Uniswap Accumulation: Whale Moves 640K UNI to Wallets

0

0

This article was first published on The Bit Journal. Uniswap’s native token UNI traded near a multi-month support zone this week as Uniswap accumulation activity emerged during a period of market compression. On-chain data also indicated that a whale bought 640,000 UNI valued at about $2.29 million at OKX, which further supported the story that strategic buyers are buying by structural lows.

A whale bought 640,000 $UNI, worth $2.29M, from #OKX.

Address: 0x76ddface11302e31730a6a36aa7eeea5b1b2959d pic.twitter.com/o8TLqu5aTH

— Onchain Lens (@OnchainLens) February 16, 2026

Uniswap Accumulation Emerges During UNI Consolidation

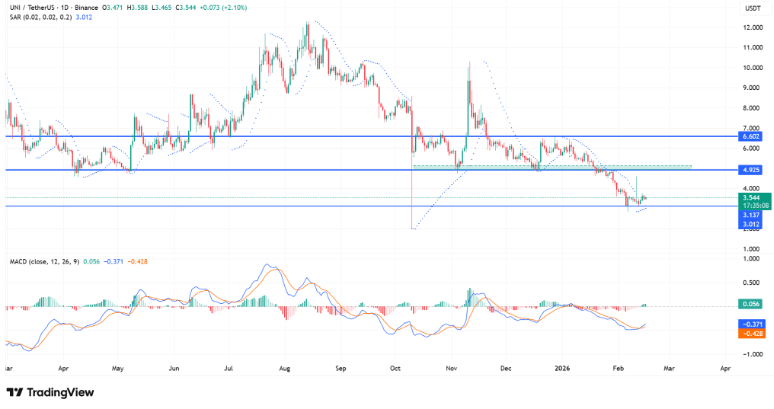

UNI was trading at approximately $3.54 at the time of reporting, a little more than the demand zone of 3.13 that had previously brought it to steep increases. The purchase was also impressive in the sense that it was made at the time of consolidation and not when the prices were strong. This is in line with the accumulation of Uniswap whose big holders silently take in supply at historically defended levels.

This localized stabilization notwithstanding, UNI is still in a wider downtrend that is correlated with the overall performance of Uniswap. The price is still under resistance at $4.92 which is a previous support level that has reverted into a selling range and $6.60 is a better supply ceiling that is associated with the previous distribution phases. All recovery efforts since the break even have been hanging at these points, which supports the existing bearish pattern.

Parabolic SAR Shows Waning Downside Momentum

Technically, short term pointers only indicate that things have bounced back but not that there has been a turnaround. The Parabolic SAR turned downwards at price less than 3.01 indicating that a negative down momentum has been exhausted. UNI has been out of recent swing lows, which strengthens short-term equilibrium with Uniswap buying power meeting the technical support.

Meanwhile, the MACD histogram indicated a contraction when the MACD line bent towards the signal line. Even though the two lines are still in the negative territory, the change implies the waning bearish pressure. Analysts warn, though that the exhaustion of momentum alone does not point to a change of trend. The buyers would require further gains to reach at the level of 4.92 to assure growth above tactical accumulation.

