Bitcoin Price: $100K On The Horizon, Bullish Sentiment Persists

0

0

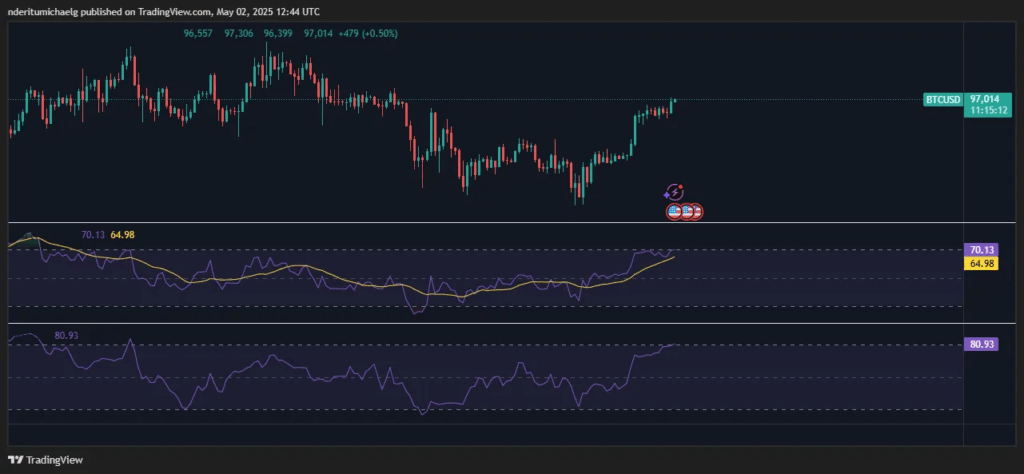

May is finally here and it has arrived with Bitcoin on a bullish leg, as sentiment pushes deeper into greed. The $100,000 price level represents a major milestone for the king of the cryptocurrencies, as it rapidly approaches that zone.

Two main reasons why $100,000 Bitcoin price milestone important; it represents a zone of volatility, and may set the pace for its performance in May. BTC had had already managed to push above $97,000 at press time, indicating that the bulls were firmly in control.

However, it also just pushed into oversold territory according to the RSI. This means short term and swing traders might be incentivized to take some profits off the table.

The Bitcoin price was up by 30% from its lowest point in April, which means holder profitability was rising. Interestingly, on-chain data signaled that profit-taking was on the rise

Bitcoin resistance on the rise as profit-taking rises

Bitcoin bears might be building up a challenge for the bulls as price approaches $100,000. The derivatives segment registered its first big spike in negative funding rates.

Spot inflows were also weak indicating that the bullish momentum cooled down significantly. This coupled with the overbought conditions suggests that bearish pullback closer to $93,000 could be on the card.

Bitcoin did experience volatile pullbacks when price approached the $100,000 price level for the first time late last year. BTC could be on the verge of a bearish weekend as exchange inflows outpace outflows.

Roughly 18,130 BTC exchange inflows were observed at the time of observation. Slightly higher than the 17,880 BTC that was taken out of exchanges, which means sell pressure was outpacing demand.

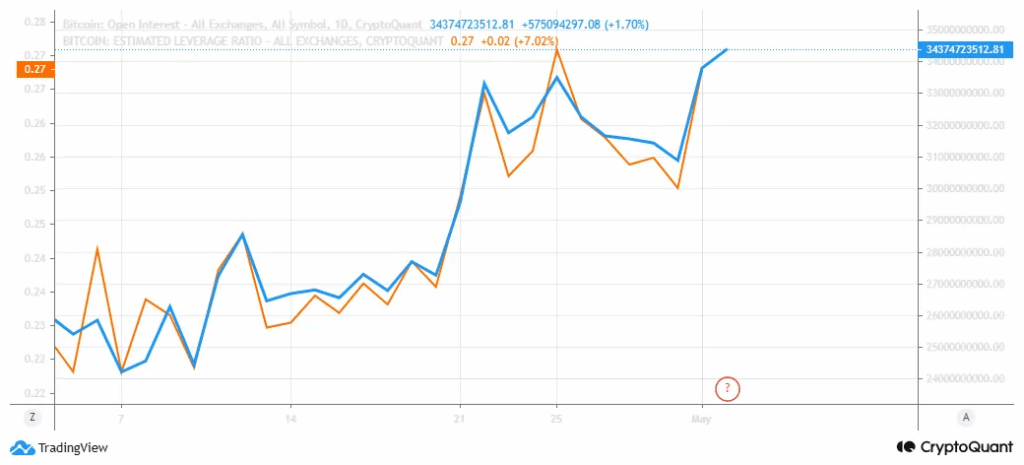

The declining demand paving the way for sell pressure signaled the rising probability of a retracement. In addition, Bitcoin open interest and estimated leverage ratio soared to new highs.

In other words, demand in the options segment accompanied by high appetite for leverage highlights potential risk of higher liquidations. On-chain data revealed that $55.1 million worth of Bitcoin short liquidations occurred in the last 24 hours.

In contrast, about $7 million worth of shorts were liquidated during the same period. This is because Bitcoin pushing higher has resulted in more short positions being wiped out.

Is a Double-Top on the Cards as Bitcoin Approaches the Previous Historic Highs?

The $100,000 Bitcoin price level is also important because it signals that the cryptocurrency is approaching its historic top. For context, it was only a 12% rally away from retesting its ATH.

The situation underscores the need to explore Bitcoin price history. Will the surging demand be enough to fuel Bitcoin’s rally closer to its previous high, or will short term profit-taking overpower demand and push prices lower?

The last bull run which ended in 2021, resulted in a double top scenario, and expectations of a similar outcome could influence Bitcoin price action in the next 4 weeks.

However, the outcome depends on how the crypto market will react to changing economic scenarios. The knock on effects of tariffs-related economic disruptions could trigger more inflation and pave the way less spending.

Will the masses still be able to buy Bitcoin under conditions where their spending capacity diminishes? This will all depend on how governments especially the Federal Reserve will respond to the economic shifts.

Attempts to stimulate the economy could usher in liquidity injection which would favor Bitcoin bulls. This is why investors are keen on observing economic factors that could have a significant impact on price action in the coming weeks.

The post Bitcoin Price: $100K On The Horizon, Bullish Sentiment Persists appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.