Bitcoin Eyes Pullback to $100k if it Loses $103k

0

0

Bitcoin risks dipping to $100k in the coming if it loses this key support. It retraced from $107,773 to $103,388 a few minutes ago.

BTC trades slightly higher than its low at the time of writing. However, it risks further declines. Several factors, including fundamentals and other indicators, suggest a potential decline to $ 100,000.

The apex coin began its recent decline as speculation about the US joining the Iran-Israel conflict spread. The United States President left the G7 meeting to attend to the ongoing war. He stressed that although negotiations with Iran will continue, he demands a full surrender, warning of dire consequences if dialogue fails.

Donald Trump’s recent statements have received notable backlash and caused significant fear across several markets.

Recall that Bitcoin retraced by almost 3% on the eve of the attacks on Iran. A formal involvement by the US may result in further panic and selling pressure for the asset. The rise of another instrument may see the largest cryptocurrency slip further.

Analysts predict the rise of the Dollar index. DXY gained almost 1% in the last 24 hours and threatens further increases as RSI soars. Investors fear that this instrument’s rise will lead to a BTC retracement, as both assets tend to trend in opposite directions. The price correlation between them ranges from -0.4 to -0.8.

Bitcoin Sees Massive Profit-Taking

Data from Glassnode noted a trend in wallets that are 12 months old. They were the biggest profit takers last week, accounting for more than 80% of the total selloffs. However, 6-month-old wallets are joining the trend, selling $904 million worth of Bitcoin in the last 24 hours, the second-highest daily profit this year.

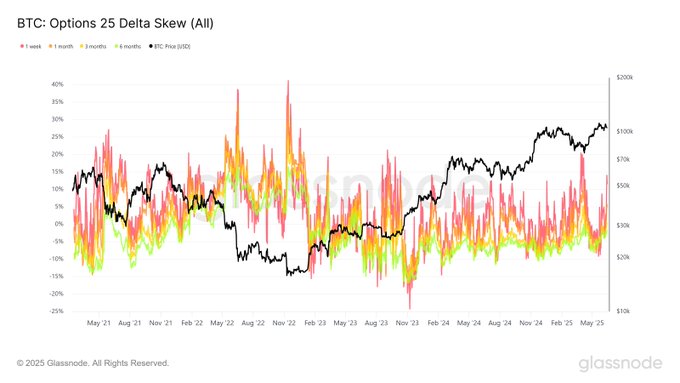

The recent BTC 25 Skew reading shows that the apex coin is gearing up for a further downtrend. The 1-week skew surged from -2.6% to 10%, and the 1-month skew from -2.2% to +4.9 %. This means that investors are more cautious as they anticipate more downside movements.

However, Bitcoin is seeing a rise in “octopuses” (those holding more than 10 BTC) amid the fall in whales and sharks. Santiment noted that the asset saw a massive 622 more holders with over 10 units in their wallets as they anticipate a retest of the all-time high.

Exchange-traded funds remain strong despite the price drop. They are seeing a 5-day net inflow streak.

CryptoQuant shares a similar positive news, noting that the largest cryptocurrency is seeing a notable rise in permanent holders. This suggests that it may indicate an impending uptrend, as it reflects long-term conviction.

BTC Eyes $100k

Bitcoin will likely retest $100k if it loses the $103k support. Its recent low indicates that the bears are sustaining selling pressure that may lead to this outcome. However, the apex coin rebounded and trades slightly higher at the time of writing.

Previous price movements show that the asset sees massive selling congestion after breaking below $103k. A recent event occurred on June 6, when the coin hit a low of $100,426 after losing the highlighted mark.

A repeat of this event is likely as fundamentals remain bearish. Market sentiment reflects the same trend, indicating a lack of strong will to alter the ongoing trend. The Fibonacci retracement favors this prediction, highlighting no strong support support before $100k.

The post Bitcoin Eyes Pullback to $100k if it Loses $103k appeared first on Cointab.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.