Best Cryptocurrencies to Invest in Today, November 3 – XRP, SOL, LINK

0

0

Highlights:

- XRP is preparing for a strong rebound as ETF approval expectations rise and institutional demand builds rapidly.

- Solana is trading in a key range, with bulls watching a breakout above $200 for upside continuation.

- Chainlink is showing strong accumulation and reduced exchange supply, signaling a possible breakout and major bullish phase ahead.

The crypto market has started the week in the red zone, with major coins losing value. The sharp decline has triggered major liquidations in the market, with the most noticeable one being a $100 million liquidation in one hour. Most analysts warn that the crypto market may experience major corrections due to macroeconomic factors. At press time, the total market cap is down 3.48% to $3.59 trillion. However, the trading volume is up 49.39% to $134 billion in the past day.

The fear and greed index sits in the fear zone at an index of 36. Meanwhile, the liquidations in the last 24 hours total $471.40 million, according to CoinGlass data. With the volatility in the market expected to continue before a major bull move, here are the best cryptocurrencies to invest in today.

Best Cryptocurrencies to Invest in Today

1. XRP

XRP is trading at $2.41 after failing to maintain the $2.5 support zone. The market cap of the coin stands at $144.93 billion, and the trading volume is up 80.03% to $3.56 billion. Meanwhile, XRP is down 20% on the monthly chart.

Despite the bearish mood in the market, XRP is expected to rally in the coming weeks due to the launch of the spot XRP ETF. ETF expert Nate Geraci predicts the first spot XRP ETF will launch within days. He also stated that this event will mark a turning point for crypto regulation. The SEC missed deadlines due to the government shutdown, which triggered automatic approvals.

Sometime in next two weeks, I expect launch of first spot xrp ETFs…

SEC had open litigation against Ripple for past five years, up until three months ago.

IMO, launch of spot xrp ETFs represents final nail in coffin of previous anti-crypto regulators.

Have come a *LONG* way.

— Nate Geraci (@NateGeraci) November 3, 2025

The Grayscale XRP ETF stood first in line for launch on October 17. Other issuers such as 21Shares, Bitwise, Canary Capital, CoinShares, and WisdomTree are waiting for decisions. The launch signals rising institutional demand. Meanwhile, analysts expect strong buying pressure on XRP once the ETFs launch.

2. Solana (SOL)

SOL is currently trading at around $176.73, with a 5.54% decrease in the past day. The trading volume of SOL has increased by 88.48% to $5.16 billion, while the market cap stands at $97.66 billion.

Solana is trading inside a wide range with clear key levels. According to analyst Ali, SOL is facing strong resistance near $260, while a major support zone sits near $158. A confirmed breakout above $200 can open a path toward $260 again. However, failure here may trigger downside continuation.

Solana $SOL needs to reclaim $200 to confirm strength. Only then a rebound to $260 comes into play. pic.twitter.com/mbu8KdRM2p

— Ali (@ali_charts) November 3, 2025

Meanwhile, a break below the $158 price level exposes a deeper demand zone between $122 and $100. That area has acted as a historical accumulation range. The current price trend remains neutral until the price of SOL breaks either $200 or $158.

