WLFI Token Meltdown: $22M Burn Raises Fresh Questions

0

0

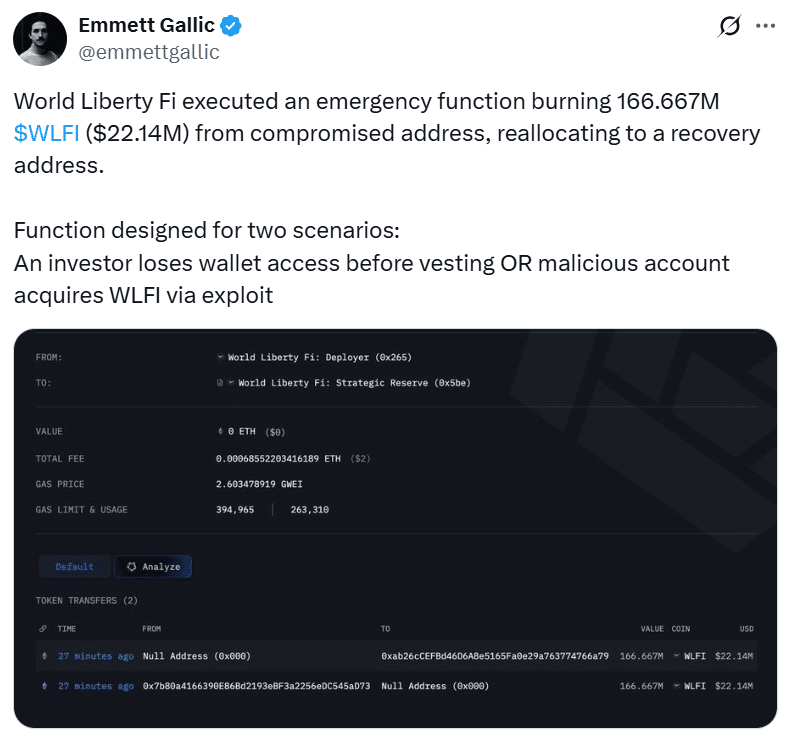

World Liberty Financial carried out a major emergency action this week. The platform burned 166.667 million WLFI tokens after a wave of wallet compromises.

The tokens were worth more than $22 million. The move was part of a recovery plan to protect users and stabilize the project. It also comes at a time when WLFI token faces rising political and regulatory pressure.

Smart Contract Safeguard Activated After Breach

World Liberty Financial confirmed that it used a built-in emergency smart contract function. The tool removed WLFI tokens from wallets flagged as compromised.

It then reallocated them to secure recovery wallets. Arkham analysts tracked two large on-chain transfers linked to this operation. Each transfer moved the same amount of WLFI token to the company’s Strategic Reserve.

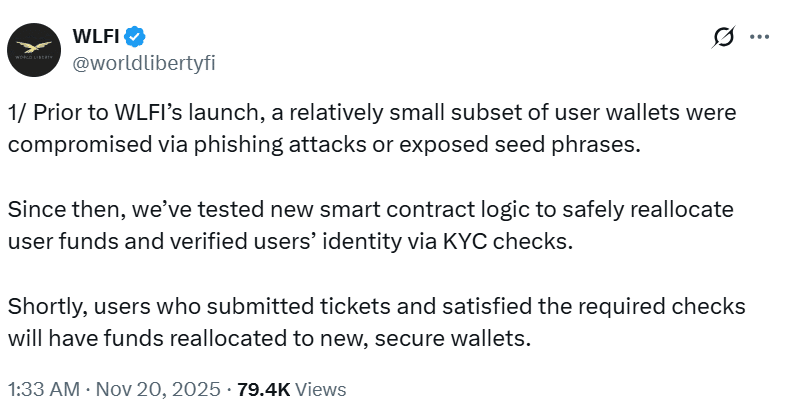

World Liberty Financial said the breach did not come from its smart contracts. Instead, attackers gained access to wallets through phishing, exposed seed phrases, and malicious third-party tools.

