Bitcoin ETFs Shed $169.87M as Ethereum ETFs Mark Seventh Consecutive Day of Outflows

0

0

Highlights:

- Bitcoin ETFs forfeited $169.87 million on April 16, terminating their back-to-back gains.

- Ethereum ETFs extended their losing streak to a seventh consecutive day.

- FBTC and ARKB topped the Bitcoin ETFs losses chart amid the funds’ heightened activities.

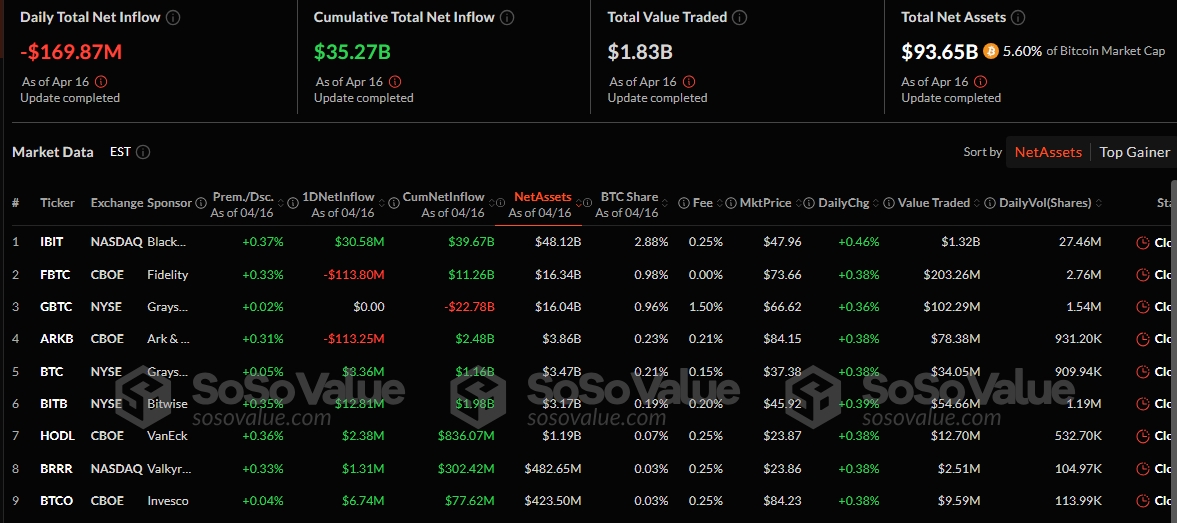

On April 16, Bitcoin (BTC) Exchange Traded Funds (ETFs) and Ethereum (ETH) ETFs recorded outflows as the crypto market attempted to recover from earlier declines. According to SosoValue’s statistics, Bitcoin ETFs succumbed to net outflows worth $169.87 million, terminating their two consecutive days winning streak recorded on April 14 and 15.

