Cardano Holders Urged To Pay Attention As Institutions Load Up On ADA: Details

0

0

Key Insights:

- Grayscale allocates 18.5% of smart contract fund to Cardano, ranking third overall.

- Reserve One includes Cardano in billion-dollar crypto treasury institutions.

- Technical indicators indicate ADA is ready to break out above key moving averages.

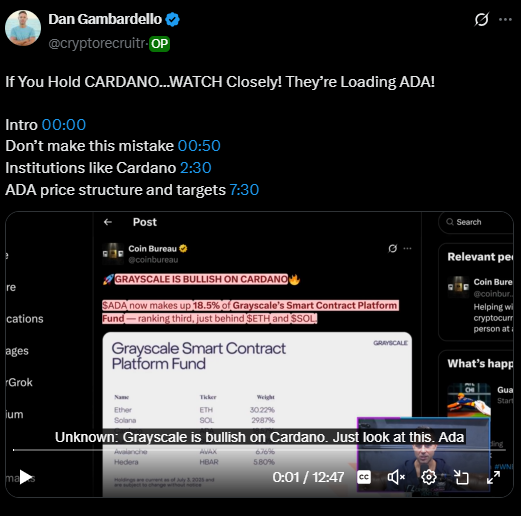

Cardano just attracted strong institutional attention as Grayscale allocated 18.5% of its smart contract platform fund to ADA.

The allocation ranks third behind Ethereum and Solana in the fund. Reserve One is planning a billion-dollar crypto treasury including Cardano following US Bitcoin reserve inspiration. Technical analysis shows momentum indicators preparing for a potential upside breakout.

Grayscale and Reserve One Drive Cardano Institutional Adoption

Grayscale allocated 18.5% of its smart contract platform fund to Cardano ADA tokens. The distribution positions ADA third in the fund after Ethereum and Solana individually.

This is institutional acknowledgment of Cardano’s status as one of the world’s leading blockchain platforms.

Reserve One will launch a billion-dollar crypto treasury amid rapidly rising institutional demand. Cardano is part of the company’s hoard-digital-assets strategy. Reserve One is built on the projected US strategic Bitcoin reserve model.

Sebastian is Reserve One’s president and chief investment officer with a Coinbase background. He was president at Coinbase Asset Management before Reserve One. The leadership has experience in traditional finance within digital asset management.

Reserve One focuses on fundamentals and sustainability metrics in crypto asset selection. The firm views Cardano as a macro value play for the cycle. They highlight ADA’s outperformance drivers against other altcoin investments.

The institutional thesis is about digital assets as the foundation of modern finance systems. Reserve One compares Bitcoin to gold and Ethereum to oil when it comes to strategic value. Cardano supports their infrastructure thesis in creating decentralized financial systems.

Several institutions today acknowledge Cardano’s technical prowess in solving advanced DeFi issues. The governance structure of the blockchain is attractive to institutional investors looking for reliable digital assets.

Cardano Maintains Strong Higher Low Pattern Structure

Cardano has formed consistent higher lows throughout its recent price action cycles. The cryptocurrency traded at around 24 cents during previous bear market conditions before pumping massively. ADA consolidated to higher lows around 34 cents before another multi-hundred percent rally.

The existing consolidation is at about 59 cents, holding the higher low structure pattern. The majority of traders are concerned with near-term price action, discarding the macro value play thesis. Cardano is a multi-year investment thesis, and not near-term trading option.

The weekly chart shows compression of significant moving averages creating potential breakout points. The 200-week moving average was at around 65 cents as a support level in bull markets. Additionally, the higher move’s key resistance is the 20-week moving average at 70 cents.

Historical data shows ADA rallying as it decisively broke out above the 20-week moving average. Previous breakouts were seen in November 2024, October 2023, and November 2020 cycles. The pattern indicated possible sustained bullish momentum after a similar technical setup.

Cardano’s risk model’s latest reading is 35, placing it in moderately buying territory. The coin remains in a pre-bull market phase according to risk indicators.

ADA is below all the major moving averages and providing support for potential breakout moves.

The macro setup suggests institutions are looking at Cardano’s longer-term value proposition relative to short-term volatility concerns.

Technical Indicators Signal ADA Breakout Preparation

Cardano ADA momentum oscillators show readiness for potential upside movement across multiple timeframes.

The RSI indicator displayed substantial upside potential on slower-moving momentum measurements. MACD was trending upwards, with the histogram showing improving chances of a signal-line crossing.

The stochastic RSI remains in oversold territory while consolidating for potential upward moves. All momentum indicators suggest ADA has prepared technically for breakout attempts. The weekly chart oscillators point toward bullish momentum building beneath current price levels.

Cardano faced key resistance in the 64 to 69 cents range on weekly timeframes. This price zone covers approximately 16 to 17 percent upward movement from current levels. The range includes both 20-week and 200-week moving average resistance areas combined.

ADA was hovering below all major moving averages at press time, awaiting potential test scenarios. The 50-cent level provides Fibonacci support if downside pressure continues developing. Bulls need weekly close above 20-week moving average to confirm breakout momentum.

Technical analysis shows Cardano is ready for directional movement after extended consolidation periods. Previous cycles show similar setups leading to substantial price appreciation phases.

However, macroeconomic headlines could impact breakout timing including Federal Reserve policy decisions. Global uncertainties may cause temporary downside breaks before eventual upward momentum resumes.

The post Cardano Holders Urged To Pay Attention As Institutions Load Up On ADA: Details appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.