tBTC Perspective Report: Exploring Bitcoin’s Onchain Opportunity through tBTC

0

0

Bitcoin ownership keeps growing, but actually using BTC onchain is still harder than it should be. Most BTC sits in wallets or on exchanges without a clear path into the broader onchain economy. It’s valuable, but not very accessible or liquid once it’s sitting still.

That’s the challenge we focus on at Threshold Network: making BTC easier to move, use, and bring into the places where people want to participate onchain, without relying on a single custodian.

To sharpen our view of where the market is heading, we partnered with Alea Research. Alea focuses on market structure, protocol research, and onchain data. Their work helps us understand how Bitcoin supply is moving, how wrappers have evolved, and where users actually want to deploy their BTC.

Important note: Threshold does not provide custody, ETF products or bespoke services for institutions today. What we are building is open, onchain infrastructure that anyone can access, and that can eventually support larger and more professional allocators when they decide to move onchain at scale.

Why Wrapping BTC Still Matters

Bitcoin is a strong settlement asset, but it is only lightly programmable on its base layer. That is why many BTC holders move into wrappers. A wrapper is a token on another chain that is backed 1:1 by BTC on Bitcoin. With a wrapper, BTC can:

- be used as DeFi collateral

- earn yield in lending markets

- support liquidity pools and trading

- back new forms of onchain credit and structured products

Not all wrappers are built in the same way. The key differences come from two questions:

- Who holds the underlying BTC?

- What guarantees prove that the wrapper is actually backed?

Some wrappers rely on a single custodian. Others use federated multisig structures or sidechains. Threshold follows a different model: a network of independent signers using threshold cryptography.

Where This Research Points Us Next

This recent research analysis of BTC confirms what many onchain participants already feel: Bitcoin is increasingly being held rather than actively traded, and a significant gap remains between long-term ownership and the ability to deploy BTC productively in a transparent and controlled manner.

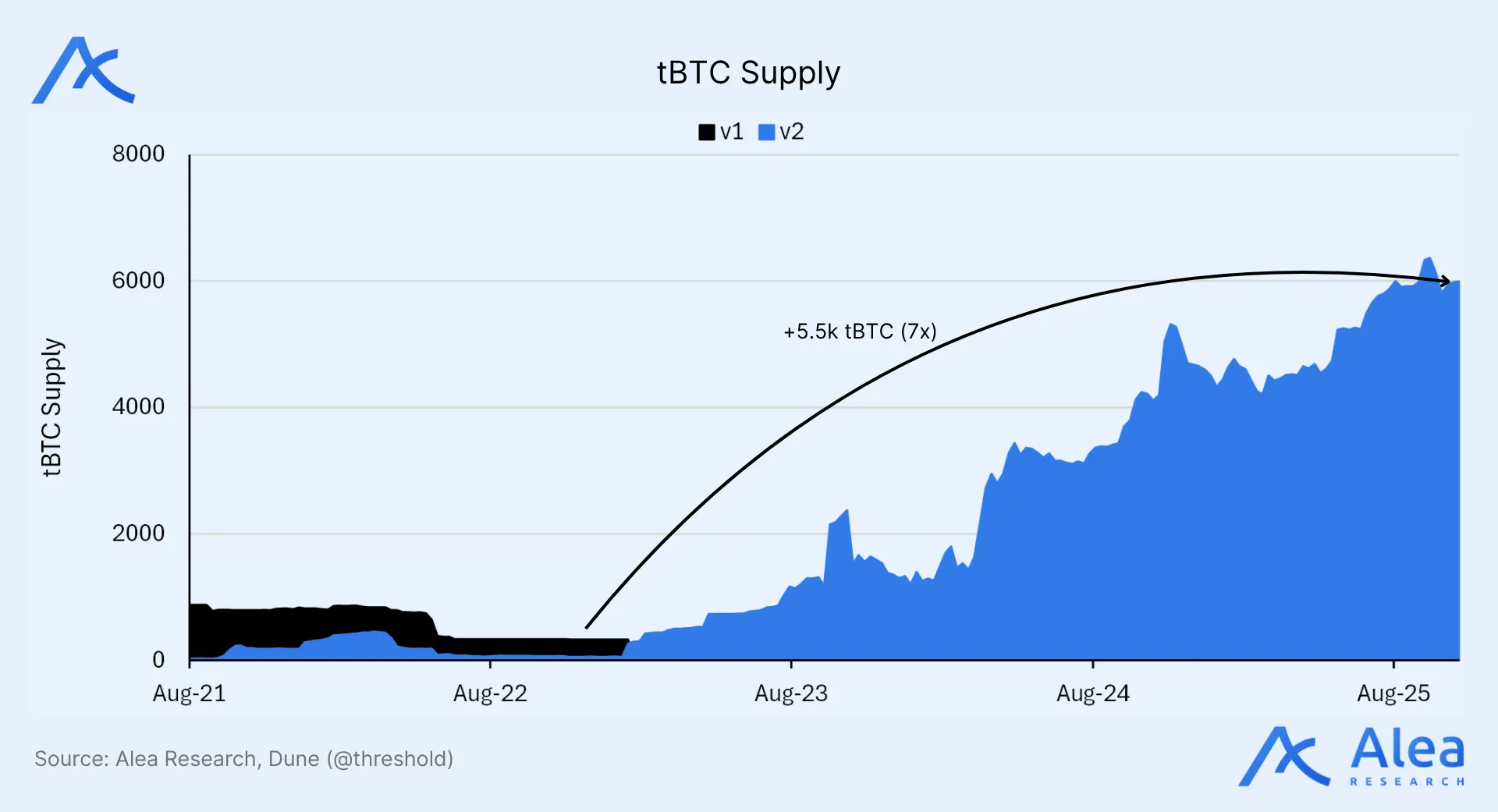

Threshold addresses this gap through tBTC, a trust-minimized wrapper built on mathematical guarantees, open accessibility, and deep integration across leading DeFi markets. The objective is not to replace Bitcoin’s base layer or introduce a new custodial intermediary, but to provide BTC holders with a secure, neutral mechanism to use their assets in ways that generate meaningful utility.

Today, this primarily supports individuals, on-chain-native funds, and sophisticated users. As larger allocators seek pathways to participate onchain without compromising security or autonomy, we expect the principles underlying tBTC’s design to become even more essential.

Read the complete analysis of Threshold Network’s trust-minimized approach to Bitcoin utilization in the latest research report by Alea.

Dive into Alea Research’s Perspective Report here:

Disclaimer: This material is provided for informational purposes only and should not be interpreted as financial, investment, legal, or tax advice. Digital assets, DeFi protocols, and blockchain-based products involve significant risk, including the potential loss of capital. Always conduct your own research (DYOR) and consult with a qualified professional before making any financial decisions.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.