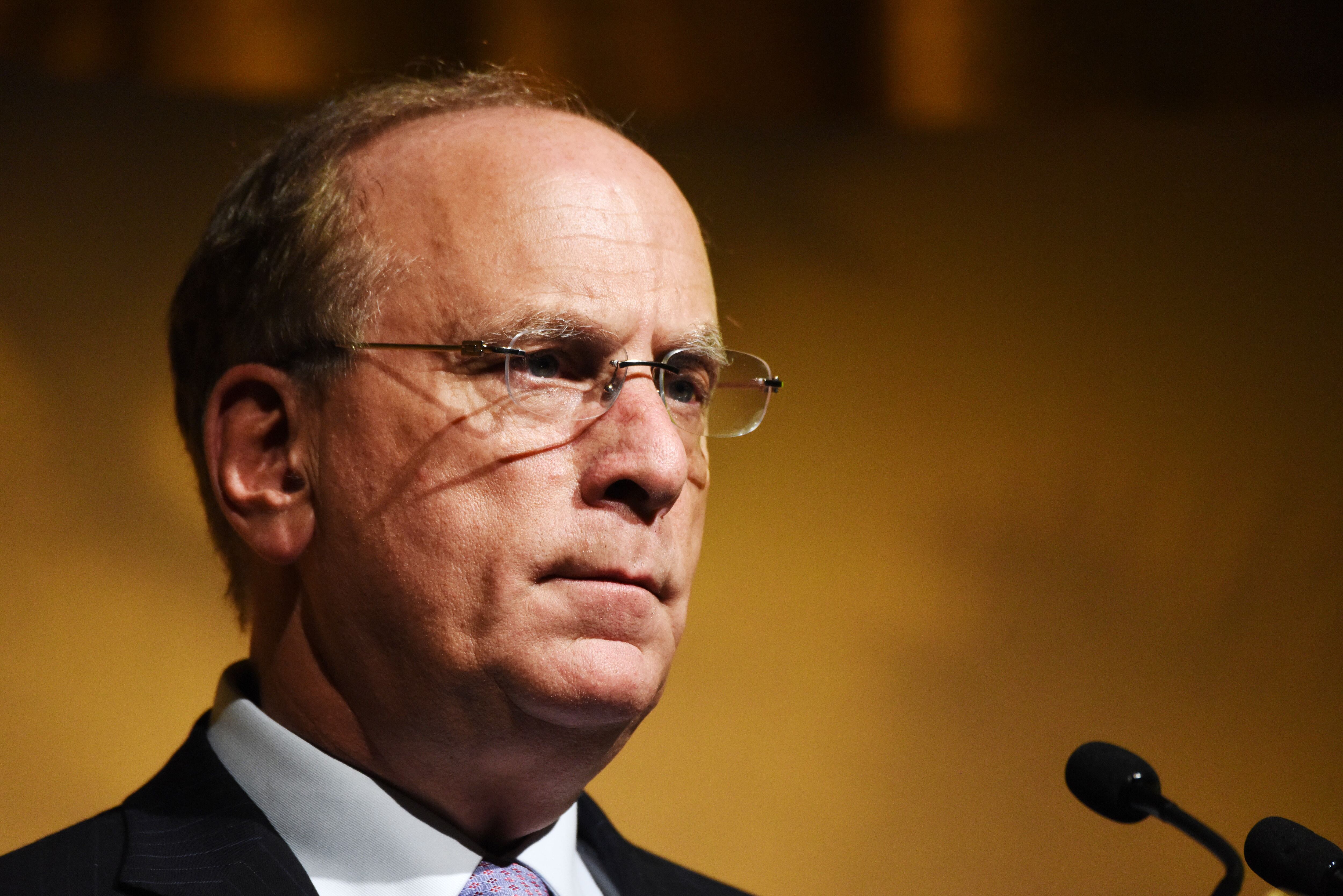

Why BlackRock CEO Larry Fink warns Bitcoin risks overtaking the US dollar

1

0

Larry Fink says that if the US doesn’t get its national debt under control, Americans may turn to Bitcoin instead of the dollar.

The national debt, which stands at more than $36 trillion, far outpaces the country’s gross domestic product — a bellwether for a country’s economic health.

That poses serious problems for the dollar’s reserve currency position, wrote the BlackRock CEO in his annual letter to shareholders.

“If the US doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin,” Fink said in the letter, released on Monday.

Fink added that he’s far from being a crypto critic, and added that decentralised finance “is an extraordinary innovation.”

Indeed, his firm is also the largest spot Bitcoin exchange-traded funds provider.

But, he worries that weakening confidence in the greenback opens the door to alternatives.

“That same innovation could undermine America’s economic advantage if investors begin seeing Bitcoin as a safer bet than the dollar,” he wrote.

Laser-eyed investors

Fink joins a growing list of financiers and industry groups sounding the alarm around growing government debt.

Moody’s, the credit ratings agency, downgraded its outlook on American debt to negative earlier this month after citing concerns around President Donald Trump’s aggressive tariff regime and unfunded tax cuts.

The Bipartisan Policy Center, a prominent Washington-based think tank, went as far as to predict that the US could default on its debt as early as July if Congress doesn’t intervene.

The BlackRock CEO also joins a unique list of laser-eyed maximalists casting the national debt in the same light as the $1.7 trillion cryptocurrency.

MicroStrategy executive chairman Michael Saylor and Wyoming Senator Cynthia Lummis have even called on the Trump administration to establish a strategic Bitcoin reserve to bolster the dollar and eradicate national debt.

Besides positioning Bitcoin as an alternative to the dollar, Fink also took time to wax poetic about the tokenisation of the financial system.

Tokenisation’s next hurdle

The BlackRock CEO again predicted tokenised versions of traditional financial assets will become as commonplace as ETFs.

With tokenised versions of stocks and bonds on the blockchain, markets will never have to close, and settlement times will drop from days to seconds, Fink said.

“Billions of dollars currently immobilised by settlement delays could be reinvested immediately back into the economy, generating more growth,” he said.

Before that can happen, however, he said that tokenised assets will need a new way to identify investors trading those tokenised assets.

“I expect tokenised funds will become as familiar to investors as ETFs — provided we crack one critical problem: identity verification,” said Fink.

Liam Kelly is a Berlin-based reporter for DL News. Got a tip? Email him at liam@dlnews.com.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.