Aergo Price Soars 10% Amid Strategic Arbitrum Partnership – Is $0.68 Plausible?

0

0

Highlights:

- The price of Aergo has risen 10% to $0.13 in the last 24 hours, with trading volume up over 250%.

- AERGO partners with Arbitrum for developing data-centric Layer 2 solutions, enhancing blockchain and AI use.

- AERGO breaks through $0.11 resistance, targeting $0.68, driven by strong market momentum.

Aergo price has spiked out in a splendid show of bullish muscle, rising 10% to $0.13 in the past 24 hours. Accompanying the movement is its daily trading volume, which has soared over 250%, signalling heightened market activity. The recent spike comes as AERGO and Arbitrum announce an important partnership that will greatly support the development of future Layer 2 (L2) solutions.

The future just got an upgrade.

We’re building the L2 of tomorrow with @arbitrum. Data-centric and designed for AI.AI everywhere. $AERGO everywhere.#HPP #Arbitrum pic.twitter.com/R0k1mcgeQW

— Aergo (@aergo_io) June 4, 2025

The main aim is to help develop a platform based on data that supports AI and extends the limits of blockchain applications. The goal is to allow more industries to use AI, demonstrating AERGO’s dedication to developing top-notch technology. As a result of integrating with Arbitrum, Aergo will grow in speed and enhance its features on the blockchain.

Aergo Price Breaks Through $0.11 Resistance, What’s Next?

Following the recent developments, AERGO price has surpassed the $0.11 resistance in the past, and the market is now oriented towards finding support at the $0.68 target. In the last few weeks, the token has made several bullish moves. This recent resistance break could launch a much-needed rally. According to Decilizer, the Aergo price exceeded the previous resistance and is aiming to move even higher.

$AERGO has broken past $0.11 resistance, now targeting $0.68. Bitcoin rally and strong volume signal an extended uptrend. Watch for support retests and bullish candlestick patterns to spot strategic entries. pic.twitter.com/CGgo9AATsx

— Decilizer (@decilizer) June 5, 2025

Decilizer has stated that AERGO’s rise is because of the coin’s positive momentum. Bitcoin is gaining momentum and volume, which means investors are looking for more gains ahead. It is important for traders to focus on possible support retests and the emergence of bullish candles for choosing entry positions. Being able to see these patterns helps traders know the correct moment to invest so they can follow the trend at its strongest point.

Volume Surge and RSI Momentum: Signs of Strength in AERO Market

A quick glance at the AERGO daily chart shows that the 50-day MA stands at $0.1715, cushioning the bulls against further upside. On the other hand, the bulls have flipped the 200-day at $0.12 into immediate support, calling for a short-term rally in the market.

Meanwhile, a break above the $0.17 resistance will open the door for further upside, potentially $0.23, $0.26, and $0.31. On the other hand, if the $0.17 resistance proves too strong, Aergo price may plunge towards the $0.12 and $0.11 support zones.

The Aergo technical indicators, including the RSI level, are at 46.42, indicating that AERGO hasn’t reached the dangerous overbought zone and is still safe. It might help traders get ready with positions before a bigger price increase occurs.

Aergo Market Sentiment and Open Interest Analysis

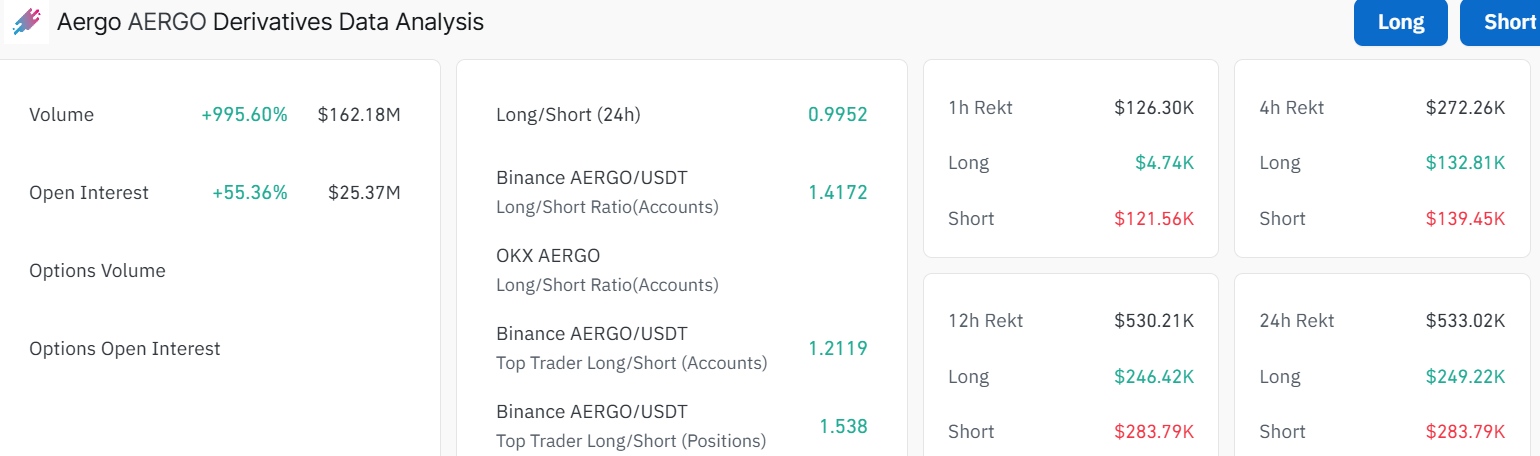

There has been an enormous surge in AERGO’s trading volume, rising to $162.18 million, suggesting many investors are taking part in the market. Also, open interest has increased by 55.36%, which proves that there are more traders entering the AERGO market, which supports a stronger bull trend.

These ratios point to the current market trend as well. The AERGO/USDT long-to-short ratio is 1.4172, which means more traders are long than short at the moment. It shows that the AERGO trend is likely to continue going up.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.