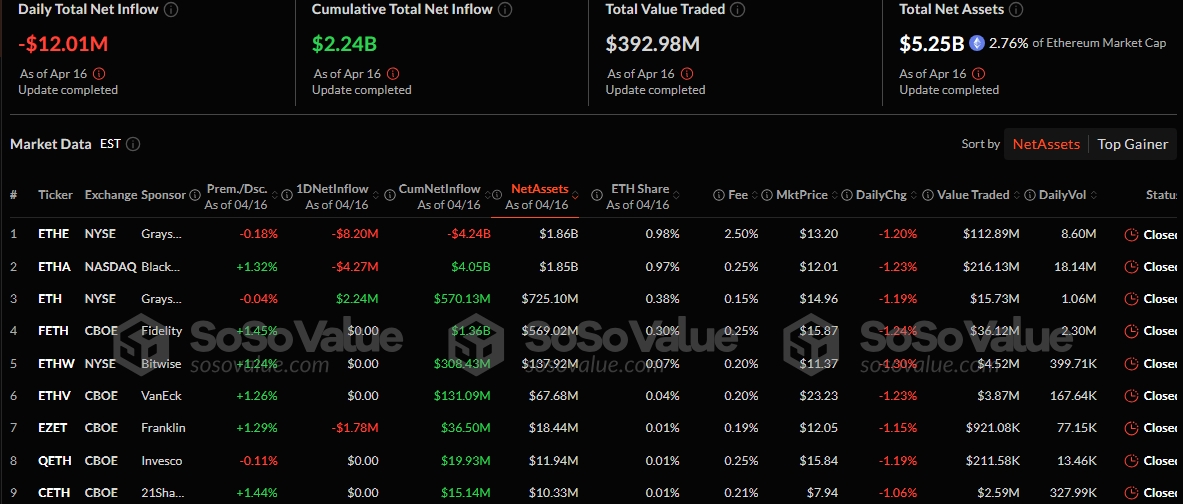

Similarly, Ethereum ETFs recorded losses of about $12.01 million. However, unlike BTC, ETH funds extended their outflow trend to a seventh straight day. Since this month began, Ethereum ETFs experienced net inflows on only April 4, raising significant price impact concerns among ETH investors.

On April 16, U.S. spot Bitcoin ETFs recorded a total net outflow of $170 million, with Fidelity's FBTC leading the outflows at $114 million. Spot Ethereum ETFs saw a total net outflow of $12.0062 million, marking the seventh consecutive day of outflows.https://t.co/Hj2Gs49bWa

— Wu Blockchain (@WuBlockchain) April 17, 2025

FBTC Tops Bitcoin ETFs Losses Chart Amid Heightened Activities

Eight Bitcoin funds were active yesterday, as the remaining four had neither inflows nor outflows. Two active ETFs recorded losses, while the remaining six attracted cash inflows. Only BlackRock Bitcoin ETF (IBIT) and Bitwise Bitcoin ETF (BITB) had profits above $19 million. They gained $30.58 million and $12.81 million, respectively.

Other profitable funds were Invesco Bitcoin ETF (BTCO), Grayscale Mini Bitcoin ETF (BTC), VanEck Bitcoin ETF (HODL), and Valkyrie Bitcoin ETF (BRRR). These funds brought in $6.74 million, $3.36 million, $2.38 million, and $1.31 million, respectively. Despite the marked number of ETFs that attracted cash inflows, the outflows from Fidelity Bitcoin ETF (FBTC) and ARK 21Shares Bitcoin ETF (ARKB) were enough to erase all the gains.

FBTC lost $113.80 million, while ARKB shed $113.25 million. Following the net outflows, Bitcoin ETF cumulative net inflow dropped from $35.44 billion to $35.27 billion. Similarly, the total net assets depreciated from $93.72 billion to $93.65 billion. The current net assets valuation represents 5.6% of Bitcoin’s $1.675 trillion market capitalization. On the contrary, the total value traded increased from $1.60 billion to $1.83 billion.

Bitcoin Records Slight Price Upswing Despite Bitcoin ETFs Net Outflows

Bitcoin is up 0.7% in the past 24 hours, trading at approximately $84,300. In the past week, Bitcoin recorded a 3.5% jump, fluctuating between $78,835.59 and $85,917.27. This range suggests that BTC has partly recovered from the marked market downturns in early April.

Detailed April 16 Statistics for Ethereum ETFs

Only four Ethereum ETFs were active, as five had neither inflows nor outflows yesterday. Only Grayscale Mini Ethereum ETFs attracted cash inflows valued at about $2.24 million. The remaining active ETFs, including Grayscale Ethereum ETF (ETHE), BlackRock Ethereum ETF (ETHA), and Franklin Ethereum ETF (EZET), lost $8.20 million, $4.27 million, and $1.78 million, respectively.

As a result of the persistent net outflows, Ethereum ETF cumulative net inflow declined from $2.26 billion to $2.24 billion. The funds’ total net assets valuation dropped from $5.36 billion to $5.25 billion. This new value represents 2.76% of Ethereum’s market cap, worth $192.486 billion. However, the total value traded jumped from $209.01 million to $392.98 million.

Ethereum’s Price Appreciates Slightly in the Short-Term Interval

At the time of press, ETH is changing hands at about $1,590, following a 1.5% increment in the past 24 hours. Within the same time frame, Ethereum oscillated between $1,551.41 and $1,607.12. In the past week, ETH spiked by about 0.3% and fluctuated between $1,501.12 and $1,677.74.

Other long-term price change data suggests that Ethereum is still struggling. For context, ETH is down 12.5% 14-day-to-date, 16.4% month-to-date, and 48.1% year-to-date. Despite its unimpressive outlook, Ethereum’s 24-hour trading volume spiked 2.42% to about $13.54 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.