Bitcoin and Ethereum ETFs Attract $143M in Combined Net Gains

0

0

Highlights:

- On June 4, Bitcoin and Ethereum ETF investors contributed a combined $143.9 million profit.

- Bitcoin ETF gain marked the funds’ second consecutive profit after periods of recording only outflows.

- Ethereum ended Bitcoin’s dominance to champion digital assets’ inflows last week.

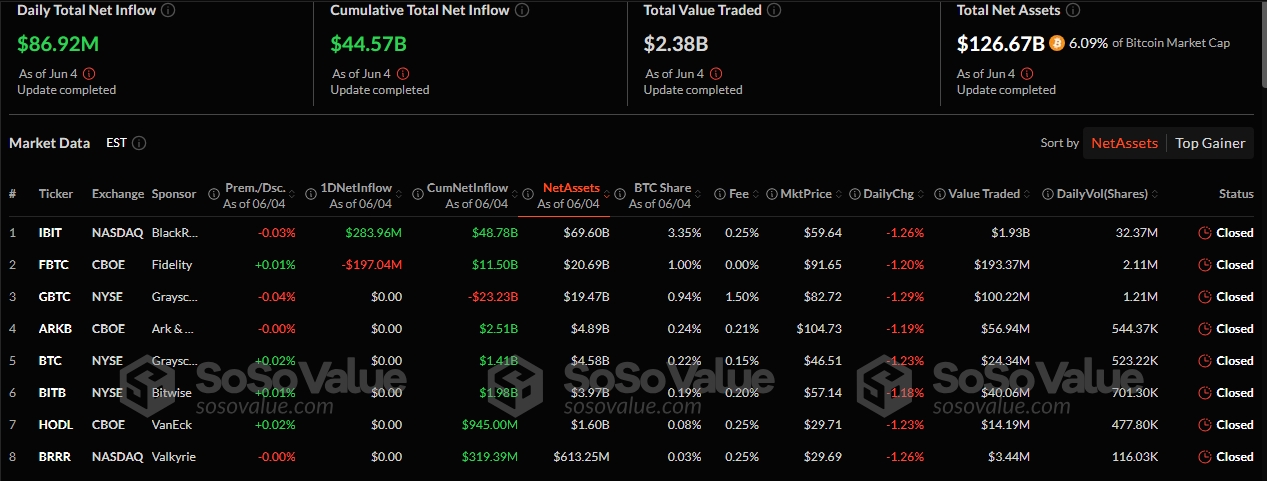

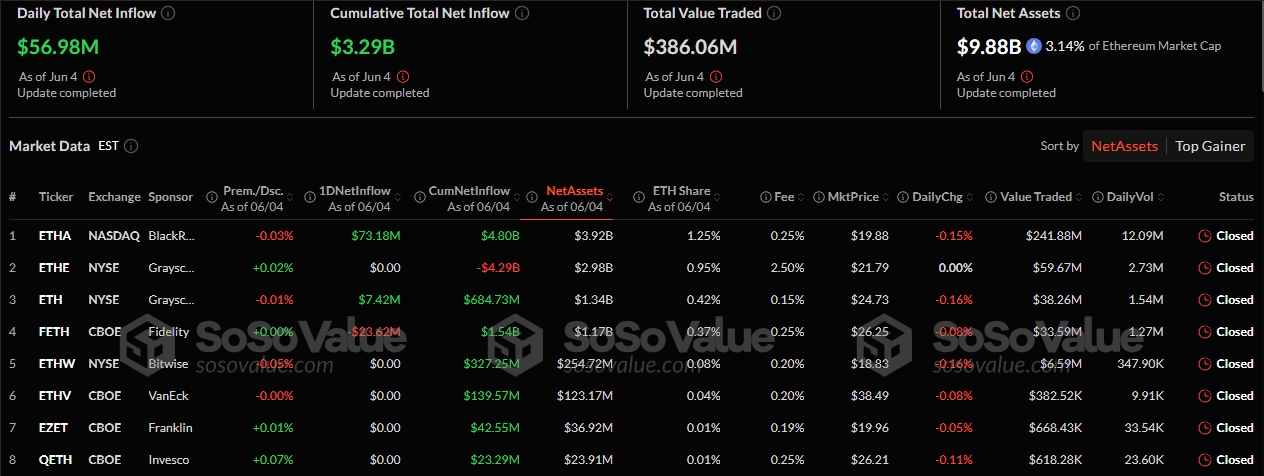

Renowned crypto Exchange Traded Funds (ETFs) tracker SosoValue has updated Bitcoin (BTC) and Ethereum (ETH) ETFs’ flow data for June 4. In the new flow data, Bitcoin ETFs recorded $86.92 million in net inflows. Similarly, Ethereum ETF investors added $56.98 million, resulting in a combined $143.9 million cash inflow.

