SharpLink Gaming Acquires Record 176,271 ETH, Leads Public Companies in ETH Holdings

0

0

Highlights:

- SharpLink Gaming has expanded its ETH holdings with a new investment worth $462.95 million for 176,271 ETH.

- The company likely capitalized on ETH’s recent struggles to purchase ETH at an average cost of $2,626 per token.

- Interest in Ethereum investments has surged significantly after the token’s recovery from the previous slumps.

SharpLink Gaming, a US-based sports betting platform, announced in a June 13 press release that it has invested in 176,271 Ethereum (ETH) tokens. In the publication, the company noted that it spent a total of about $462.95 million at $2,626 per ETH. The total amount spent also accounted for extra charges for the purchase. These included gas fees and other transactional expenses.

The sports betting company was among the early Nasdaq-listed companies to establish an Ethereum reserve. Following today’s purchase, the company became the world’s largest publicly traded holder of ETH. However, it ranks behind the Ethereum Foundation in terms of the number of held ETH tokens. SharpLink Gaming has continued to show strong faith in blockchain’s potential to transform the global industry via consistent ETH procurement. The company is also increasing shareholders’ exposure to ETH, driving the cryptocurrency’s adoption.

#sharplinkgaming is pleased to announce that we have acquired 176,271 ETH for $463 Million,officially becoming largest publicly-traded ETH holder (Nasdaq: SBET). https://t.co/rS1ORyv6KT pic.twitter.com/ET1Jd1txSp

— SharpLink Gaming (@SharpLinkGaming) June 13, 2025

SharpLink Gaming Fundraising Strategies

In the released publication, SharpLink Gaming highlighted some of its fundraisers that aided its consistent investments in Ethereum. Some of the adopted fundraising strategies included proceeds from Private Investment in Public Equity (PIPE) and at-the-market (ATM) facilities.

SharpLink Gaming stated:

“In addition to the initial PIPE transaction from May 26, 2025, the Company also disclosed it raised $79 million in gross proceeds through its ATM facility.”

The game betting platform also noted that its consistent ETH procurements have resulted in an increased ETH per share increment rate. Since June 2, 2025, the variable has spiked to about 11.8%. Meanwhile, as of June 13, 2025, SharpLink Gaming has allocated more than 95% of its ETH holdings to staking and liquid staking solutions. The allocation is targeted towards improving Ethereum network security and native yield generation rate.

SharpLink Gaming CEO Voices Strong Support for Ethereum Transformation Potential

Rob Phythian, Chief Executive Officer (CEO) of SharpLink Gaming, commented on the company’s latest acquisition. He described it as a significant milestone for the betting platform and other crypto-related companies. The CEO also voiced a strong conviction about Ethereum’s potential to transform digital commerce and decentralized applications.

Joseph Lubin, Chairman of SharpLink Gaming, Co-Founder of Ethereum and Founder and CEO of Consensys, also reacted to the acquisition news. He described how the United States’ new legislation can boost the adoption rate of the Ethereum technology.

The Chairman stated:

“It comes at a time when the US Congress is moving towards passing significant stablecoin and digital asset market structure legislation. Hopefully, it will catalyze the adoption of Ethereum technology.”

Whales and Institutions Show Renewed Interest in Ethereum

After recovering from a concerning dip that saw ETH plummet below $2,000, the coin has experienced a sudden spike in investors’ interest. Earlier today, Lookonchain, a leading crypto transactions tracker, reported that a whale who has amassed $30 million in profits from ETH started repurchasing the token. The on-chain tracker noted that this whale acquired 48,825 ETH at $2,605 per token, totaling $127 million. The procurement occurred within eight hours on Coinbase and Wintermute.

While the crowd panic-sells $ETH, this whale – who's already made ~$30M profit on $ETH – is buying $ETH crazily.

Over the past 8 hours, he's bought 48,825 $ETH($127M) from Coinbase and Wintermute at an average price of $2,605.https://t.co/7eUZQPGfROhttps://t.co/SHASXyPST1 pic.twitter.com/r7VZMz12tV

— Lookonchain (@lookonchain) June 13, 2025

On June 12, Ethereum ETFs recorded their nineteenth consecutive profitable outing. The funds attracted $112 million in cash inflows led by BlackRock Ethereum ETF’s (ETHA) $101.53 million gain. Fidelity Ethereum (FETH) also contributed to yesterday’s net inflows, with profits valued at about $10.83 million.

