BlackRock’s Bitcoin ETF Records Largest Single-Day Outflow of $430.8 Million

0

0

Highlights:

- BlackRock’s spot Bitcoin ETF ended a 31-day inflow streak with $430.8 million outflows.

- BTC ETFs in the US recorded $616.1 million in total outflows during Friday’s session

- Meanwhile, BlackRock’s Ethe ETF attracted $70.2 million as ETH prices continued to climb.

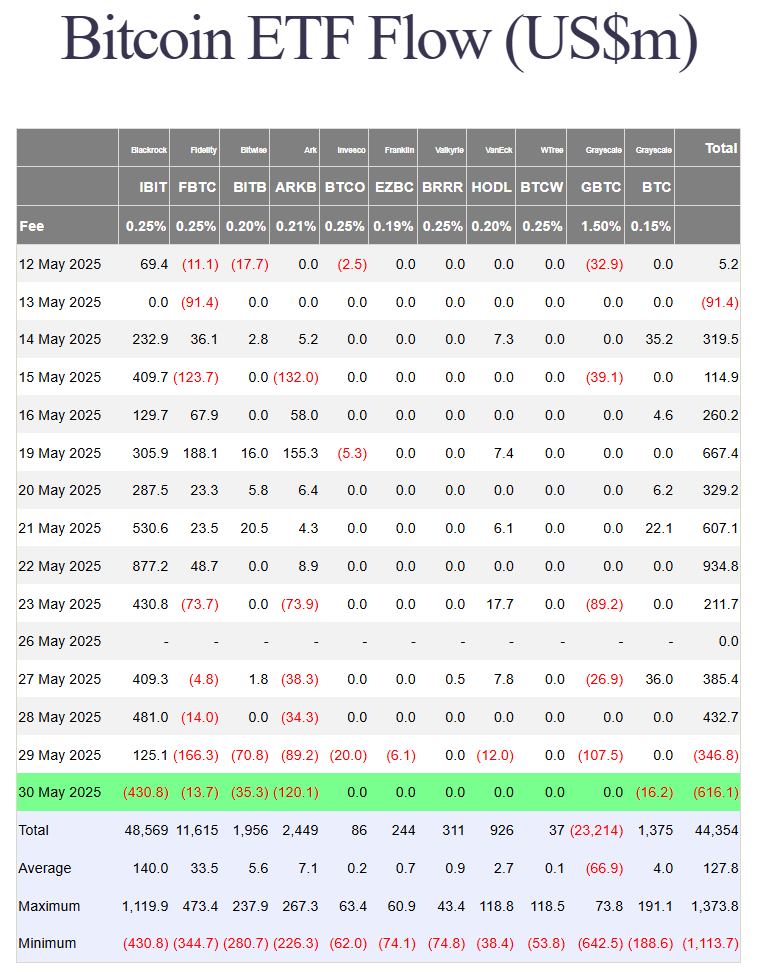

On May 30, BlackRock’s iShares Bitcoin Trust (IBIT) saw an outflow of $430.8 million, ending a 31-day streak of inflows, according to data from Farside. This marked the largest single-day net outflow since the fund’s launch in January 2024. Previously, the biggest outflow occurred on February 26, with $418.1 million withdrawn.

Despite the recent decline, IBIT remains the leading BTC ETF worldwide. Since its launch, the fund has attracted approximately $48 billion in new investments, pushing its assets under management close to $70 billion. On Friday, US-listed spot Bitcoin ETFs saw total outflows of approximately $616.1 million. Ark Invest’s ARKB led the decline with $120.1 million in outflows, followed by Bitwise’s BITB, which lost $35.3 million. Grayscale’s GBTC recorded a $16.2 million drop, while Fidelity’s FBTC saw nearly $14 million withdrawn.

Bitcoin ETFs Face Outflows as Price Slips

On May 29, BTC ETFs ended a 10-day streak of money coming in, with $346.8 million flowing out. But BlackRock still had inflows, which got noticed in the industry. Kyle Chasse, founder of Master Ventures, noted that while all other issuers faced outflows, BlackRock continued accumulating. He added that the recent drop wasn’t caused by panic-selling from retail investors. Chasse explained that the recent sell-off is not driven by retail panic. Instead, it represents a calm shift of Bitcoin supply into the hands of the most confident and long-term holders.

BITCOIN ETF UPDATE: Bitcoin ETFs just saw $347M in outflows, breaking a two-week inflow streak.

But BlackRock’s $IBIT held firm with $125M in inflows. That’s 34 straight days of demand.

Every other issuer saw red. BlackRock kept buying… big brain energy right there.