On-Chain Data Supports Uniswap Accumulation

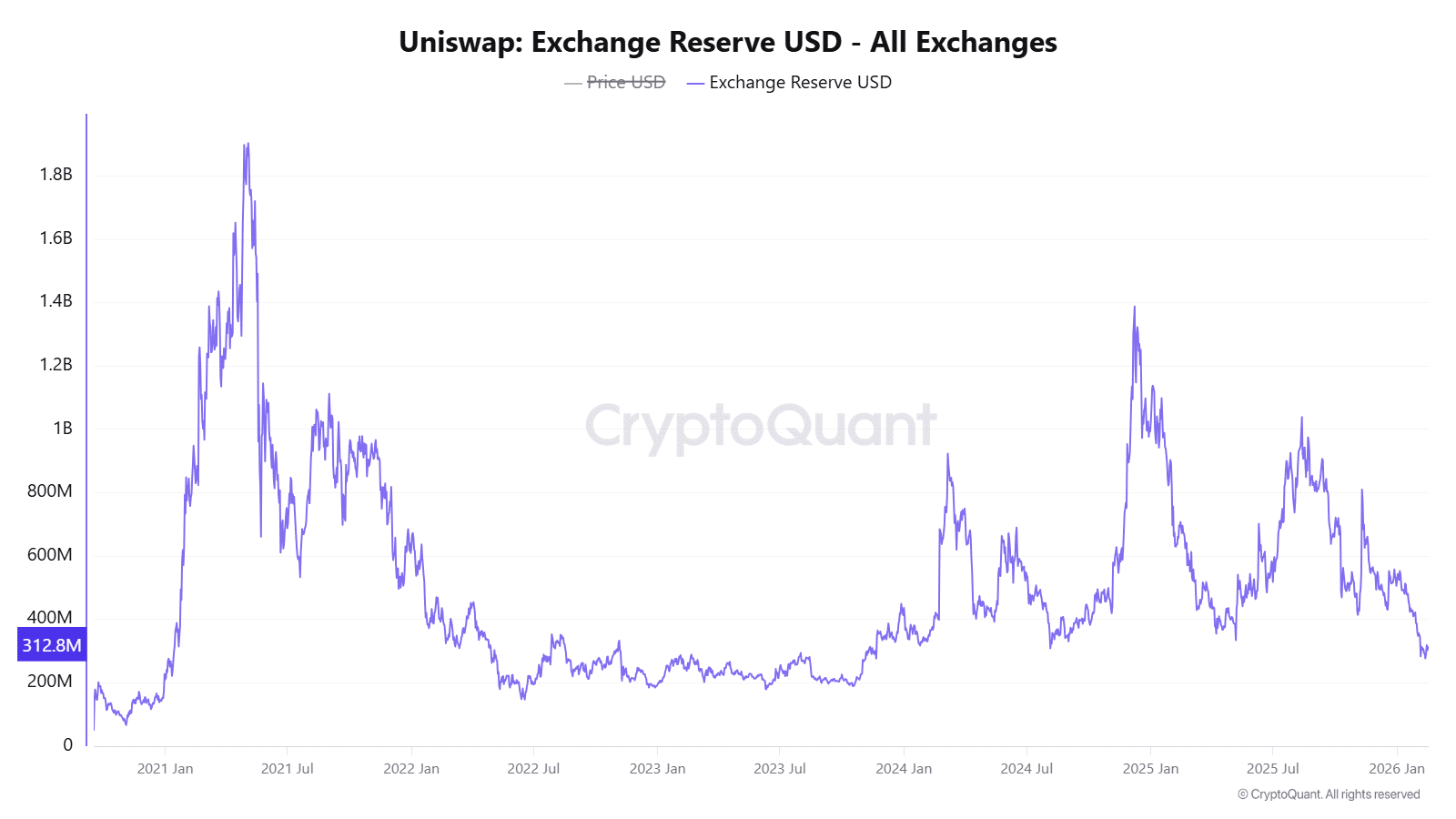

On-chain measures also contribute to the accumulation narrative. Exchange Reserve USD was down to 3.07 to $307.95 million, with a reflection of an on-exchange liquidity which has been contracting measurably. As the balances of exchanges decrease with substantial withdrawals of spots, the supply of the circulating amounts to be sold in the immediate future is reduced. The recent whale buy is a direct contribution to this tightening effect, which serves to support the larger Uniswap accumulation pattern.

A decrease in exchange balances may increase price responses in case demand rises at a faster rate. Nevertheless, the declining reserves will not support lasting upturn. Spot absorption and coincidences with technical support make a favorable background in this scenario, although wider involvement is necessary. The upside potential might be constrained unless more buyers enter the accumulation stage.