On June 12 (ET), Ethereum spot ETFs recorded a total net inflow of $112 million, marking 19 consecutive days of net inflows. Bitcoin spot ETFs saw a total net inflow of $86.31 million, extending their net inflow streak to 4 consecutive days.https://t.co/YoUZSIH5ws

— Wu Blockchain (@WuBlockchain) June 13, 2025

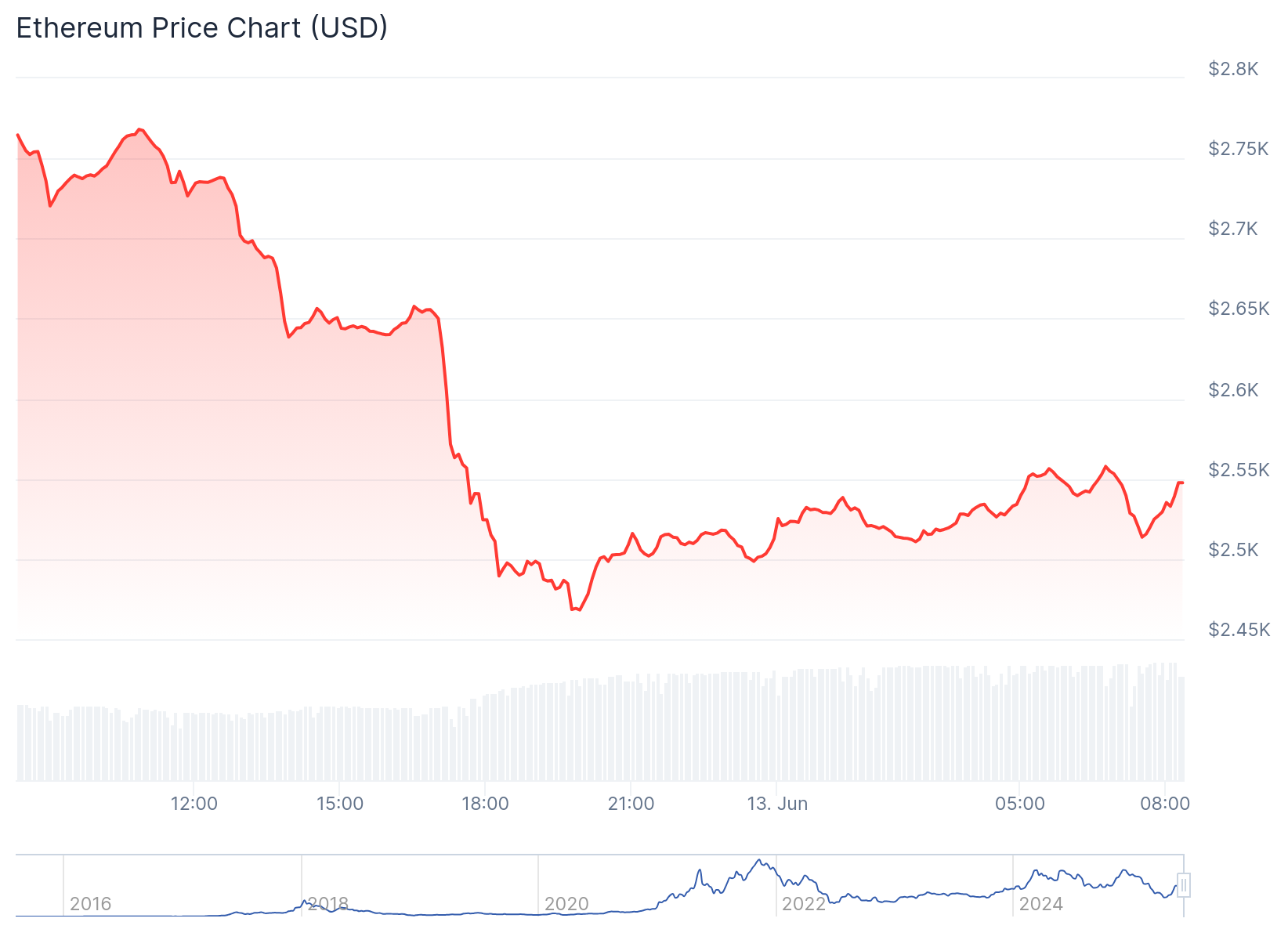

Ethereum Drops Significantly

At the time of writing, CoinGecko data showed that Ethereum lost 7.7% in the past 24 hours, trading at $2,540. Within the same timeframe, the world’s number one altcoin fluctuated between $2,468.28 and $2,768.20, reflecting a significant drop and concentrated recovery effort.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.