These lapses happened before the platform’s official launch. The company froze the affected accounts in September. It has been working on a large-scale recovery system since then.

Emergency Smart Contract Action

WLFI token designed its emergency function for two main cases. The first is when an investor loses wallet access before token vesting. The second is when a malicious actor gains WLFI through an exploit.

Also Read: WLFI Token Jumps 9% After World Liberty Financial Confirms 8.4M Token Airdrop

The function allowed the deployer address to pull tokens from compromised wallets. Tokens were then moved into recovery wallets that belonged to verified users. The company said this feature was part of the project from the start.

Arkham Data Shows Large Transfers

Arkham shared fresh data from the World Liberty Financial deployer address. It showed two identical transfers to the Strategic Reserve. Each transfer carried 166.667 million WLFI tokens.

These transactions confirmed the scale of the burn-and-reallocate process. They also offered transparency to analysts watching the recovery unfold.

Phishing and Exposed Keys Behind the Breach

WLFI token explained the root cause in a public statement. The attack came from phishing links and exposed private keys. Some users had interacted with unsafe tools. Others entered seed phrases on fake websites.

This gave attackers access to their accounts. The breach also overlapped with Ethereum’s EIP-7702 Pectra upgrade. Attackers used this moment to deploy malicious contracts inside already compromised wallets.

Wallet Freezes and New Verification Checks

The company froze 272 wallets once users reported strange activity. World Liberty Financial required each affected user to complete identity verification a second time. This step helped confirm ownership before releasing any recovered funds.

The platform warned users about fake support accounts and scam recovery offers. It urged them to use only official channels during the process.

Regulatory Pressure Builds

A report from Accountable, US added new challenges for the project. It claimed that World Liberty Financial sold $10,000 worth of WLFI tokens to traders linked to a sanctioned blockchain address.

The address was tied to the North Korean Lazarus hacking group. The report also alleged links to Russian and Iranian entities. Two U.S. Senators, Elizabeth Warren and Jack Reed, asked federal officials to investigate.

Trump-Affiliated Project Under Scrutiny

WLFI token is backed by members of the Trump family. The project launched its WLFI governance token earlier this year. Since launch, it has faced questions about its token structure and regulatory position.

The team said it spent months testing the bulk-reallocation logic. World Liberty Financial claimed that user protection and compliance mattered more than launching the recovery fast. The company said it will continue improving its security tools to prevent similar incidents.

Conclusion

The emergency burn and recovery effort marks a turning point for World Liberty Financial. The platform acted quickly to remove tokens from compromised wallets. It then shifted those assets into secure recovery channels.

The number of affected users was small. But the broader impact on trust, regulation, and public scrutiny remains significant. The company now faces the dual challenge of restoring confidence and handling growing political pressure.

Also Read: New ChatGPT Crypto Prediction: WLFI to $1, AAVE to $500, and SUI to $10?

Appendix: Glossary of Key Terms

Emergency Smart Contract Function: A built-in tool that reclaims and reallocates tokens under threat.

Recovery Wallet: A secure wallet used to receive tokens reclaimed from compromised accounts.

Strategic Reserve: The official wallet holding large WLFI allocations during recovery operations.

Phishing Attack: A scam tactic used to trick users into revealing private keys or credentials.

Seed Phrase Exposure: A security breach caused by shared or stolen wallet recovery phrases.

On-Chain Transfer: A blockchain transaction recorded publicly on the network.

FAQs about WLFI token burn

1- Why did World Liberty Financial burn WLFI tokens?

The burn happened because attackers gained access to several user wallets through phishing and exposed credentials.

2- How many tokens were burned?

World Liberty Financial burned 166.667 million WLFI tokens worth about $22.14 million.

3- Were the smart contracts hacked?

No. The company said the exploit came from external security failures, not its smart contracts.

4- How many wallets were affected?

A total of 272 wallets were frozen during the response.

References

Read More: WLFI Token Meltdown: $22M Burn Raises Fresh Questions">WLFI Token Meltdown: $22M Burn Raises Fresh Questions

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.