3. Chainlink (LINK)

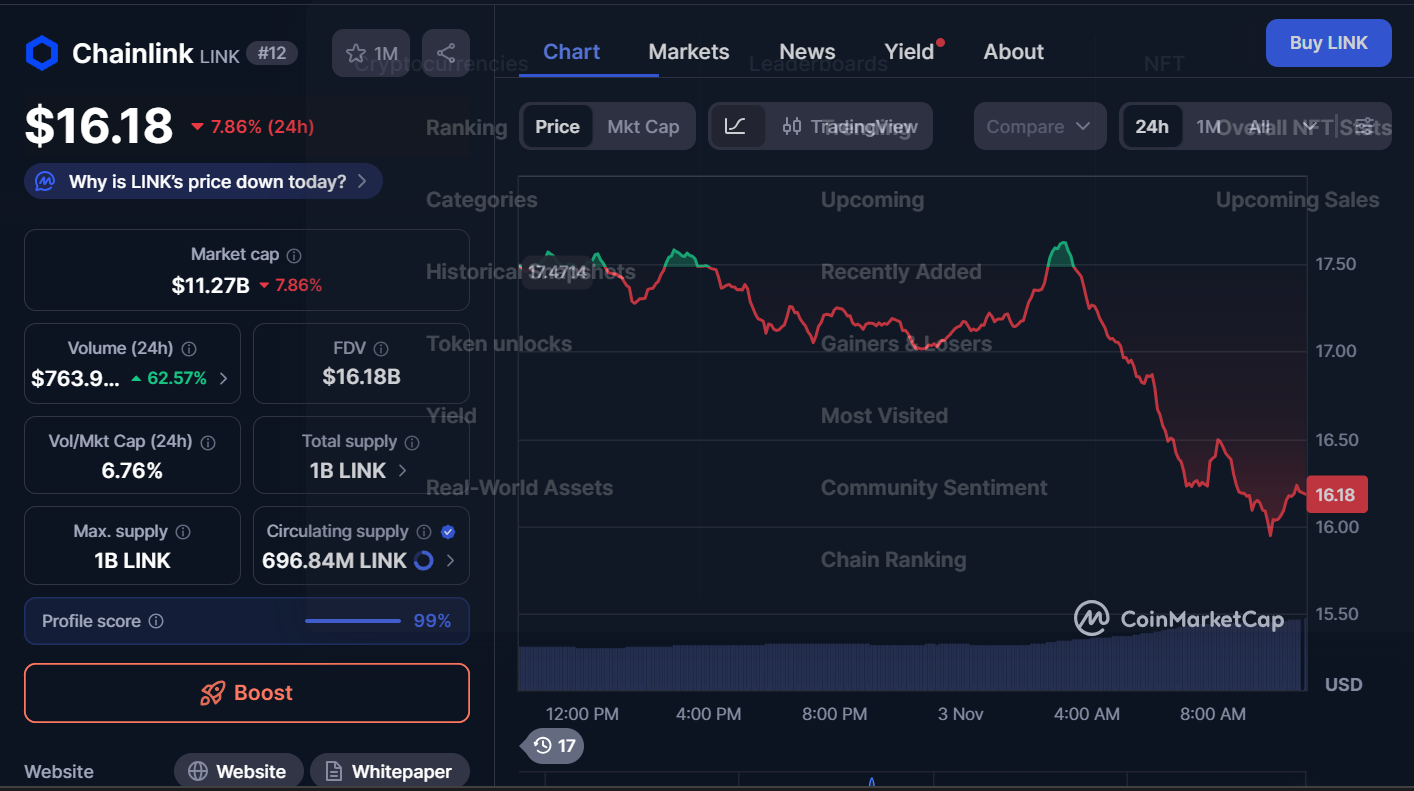

LINK is currently trading at $16.18, with a 7.86% decrease in the last 24 hours. The trading volume of the coin is up by 62.57% to $763.9 million, while the market cap stands at $11.27 billion.

Chainlink has held its upward trajectory despite recent volatility, trading near $17 after a brief correction. Buyers are defending the $13 zone, which remains a key support level. The price action points to consolidation before a possible breakout toward $46. If momentum strengthens, LINK could extend its run to $120 and later $160. The RSI near mid-levels signals enough room for growth.

$LINK Livermore Accumulation pic.twitter.com/wnmVGY0bAR

— TimeFreedom ®0⃣

(@TimeFreedomROB) November 2, 2025

Meanwhile, exchange reserves have dropped sharply to 145.6 million LINK, suggesting fewer tokens are available for selling. This supply decline often fuels upward price pressure as demand builds. Investors appear to be accumulating, betting on a stronger recovery. Hence, maintaining support above $13 could trigger a major rally that propels Chainlink into a new bullish phase.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.