Derivatives Data Signals Reduced Risk Appetite

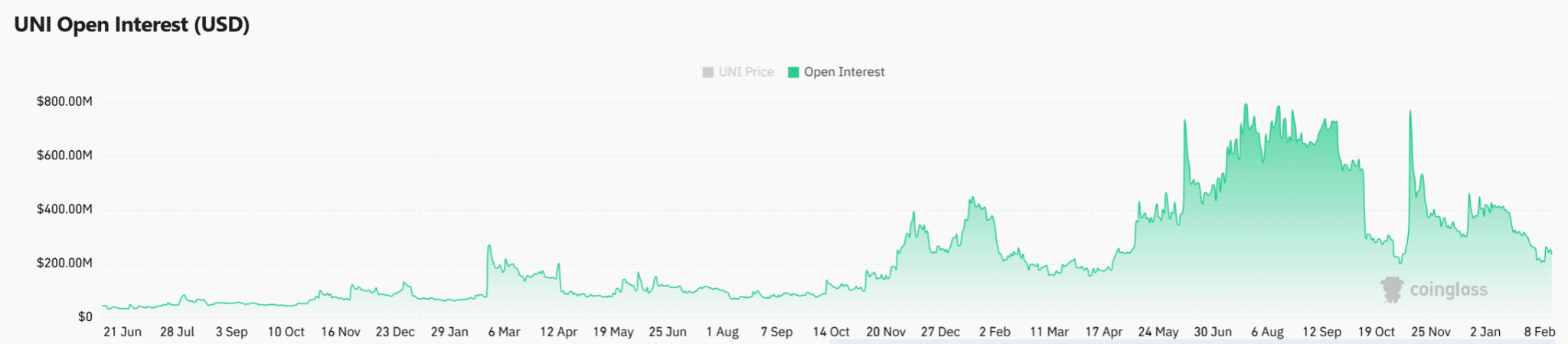

Derivatives statistics indicate that traders were cautious. Open Interest decreased by 3.46 percent to $243.56 million indicating a decrease in leveraged exposure. These contractions tend to be a sign of market resetting as opposed to violent directional conviction. Although this limits the risk of liquidation, it is also indicating that derivatives traders are yet to make a breakout fueled by Uniswap accretion.

When the spot demand is strong, and leverage is light, then the movements of the price may become more efficient. On the other hand, unless there is rejuvenated interest, UNI can keep consolidating within its present support range.

UNI Stabilizes Below Key Resistance Levels

In brief, UNI remains above the level of $3.13 because Uniswap accumulation and declining exchange reserves are constraining supply. Nevertheless, the token is still kept under the critical points of $4.92 and 6.60 resistance band. The technical indicators are signs of short term stabilization, rather than a reversal and falling Open Interests are signs of wary market participation.

A structural improvement would be a sustained movement over $4.92 backed by an increase in volume and fresh Open Interest. Up to this point, the current Uniswap accumulation seems to be a strategic positioning in a larger downward trend and not a clear change in market control.

Conclusion

Comprehensively, UNI remains supported at levels above 3.13 as the Uniswap accumulation and decreasing exchange reserves restrict the selling pressure in the near term. Price has however been held under major resistance and technical indications are of stabilization and not reversal. The long-term breakout through the price of $4.92 is required to substantially change the market structure.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

- UNI finds support near $3.13 amid whale buying and Uniswap accumulation.

- Technical indicators show stabilization but no confirmed reversal yet.

- Open Interest and Exchange reserves decline, predicting skeptical market participation.

- Price capped at less than $4.92 and $6.60, trend shift required breakout.

Glossary of Key Terms

UNI: Native token of Uniswap exchange.

Uniswap Accumulation: Large holders buying near support.

Whale: Investor holding large crypto amounts.

Support Zone: Price level where buying occurs.

Resistance Level: Price level where selling occurs.

Parabolic SAR: Indicator for short-term trend shifts.

MACD: Momentum indicator for bullish/bearish pressure.

Exchange Reserve USD: Crypto held on exchanges.

Open Interest: Total value of derivative contracts.

Frequently Asked Questions about Uniswap Accumulation

1. Why is UNI holding near $3.13?

Due to Uniswap accumulation, whale buying, and shrinking exchange reserves.

2. Is UNI reversing its downtrend?

Technical indicators indicate that stabilization has taken place but not a reversal yet.

3. How do reserves and Open Interest affect UNI?

Falling reserves and lower Open Interest indicate cautious market participation.

4. What level must UNI break for an uptrend?

A sustained move above $4.92 with volume and Open Interest is needed.

References

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrencies are highly volatile and risky. Readers should do their own research and consult a qualified financial professional before investing.

Read More: Uniswap Accumulation: Whale Moves 640K UNI to Wallets">Uniswap Accumulation: Whale Moves 640K UNI to Wallets

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.