Goldman Sachs Increases Its Stake in BlackRock’s Bitcoin ETF by 28%, Reaching $1.4B

0

0

Highlights:

- Goldman Sachs boosts IBIT investment by 28%, holding 30.8M shares worth $1.4B.

- IBIT leads Bitcoin ETFs with $62.8B in assets.

- Goldman Sachs’ involvement signals growing Wall Street confidence in Bitcoin and digital asset portfolios.

Investment bank Goldman Sachs boosted its investment in BlackRock’s iShares Bitcoin Trust (IBIT) by 28%. As of March 31, they now own 30.8 million shares worth over $1.4 billion, up from 24 million shares earlier, according to a recent United States Securities and Exchange Commission (SEC) filing reported by MacroScope.

In February, Goldman Sachs revealed it held over $1.5 billion in U.S. spot Bitcoin ETFs, including about $288 million in Fidelity’s Bitcoin fund (FBTC) and $1.2 billion in BlackRock’s IBIT. The latest update shows that its investment in FBTC has stayed about the same.

In a 13F filed this afternoon, Goldman Sachs reported the following positions as of March 31:

IBIT 30.8 million shares valued at $1.4 billion

FBTC 3.47 million shares valued at $250 millionThis compares to the previous filing as of December 31, when Goldman reported:

IBIT: 24…

— MacroScope (@MacroScope17) May 9, 2025

Goldman Sachs Leads Institutional Investment in IBIT

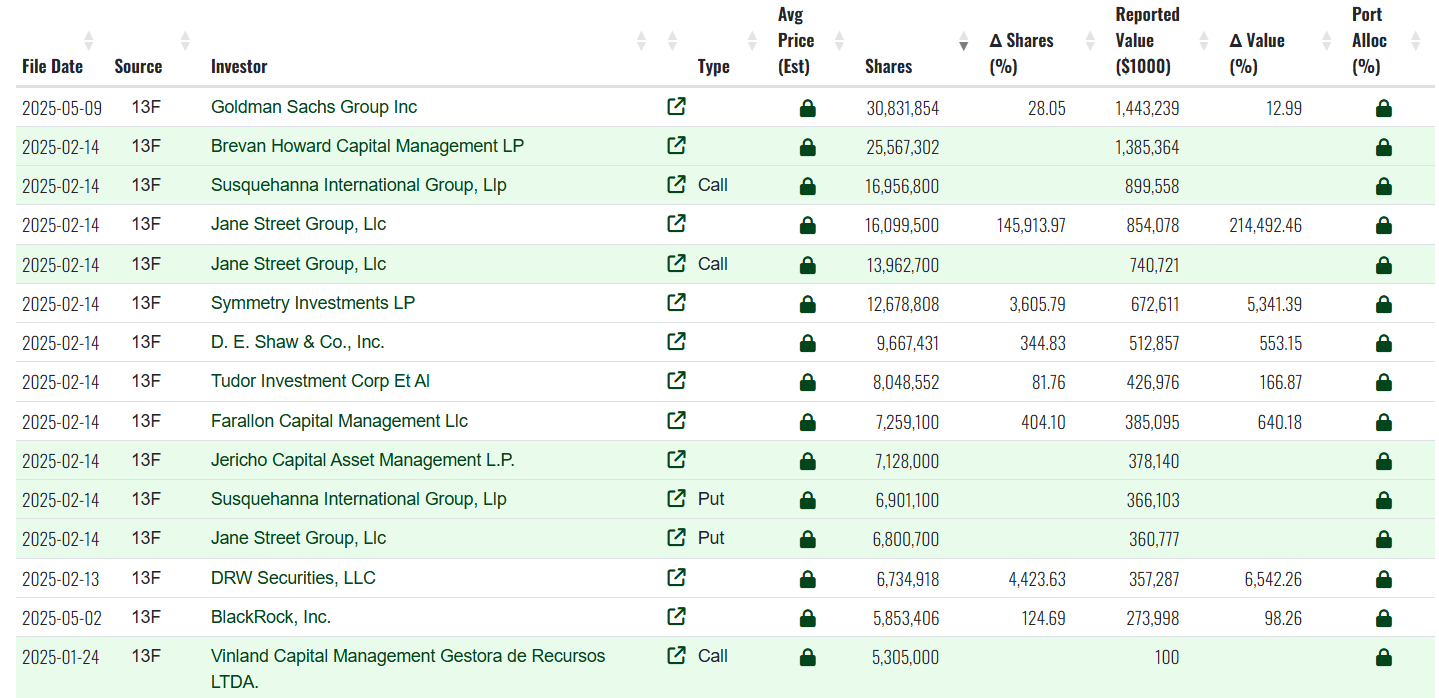

According to the latest data from Fintel, Goldman Sachs is now the largest institutional investor in BlackRock’s IBIT. Brevan Howard holds second place with more than 25 million shares, valued at approximately $1.4 billion. Other well-known investors in IBIT include Jane Street, D.E. Shaw, and Symmetry Investments, showing that hedge funds and trading firms are becoming more confident in the Bitcoin ETF market.

Bank of America is still considered fairly valued. Goldman Sachs’ December 13F report disclosed BTC ETF positions, including $157 million in call options. These options profit if Bitcoin prices rise. The firm also held $527 million in put options, which benefit from a price decline, specifically tied to IBIT.

Additionally, Goldman Sachs reported $84 million in put options for Fidelity’s spot Bitcoin fund (FBTC), as noted by MacroScope. But these positions are missing from the latest report, suggesting that Goldman may have closed them or let them expire as market conditions changed.

IBIT Becomes Leading Bitcoin ETF with Record Investments

IBIT has rapidly become the top-spot Bitcoin ETF from BlackRock. By early May 2025, it was managing roughly $62.8 billion in assets, based on data from Farside Investors. Since it launched, IBIT has brought in over $44 billion in net investments a record pace for any ETF, not just in crypto. Just this week, it has already received $674 million in new investments.

On May 9, IBIT shares rose by $1.04 and closed at $58.66. This increase follows a recent rebound in Bitcoin’s price, which has stayed above $60,000 over the past month. On Friday, BlackRock revised its S-1 filing for IBIT, pointing out possible risks related to quantum computing. Bloomberg ETF analyst James Seyffart mentioned that such risk disclosures are typical in SEC filings.

To be clear. These are just basic risk disclosures. They are going to highlight any potential thing that can go wrong with any product they list or underlying asset thats being invested in. It's completely standard. And honestly makes complete sense.

People looked to this…

— James Seyffart (@JSeyff) May 9, 2025

Many see Goldman’s growing involvement in Bitcoin ETFs as a strong sign of support not just for Bitcoin, but also for the creation of financial products that make it easier for more people to invest in digital assets.

This move also shows a bigger trend Wall Street is starting to include digital assets like Bitcoin in regular investment portfolios, especially now that U.S. regulators have approved several spot Bitcoin ETFs. As more big investors are expected to join and rules become clearer, the Bitcoin ETF market could keep growing. Currently, Goldman Sachs is at the forefront.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.