On June 4, spot Bitcoin ETFs saw a total net inflow of $86.92 million, with BlackRock’s IBIT being the only ETF to record a net inflow. Spot Ethereum ETFs recorded a total net inflow of $56.98 million, marking 13 consecutive days of net inflows.https://t.co/ueXcZjuIVU

— Wu Blockchain (@WuBlockchain) June 5, 2025

Bitcoin ETFs Detailed Statistics

Bitcoin ETFs had their first back-to-back profits after three consecutive losses worth over a billion dollars in the space of three days. Meanwhile, in their most recent outing, only two ETFs were active, as ten others had neither inflows nor outflows. BlackRock Bitcoin ETF (IBIT) attracted the only cash inflows valued at approximately $283.96 million.

Fidelity Bitcoin ETF (FBTC) was the second active fund. However, it forfeited $197.04 million, marking its sixth outflow contribution in its past seven outings. Overall, Bitcoin ETFs’ cumulative net inflows increased slightly from $44.48 billion to $44.57 billion. However, other cumulative variables suffered decrements. The total value traded was $2.38 billion, having dropped from $2.87 billion. Similarly, the total net assets decreased from $128.13 billion to $126.67 billion, representing 6.09% of Bitcoin’s over $2 trillion market cap.

Ethereum ETFs Maintain Impressive Performance

On June 4, Ethereum ETFs added $56.98 million in net inflows, extending the funds’ profit streak to thirteen straight days. Notably, only three ETFs attracted investors’ attention, as the remaining six were inactive. BlackRock Ethereum ETF (ETHA) gained $73.18 million, while Grayscale Mini Ethereum ETF (ETH) added $7.42 million.

Fidelity Ethereum ETF (FETH) was responsible for the only outflow recorded yesterday. This fund forfeited $23.6 million. Meanwhile, cumulative net inflows and total net assets appreciated slightly to about $3.29 billion and $9.88 billion, respectively. The net assets value has equalled 3.14% of Ethereum’s $314.98 billion market cap. In contrast, the total value traded dropped from $472.49 million to $386.05 million.

Institutions Intensify ETH Investments

Ethereum has experienced significant spikes in investors’ interest over the past few weeks. On June 4, a renowned on-chain crypto transactions tracker, Lookonchain, reported that BlackRock spent over $500 million accumulating ETH in roughly three weeks.

Lookonchain stated:

“Since May 11, BlackRock has bought 214,000 ETH ($560M), even as $ETH has traded sideways between $2,500 and $2,700.”

Lookonchain also tracked another whale that bought 108,278 ETH for $283 million via over-the-counter (OTC) trading. According to the on-chain tracker, the whale’s wallet currently holds 139,476 ETH, valued at about $365 million.

It seems that a whale/institution bought 108,278 $ETH($283M) through OTC.

Galaxy Digital OTC wallet withdrew 89,000 $ETH($233.5M) from exchanges in the past 12 hours, and then transferred 108,278 $ETH($283M) to the whale/institution wallet 0x0b26.

Wallet 0x0b26 currently holds… pic.twitter.com/BgqiLH2xlH

— Lookonchain (@lookonchain) June 4, 2025

On June 2, asset manager CoinShares published digital assets flow statistics for the previous week. The report showed that Ethereum led the inflows chart, ending Bitcoin’s dominance. Notably, Bitcoin ended the week with net outflows worth $8 million.

CoinShares stated:

“Ethereum led the pack this week, with another week of inflows totalling $321 million, bringing this six consecutive week run of inflows to $1.19 billion, its strongest run since December 2024, marking a decisive improvement in sentiment.”

According to CoinShares, digital asset investment products saw $286M in net inflows last week, totaling $10.9B over seven weeks. Ethereum led with $321M, its highest since Dec 2024, while Bitcoin recorded a slight $8M outflow, its first after six consecutive weeks of $9.6 billion…

— Wu Blockchain (@WuBlockchain) June 2, 2025

Meanwhile, at the time of press, ETH is down 1.6% in the past 24 hours, trading at about $2,600 and fluctuating between $2,594.39 and $2,667.17. On the other hand, BTC is changing hands at approximately $104,600, following a 1% decline in the past 24 hours.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.