0

0

Highlights:

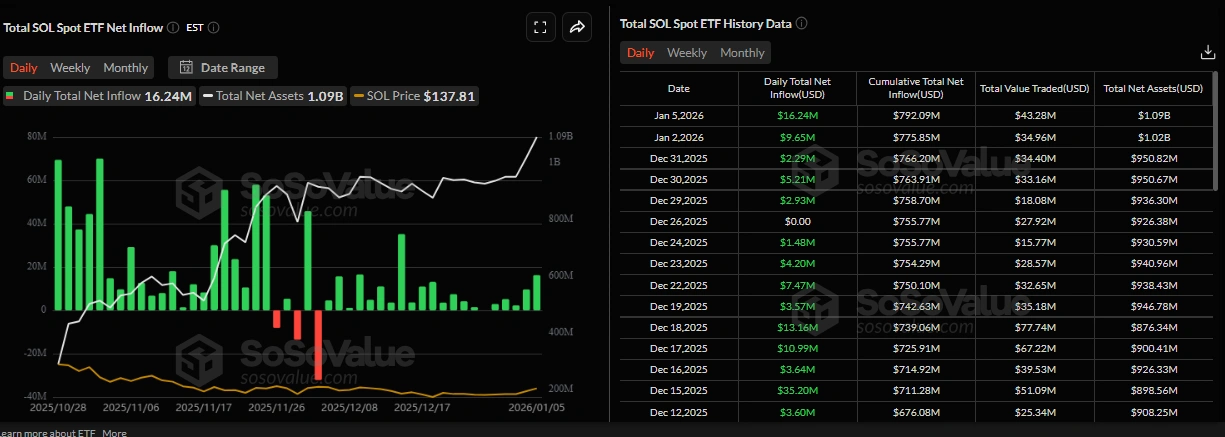

Solana (SOL) price has climbed to $137 as of Tuesday, increasing by a significant 10% in the past week. The institutional demand for SOL is growing, with spot exchange-traded funds (ETFs) having registered positive inflows of over $16 million on Monday. This marked the highest one-day inflow in a long time since mid-December. In the meantime, positive on-chain indicators suggest a positive perspective with a promise of additional returns of SOL.

Since its introduction on October 28, institutional demand for Solana has been on the rise. According to datasets of SoSoValue, the spot Solana ETFs registered the largest single-day inflows since mid-December, at $16.24 million. In addition, the net assets in general exceeded $1 billion thus far this week, indicating a growing institutional demand. In case the inflows persist and spread, SOL may experience an increase in price soon.

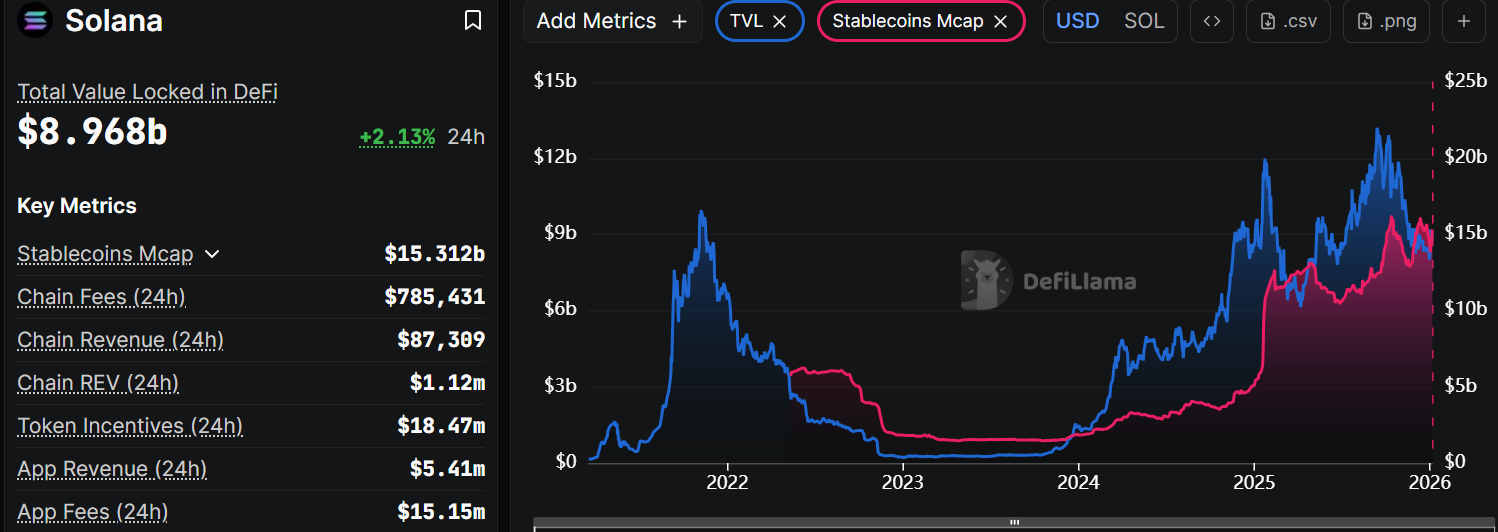

According to DefiLlama data, the total supply of SOL as a stablecoin has been on an upward trend since the beginning of January and is now at the amount of $15.31 billion. The activity of such stablecoins and their growth in value on the SOL project is a sign of a bullish future. This is because it increases the utilization of the network, and it could bring more users to the system.

SOL is trading at around $137 after bouncing from recent lows near $120, flipping above the 50‑day simple moving average around $131. The bulls are showing strength, as they have established a strong support at $131, indicating potential upside if the zone holds. As long as SOL stays above this zone, the market is likely to treat dips as buying chances rather than the start of a deeper breakdown.

Meanwhile, the RSI on the daily timeframe is recovering currently at 62.58, showing growing strength but still leaving room for further gains before conditions become overbought. The MACD has started to turn up to the upside with a bullish crossover forming. This clearly shows that the bulls are in control, calling for more traders to rally behind SOL.

On the upside, the first major hurdle sits around the 200‑day SMA at $172. If buyers can push the Solana price above $145 and hold it, the next target sits near $165, and beyond that, a move toward $172 cannot be ruled out over the coming months.

However, if the SOL price fails to break the immediate resistance zone at $145 and slips, the support at $131 would act as the safety net. In the meantime, only a drop below $131 will rule out the bullish outlook in the market, causing further losses towards $120-$117.

Best Crypto Exchange

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.