Circle’s Stellar IPO Fuels ProShares and Bitwise ETF Filings Tied to CRCL Shares

0

0

ProShares, Bitwise Act Quickly After IPO

Just weeks after Circle Internet Group’s massive IPO, asset managers ProShares and Bitwise filed for ETFs that track Circle’s newly issued CRCL shares. The move indicates ever-more mature institutional demand for access to regulated crypto-adjacent equities.

The ProShares Ultra CRCL ETF utilizes leverage to deliver the daily performance of CRCL stock twice over, targeting more aggressive investors. The Bitwise CRCL Option Income Strategy ETF will generate yield through a covered call approach and, indeed, will attempt to minimize any downside risk given a covered call strategy that writes out call options on CRCL stock. Both will have effective dates of August 20, 2025.

These filings indicate that established finance participants view Circle’s equity as a solid basis for diversified investment platforms, ranging from high-risk leveraged products to conservative income strategies.

IPO Sparks Surging Interest and Valuation

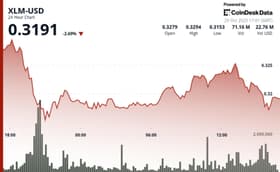

Circle went public through an IPO on June 5 on the New York Stock Exchange, where the company started trading at $31 a share. The stock rose to 170% on the first day of trading, but the rally did not hold over until the next morning’s premarket trading as the stock price surged another 16% putting the price over $117 and making the market capitalization of Circle cross $20 billion.

Support from leading financial institutions gave the company credibility: BlackRock announced a 10% stake in equity, and Cathie Wood’s Ark Invest invested $150 million.

World Capital Looks to Circle’s Expansion

Circle is not just attracting ETF interest based in the U.S. Japan’s SBI Holdings, via its subsidiary SBI Shinsei Bank, just invested $50 million in a joint venture with the company. The action speaks to Circle’s expanding global institutional appeal.

Circle, which created the world’s second-largest stablecoin USDC, is now also the first company to be officially compliant with the EU’s MiCA regulation. This regulatory milestone—alongside its IPO triumph—positions Circle as a gateway between old finance and the new generation of digital assets.

With ETFs being planned, CRCL shares are soon becoming the hub of diversified crypto investment strategies.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.