instances of rot in nearly a third of their managed volumes.

Bangladesh

Moving to Asia, the country is the seventh largest global producer of potatoes with an output of just under 10 million metric tons in 2021.

Close on the heels of the 2024 national elections, in early November, the Trading Corporation of Bangladesh (TCB) found that prices had surged 30%-40% in a single week.

A couple of weeks ago, potato prices were reported to have sped to Tk 55-60 (£0.4 -0.43) per kilogram, amounting to an increase of 109% YoY.

Rocked by the volatility in prices, the government has argued that inflation in the potato is a result of hoarding and other illegal activities which resulted in an artificially induced crisis; although, there are also some reports of below expected production in the second half of the year as well.

A November 2023 study by the commerce ministry revealed that 90% of potatoes were owned by cold storage owners or traders, and noted,

The teams found that farmers or traders who preserve potatoes are given a slip or card without the use of a National ID or other documents…If a farmer sells their product, the new owner does not need to register their name or any identification in the cold storage.

The government has decided to address this situation on a war footing, with the Bangladesh Competition Commission (BCC) dispatching deputy commissioners to cold storage facilities to ensure transactions are legal and undertaken with ‘authentic receipt slips.’

In addition, a separate study found that the acreage of potato cultivation reached a seven-year low, falling to 455,000 hectares and registering a 2% YoY decline.

Lower production costs of mustard and other oilseeds have incentivized farmers to make such a switch which contributed to tightening the market.

To bridge the prevailing supply-demand gap, the country has initiated emergency potato imports from India, although total buying has been capped at 200,000 tons.

The policy situation has been further complicated with the Department of Agricultural Extension, Bangladesh Bureau of Statistics, and Bangladesh Cold Storage Association arriving at diverging estimates of potato production in 2023.

In a report published by The Daily Star yesterday, the TCB announced the sale of potatoes to consumers in Dhaka at Tk 30 per kilogram.

However, this was higher than the purchase price of between Tk 22 and Tk 28 per kilogram available earlier this week.

Given the alarm around the sharp rise of potato prices in the country, the government has rolled out subsidized public distribution for economically weaker households, as well as stepped up the imports of various other items such as onions, lentils, and sugar.

Next steps

For countries that are struggling with their potato crops, accelerating imports is likely the most effective way to cap the price rise.

Bangladesh is already importing potatoes from India, while European countries may be fortunate given the bumper crop in the US.

This may prove especially important at a time when weather agencies are fearing even more disruption in the harvesting season.

However, the US primarily exports to countries such as Canada, Mexico, Japan, and Taiwan.

European countries that are facing a potato shortfall will need to act swiftly to secure fresh supplies.

The post A snapshot of the global potato market amid ‘nightmare’ polar vortex appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.