Cat in a Dogs World (MEW) joins DeFi with WhiteBit lending program

1

0

Cat in a dogs world (MEW) is expanding its influence beyond what is usual for a meme token. After a series of centralized listings, MEW is becoming part of incentives and serves as a DeFi asset.

Cat in a dogs world (MEW) will become part of a new lending project through a WhiteBit exchange program. MEW holders can now deposit their meme token to gain passive income.

The move will bring MEW into the crypto lending and yield ecosystem. For now, MEW earnings will be only 1.5% annualized, for a relatively low risk. All MEW holders can deposit between 7,000 and 409,000 MEW into the special time-limited program.

WhiteBit has additionally opened a bounty program, preparing to distribute 6M MEW to 250 winners. The bounty program is still active until August 12, and requires a new account creation and full KYC completion.

After that, users will have a series of tasks to complete. The final list of winners will be known after August 26. The MEW program has been limited from a list of countries and territories. WhiteBit itself is still not listed as an active MEW trader, though it promotes the token.

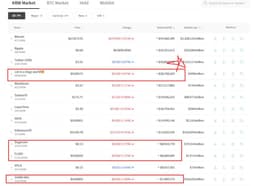

MEW remains the token with the biggest share of Korean won trading, up to 28% based on Bithumb activity. However, during its latest rally, MEW changed its trading profile to a new set of leading exchanges. Most MEW volumes are concentrated on Gate.IO, for 39% of all activity.

A new project-based Crypto Lending plan for $MEW supported by @MewsWorld: deposit from 7,000 to 409,000 $MEW at 1.5% for 30 days: https://t.co/mBUk0S5xCp

By the way, the Bounty Program with $MEW now has a new "Alpha Quest 3: MEW Yield" quest to earn more BITS:… pic.twitter.com/9PwrzPaI3W— WhiteBIT (@WhiteBit) July 29, 2024

MEW goes through fourth rally since its launch

MEW is going through its fourth significant period with active price moves and high volumes. Previously, MEW rallied soon after its launch, followed by speculative spikes in April and May.

MEW now has to show whether it has gained its spot among top memes, or will be swept aside by the next hyped launch. MEW is yet to flip POPCAT and still lags behind MOGCOIN, the leading cat-themed meme token. Overall, all cat-themed tokens have a total market capitalization of $2.5B.

MEW saw its DEX volumes on Solana expand in July, with activity not seen since April. The DEX activity holds a share of wash trading, suggesting not all MEW activity is fully organic.

As of July 31, MEW also had a wallet cluster developed, with high activity between wallets. The cluster was linked to a whale wallet holding 0.49% of the supply, and together with smaller wallets controlled 1.19% of the MEW supply. Even this cluster could be enough to sway MEW decentralized trading.

Is MEW a ‘cabal coin’?

MEW has been called out for being more influential compared to other cat memes. During previous rallies, MEW has been called a ‘cabal coin’, driven by special interest groups.

Since then, the market matured, especially after adding listings to OKX. MEW has not managed to gain a Binance listing, as traders expected earlier. However, MEW is highly active on Raydium, with more than $41M in liquidity, more than double the available SOL pool of Dogwifhat (WIF).

The heavy trading on the Raydium DEX also means MEW is heavily affected by MEV bots, taking up to 50% of transactions during busy time periods.

One of the reasons for the sudden MEW rallies is the Korean won market. MEW has also started to behave more like a token for heavy trading, rather than a meme. Despite this, the MEW price action also suggested potential insider manipulation and attempts to hype the token and sell to new retail buyers.

As of July, MEW is held in more than 180K wallets, and carries a total market cap of $588M. MEW is a fully diluted asset, despite suspicions of pre-mints or VC distribution. At its launch, MEW was held in 147K wallets, some reached via an airdrop. MEW was initially distributed to BONK and WIF holders, before gaining more prominence among cat memes.

MEW traded at $0.006, close to its higher range for the past month. In July, increased activity took MEW to a temporary peak of $0.0085. In July, MEW trading volumes broke above $300M in a day for the first time in two months, but slid to $88M in 24 hours.

Cryptopolitan reporting by Hristina Vasileva

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.