Is DeFi the Reason Crypto Rallies Are Stalling?

0

0

The crypto space is known for explosive rallies. In October 2024, the total market cap jumped from about $2.7 trillion to $3.8 trillion in just two months. Something similar happened in early 2024 when the total crypto market cap jumped from $1.7 trillion in February to $2.85 trillion by mid-March.

Today, the story looks different. Since June 2025, the market has only moved from $3.5 trillion to $3.94 trillion. The market is still in a bull phase (as experts would suggest), but rallies keep stalling. One reason may be hidden inside DeFi, where borrowing dominates growth. Read on to know more.

Borrowing Growth and Stablecoin Dominance

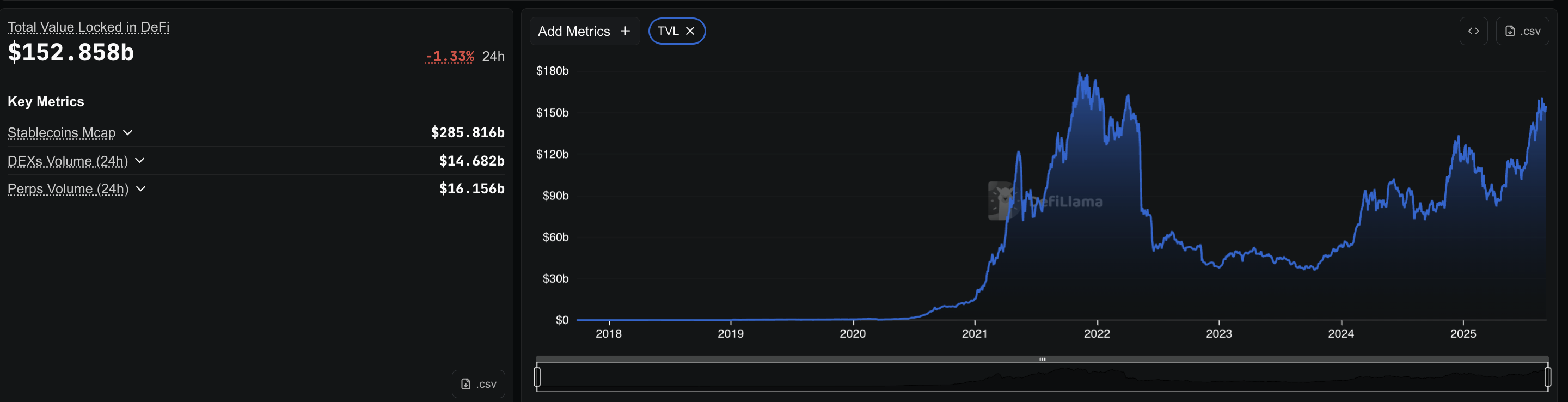

At press time, DeFi total value locked (TVL) stood at about $152 billion, with nearly $49 billion borrowed across protocols. Using a 40% utilization assumption, lending pools would need approximately $123 billion of deposits to support $49 billion borrowed. That would be about 81% of the $153 billion total TVL — but this is an estimate.

TVL includes many other assets (staking, LPs, and bridge balances), so treat the 80% figure as a rough sign of how big lending is, not a precise share.

