TRON Sets New USDT Record as It Closes In on Ethereum’s Lead

0

0

With several impressive milestones, the TRON network continues to assert its dominance in the stablecoin payment sector. Recently, the amount of USDT (Tether) circulating on TRON reached a new all-time high.

Meanwhile, the number of long-term holders on TRON has exceeded 2.66 million addresses. This reflects retail investors’ strong confidence and long-term commitment to this layer-1 blockchain.

Can USDT Supply on TRON Surpass Ethereum?

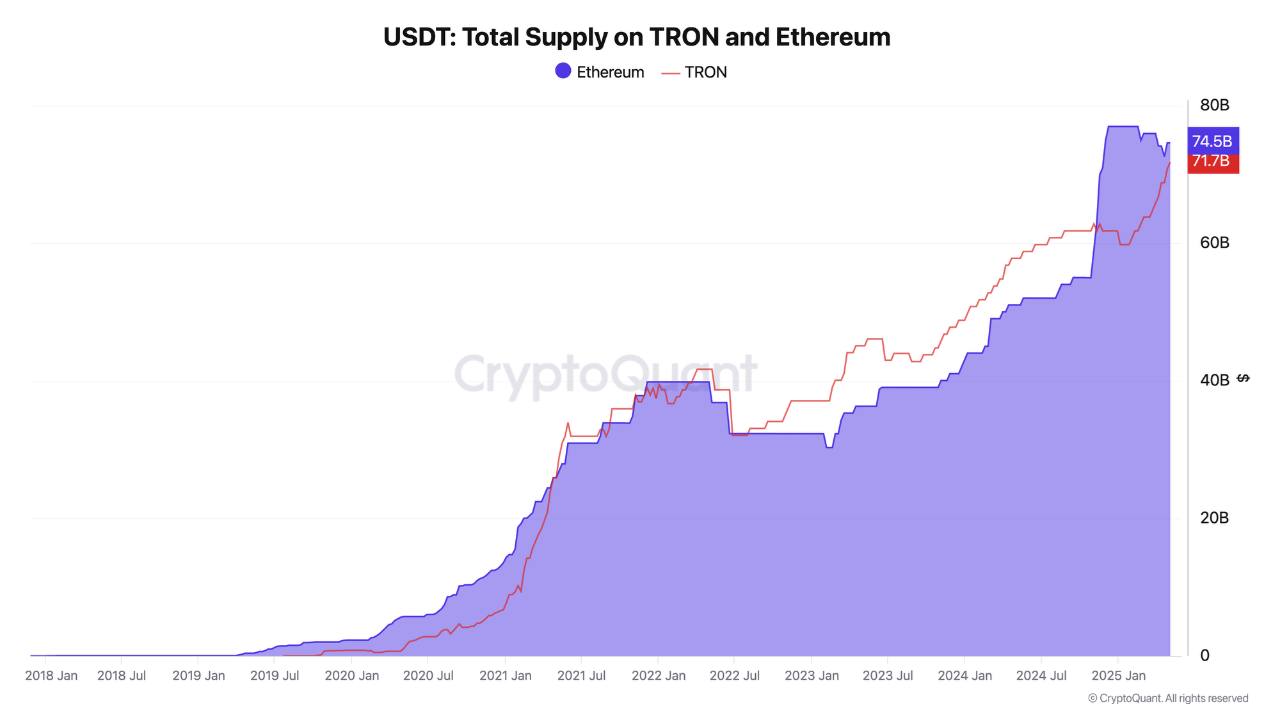

Data from CryptoQuant shows that the USDT supply of TRON has grown steadily over recent years. Currently, the market cap of USDT on TRON has hit a record high, with over $71 billion USDT in circulation.

Meanwhile, Ethereum hosts $74.5 billion USDT in circulation. TRON is narrowing the gap with ETH in terms of traders’ USDT usage.

USDT Total Supply on TRON and Ethereum. Source: CryptoQuant

USDT Total Supply on TRON and Ethereum. Source: CryptoQuant

“This milestone cements TRON’s position as one of the major blockchains in the DeFi space, and it may even surpass the adoption of some major chain competitors in the future,” Analyst Darkfost commented.

For context, the total stablecoin market capitalization is $242 billion, and Tether (USDT) alone accounts for $149 billion. That means TRON facilitates smooth transactions for 29% of the stablecoin market cap and 47% of USDT’s market cap.

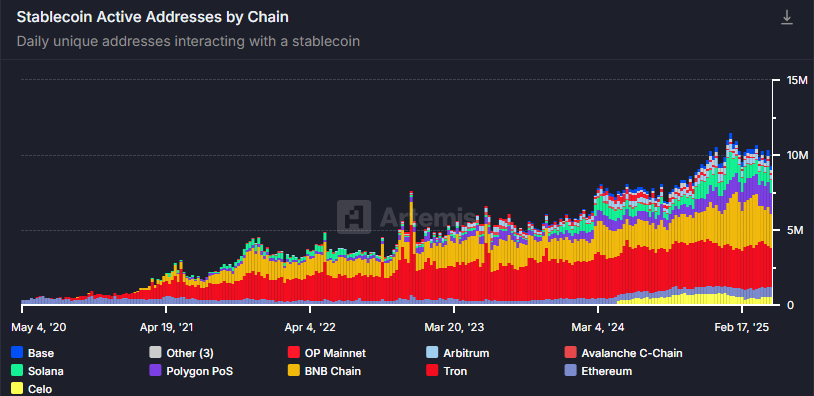

Additionally, data from Artemis shows that TRON accounts for 28% of all active stablecoin wallet addresses, more than any other blockchain tracked. This makes TRON the top chain in terms of fee revenue.

Stablecoin Active Address by Chain. Source: Artemis

Stablecoin Active Address by Chain. Source: Artemis

A recent report from BeInCrypto reveals that experts predict stablecoins will attract strong VC interest in the future. The number of issuers could grow tenfold. New issuers may choose TRON, which would benefit a blockchain capable of handling $150 billion in weekly stablecoin transaction volume.

Tron (TRX) Backed by Loyal Long-Term Holders

CryptoQuant also reports that 2.66 million TRX addresses have held their tokens for over one year without spending them. These wallets maintain balances of at least 10 TRX. While 10 TRX is worth only a few dollars, many retail investors choose to hold TRON long-term, even with small amounts of capital.

Analyst Crazzyblockk believes this metric indicates strong user loyalty and sustained engagement, which can support TRX’s price in the long run.

Tron Long-term Holders (> 1 Year Holders). Source: CryptoQuant.

Tron Long-term Holders (> 1 Year Holders). Source: CryptoQuant.

“Increased long-term holding is often linked to higher confidence in the underlying network and potential for liquidity resilience,” Crazzyblockk said.

However, some investors argue that TRON’s vitality relies too heavily on USDT transactions. Data from Dune shows over 3 million TRON wallets are active daily, but most only transact USDT. Therefore, any strategic changes in the TRON–Tether relationship could significantly impact the network and the price of TRX.

This dependency highlights TRON’s weak utility outside the USDT space. For example, TRON lags far behind Solana in meme coin deployment and is significantly behind other chains in decentralized exchange (DEX) trading volume. Moreover, TRON appears nearly absent from the real-world asset (RWA) market share.

Tron (TRX) Price Performance Chart. Source: BeInCrypto.

Tron (TRX) Price Performance Chart. Source: BeInCrypto.

At the time of writing, TRX is trading around $0.25, showing little movement after falling from a high of $0.45 late last year.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.