The… pic.twitter.com/2UomVkNJvh

— Kyle Chassé / DD

(@kyle_chasse) May 30, 2025

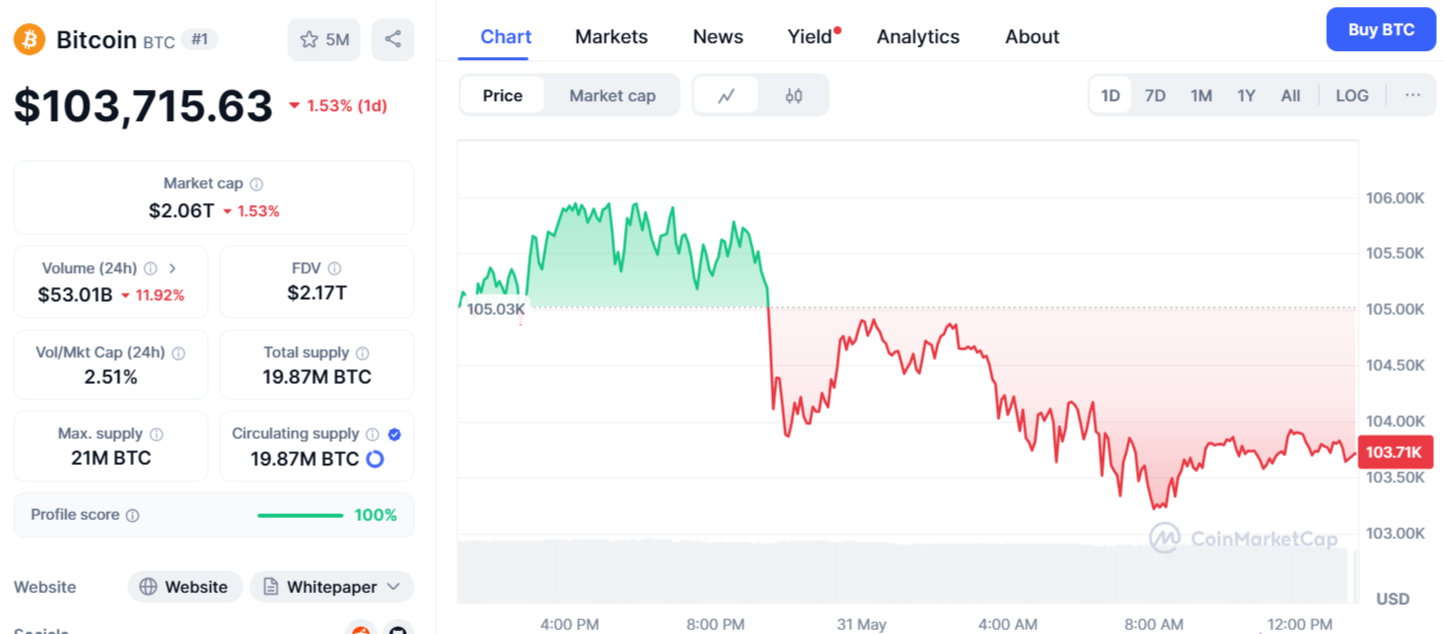

Negative ETF outflows returned as Bitcoin faced increased selling pressure. After hitting a weekly peak of $110,000, the price dropped below $105,000 on Thursday and fell further toward $103,000 by Saturday. Currently, Bitcoin’s spot price stands at $103,715, reflecting a 1.53% decrease in the last 24 hours, based on data from CoinMarketCap.

Ethereum ETFs See Strong Inflows Led by BlackRock’s ETHA

Over the last ten trading sessions, spot Ether ETFs have seen increasing inflows, with BlackRock’s iShares Ethereum Trust (ETHA) leading the way. Farside Investors reported that ETHA brought in $70.2 million in new inflows on Friday. Since its launch, ETHA’s total inflows have surpassed $4.6 billion, contributing to over $3 billion in net flows across all US ETF providers. Mirroring the rise in Ethereum’s price, ETHA’s share price has jumped 44% in the past month and is currently trading at $19.49.

BlackRock recently revised its ETHA filing to include in-kind redemptions, boosting investor interest. Since the update, ETHA has seen stronger inflows. At the same time, asset managers are pressing the SEC to approve staking for Ether ETFs. On Friday, RexShares submitted a proposal to introduce staking features for Ethereum and Solana ETFs in the US.

BIG NEWS: @REXShares just filed an effective prospectus for Solana and Ethereum staking ETFs to list here in the US. Don’t know launch date but could be within the next few weeks. These are 40-act funds with a unique structure and do not go through the 19b-4 process pic.twitter.com/cqUCWlFAZW

— James Seyffart (@JSeyff) May 30, 2025

Even though spot Ethereum ETFs are seeing more inflows, they are unlikely to affect ETH’s price much. A recent Glassnode report shows ETFs make up only 1.5% or less of Ethereum’s daily trading volume, which is too small to move the market significantly.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.