DeFi TVL At Press Time: DeFillama

DeFi TVL At Press Time: DeFillama

Total Borrowed in DeFi: DeFillama

Total Borrowed in DeFi: DeFillama

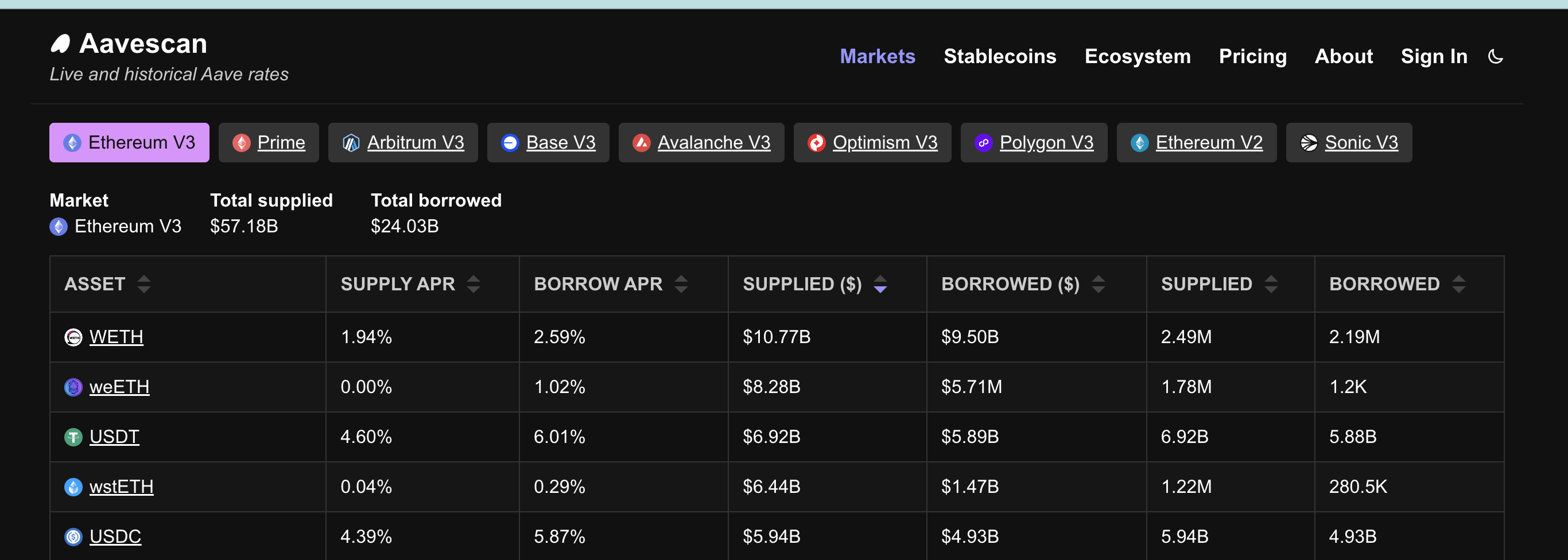

Utilization rate means how much of the money supplied in a lending pool is actually borrowed. For example, if Aave has $57 billion deposited and $24 billion borrowed, the utilization rate is about 40%.

AAVE Borrowing Trends: AAVE

AAVE Borrowing Trends: AAVE

Aave leads the sector with about $24 billion in outstanding debt on Ethereum alone, meaning the total money already borrowed from its pools.

Compound adds around $986 million. Stablecoins dominate this borrowing. On Aave, $5.94 billion in USDT and $4.99 billion in USDC are borrowed. Compound shows a similar pattern, with almost $500 million in USDC and $190 million in USDT.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Compound Borrowing Trends on Ethereum: Compound Finance

Compound Borrowing Trends on Ethereum: Compound Finance

This reliance on stablecoins matters. Traders do not borrow ETH or volatile coins to hold.

They borrow dollars. And like any loan, borrowed dollars are not kept idle. Just as people take loans to buy houses or cars, traders borrow stablecoins to move them elsewhere — most often to exchanges for trading. But what kind of trading!

Stablecoins Flow to Exchanges: Spot vs Derivatives

Stablecoin reserves show where the money goes. Spot exchanges currently hold about $4.5 billion in stablecoins, up from $1.2 billion a year ago. By contrast, derivative exchanges jumped from $26.2 billion to $54.1 billion in the same period.

Spot Stablecoin Reserves Are Dropping: CryptoQuant

Spot Stablecoin Reserves Are Dropping: CryptoQuant

Derivative exchanges — the derivatives sections of major exchanges — hold about $54.1 billion in stablecoins.

Stablecoin Reserves in Derivatives: CryptoQuant

Stablecoin Reserves in Derivatives: CryptoQuant

This tweet shows how big exchanges have massive stablecoin liquidity, more so on the derivatives side of things.

The split is clear. Most borrowed stablecoins are not being used for one-to-one spot buying of Bitcoin or Ethereum. They are sent to derivatives platforms, where each borrowed dollar acts as margin and can be multiplied 10 times, 25 times, or even 50 times. This shift shows traders prefer leveraged bets over simple spot purchases.

