Institutional Demand Fuels BONK Breakout Amid Burn Plan, Holder Surge

1

0

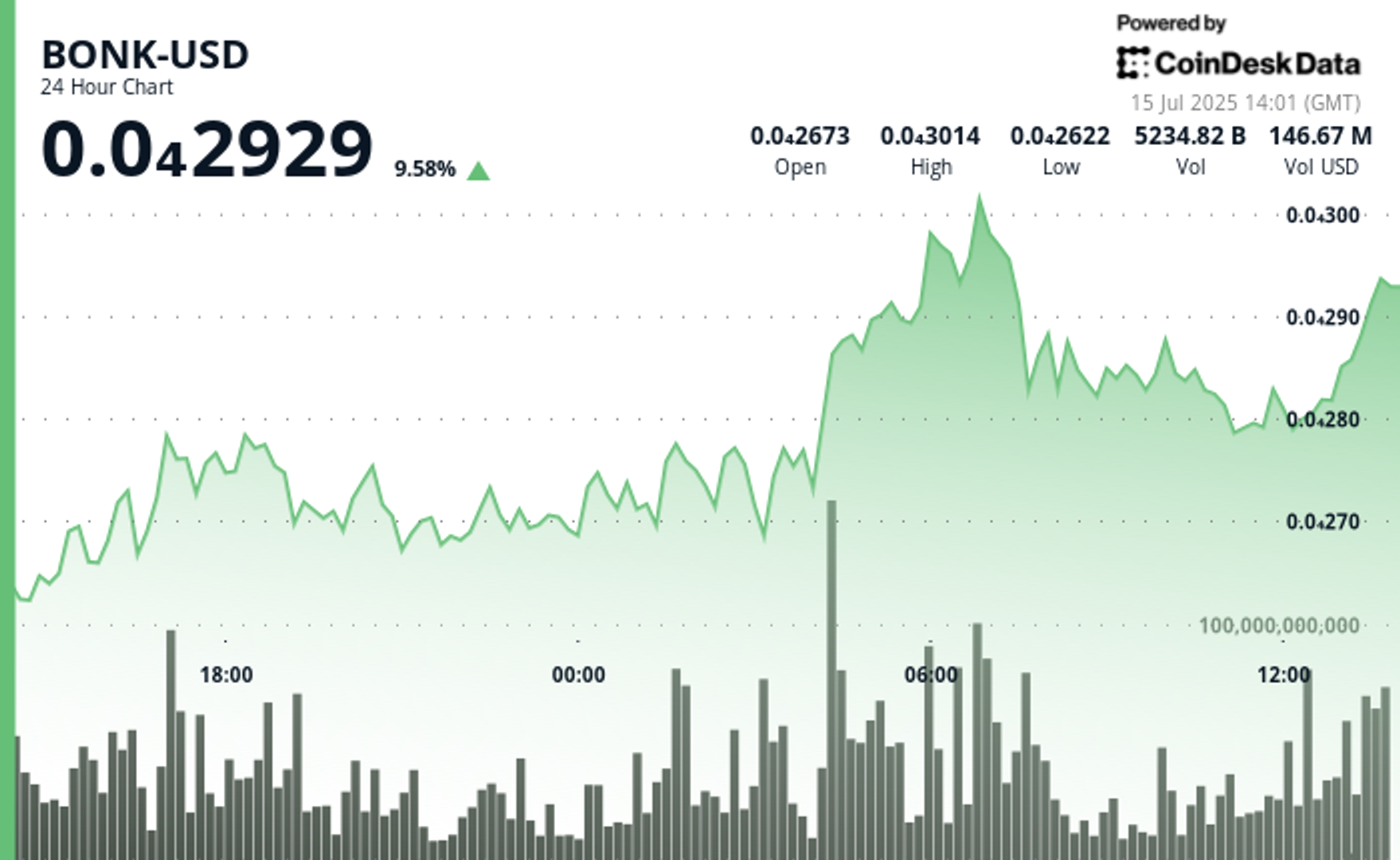

BONK saw a 15% breakout, driven by a jump in trading activity and rising on-chain traction.

With open interest increasing 9% and derivatives volume also higher, market participants are signaling increased conviction in the Solana-based meme token’s upside potential, according to CoinDesk Research's technical analysis data model.

Much of the excitement stems from BONK’s evolving fundamentals. The project recently announced plans to burn 1 trillion tokens, a move that could significantly reduce supply and strengthen the case for long-term appreciation.

The community is pushing aggressively toward reaching 1 million on-chain holders, a symbolic milestone for adoption, which will also trigger the aforementioned burn.

The momentum kicked off on July 14 at 13:00 UTC, with BONK rising steadily from $0.000027 and peaking at $0.000031 by 07:00 on July 15. That rally was accompanied by massive activity — over 3.5 trillion tokens were traded during the peak hour, marking a period of institutional-grade breakout volume.

Grayscale’s inclusion of BONK on its asset watchlist further signaled a shift in perception, as meme tokens evolve from speculative plays to legitimate vehicles for market participation.

With deflationary mechanics, deepening liquidity, and growing institutional validation, BONK may be primed for further momentum in the days ahead.

Technical Analysis Highlights

- BONK rallied 15% to $0.000031 (July 14 13:00–July 15 12:00 UTC).

- Trading volume topped 3.5 trillion tokens during the 06:00–07:00 UTC breakout phase.

- Open interest surged 9%, while derivatives activity spiked sharply.

- A planned 1 trillion BONK token burn introduces a deflationary catalyst.

- Price consolidated at $0.000028 following the rally; support held at $0.000026

- BONK spiked 2% in minutes at 12:30 UTC on 75 billion tokens exchanged.

- Current price: $0.0000294, with daily gains of 7.8% and bullish structure intact.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.