The Futures trading volume on exchanges confirms that:

Leverage Builds Fragile Positions

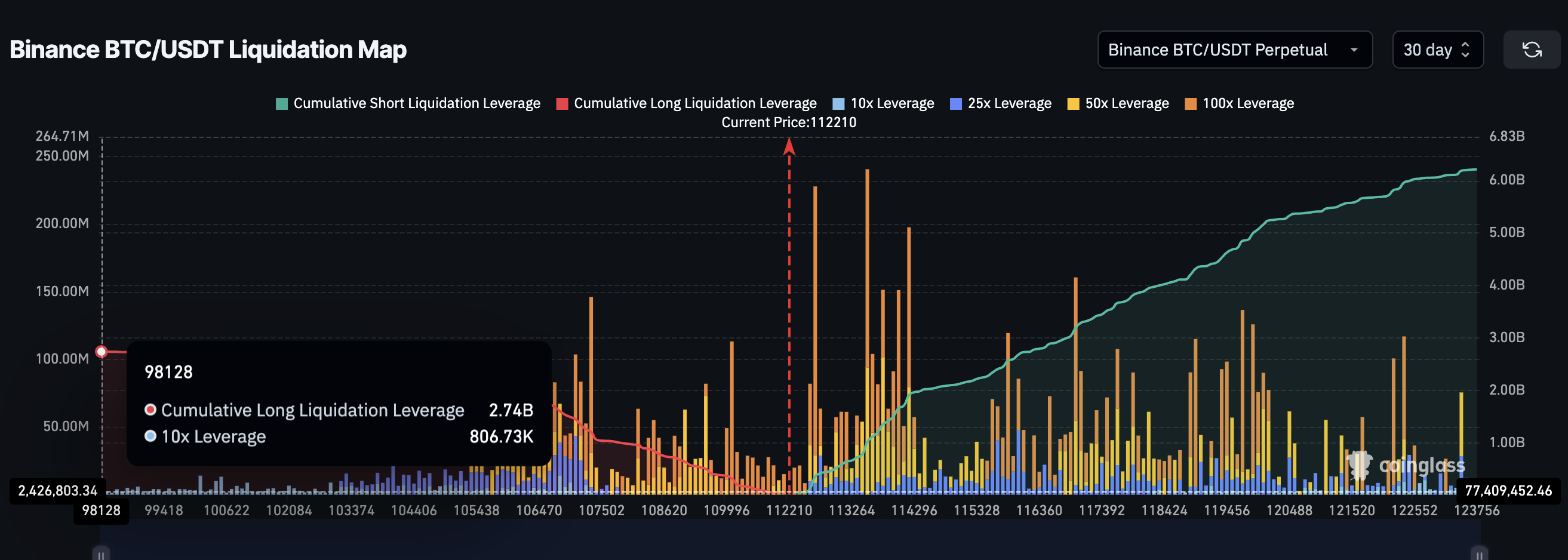

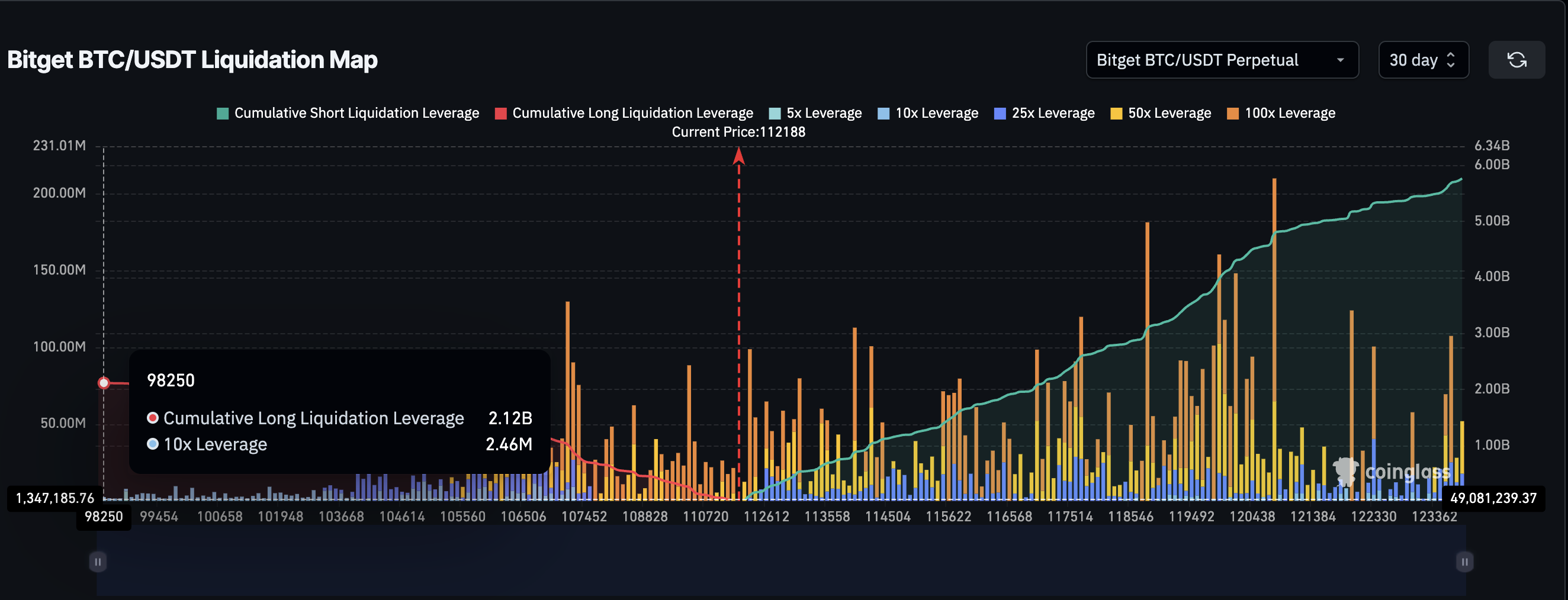

Liquidation maps reveal how fragile leveraged trading can make crypto rallies. On Binance, Bitcoin/USDT perpetuals — a type of futures contract with no expiry — show about $6.22 billion in short positions and $2.74 billion in long positions. On Bitget, Bitcoin pairs add another $5.71 billion in shorts and $2.09 billion in longs. Together, these two exchanges and one trading pair add up to nearly $17 billion in open positions.

BTC Liquidation Map On Binance: Coinglass

BTC Liquidation Map On Binance: Coinglass

BTC Liquidation Map on Bitget: Coinglass

BTC Liquidation Map on Bitget: Coinglass

At present, short positions are heavier because the market is moving sideways. But the dynamic flips during rallies. Traders load up on long positions, hoping to ride the move higher.

When these long bets cluster at similar price levels, even a small 2–3% pullback can wipe them out. This triggers a chain of forced liquidations, turning what should be strong crypto rallies into sharp reversals.

You might ask why the same doesn’t happen in reverse — why short liquidations don’t fuel rallies in the same way. The difference lies in how traders use short positions.

Many short positions are not outright bearish bets, but part of other strategies. Traders farm funding premiums or run delta-neutral setups where shorts hedge other positions. When these shorts disappear, the squeeze can cause sharp spikes, but they rarely sustain. Unlike long squeezes, which remove buyers from the market, short squeezes tend to fizzle out quickly instead of building lasting rallies.

This scale of exposure would not be possible without leverage. Remember, total stablecoin reserves on derivative exchanges are close to $54 billion. If all trading were one-to-one without leverage, these two pairs we just mentioned earlier alone could not account for nearly a third of that. This shows just how dominant leverage has become.

The size of this market is clearer when looking at volumes. In August 2025, Binance’s futures trading volume hit a yearly high of $2.62 trillion. That monthly total, the largest this year, underlines how futures and perpetuals now dwarf spot activity and fuel the scale of these leveraged positions.

Borrowing Costs Push Traders Toward Leverage

The final piece is cost. Borrowing stablecoins comes with interest. On Aave, the borrow APR for USDT is about 6%.

A trader who borrows $1,000 pays about $1.15 a week. With 10x leverage, a hairline price move of just 0.011% covers the interest cost.

Borrowing Rates On AAVE: Aave Scan

Borrowing Rates On AAVE: Aave Scan

The hurdle is so low that traders often move toward higher leverage. Tiny moves cover costs, and larger moves bring bigger profits. But the longer positions stay open, the higher the cost climbs.

This creates pressure to exit quickly, adding to the cycle of rallies that rise and fade without follow-through. And there also remains the risk of liquidation. For instance, a 10X leverage would more or less liquidate the trader for a 10% fall, something that isn’t uncommon in crypto. Hence, while DeFi-led long liquidations can stall rallies, the possibility of such liquidations also remains high, owing to the volatile nature of crypto.

Crypto rallies are not vanishing. The market is still bullish. But DeFi’s structure and overreliance on the lending-borrowing space may explain why rallies are shorter and weaker. Borrowed stablecoins are fueling leverage, not spot demand, making the market more fragile each time it tries to climb.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.