Ethereum Price Consolidates Near $2,500 as Derivatives Market Shows Signs of Strength

0

0

Highlights:

- The price of Ethereum struggles near $2,500, down 0.55% with daily volume up 19%, signaling growing market interest.

- Derivatives market sees a 41% rise in volume and bullish long-to-short ratios, with top traders confident in the upside.

- The Ethereum price consolidates under the 50-day MA, forming higher highs and higher lows, indicating bullish trend potential.

The Ethereum price is still struggling to regain the $2,500 mark, as it sits at $2,498, indicating a 0.55% drop in the past 24 hours. However, its daily trading volume has increased by 19%. This increase shows that investors and traders are confident in a potential price surge.

Ethereum Price Moves Into a Consolidation Channel

The daily price chart for Ethereum shows the price stabilizing around $2,500. Currently, ETH bulls have established strong support around $2,152, aligning with the 50-day MA. Looking at the 200-day moving average, which is a longer-term sign, hovers around $2,681, cushioning against further upside.

As per UniChartz, the higher highs (HH) and higher lows (HL) in ETH’s price structure are a strong indication that its trend is bullish.

Hello traders, here is the analysis of $ETH/USDT

Ethereum is currently consolidating within a clear accumulation zone, right below a key resistance level. The price structure continues to form higher highs (HH) and higher lows (HL) — a classic bullish trend.

This sideways… pic.twitter.com/JWTyT6jEvd

— UniChartz (@UniChartz) June 1, 2025

If Ethereum’s price stays over the accumulation region and rises past the main resistance close to $2,500, it could rise powerfully to reach $3,200 or even $3,600. If the market keeps making higher lows, bulls are kept in control and can push the prices up.

The Relative Strength Index (RSI) is currently at 54.34, indicating that the market is neither overbought nor oversold. A slight bearish crossover on the Moving Average Convergence Divergence (MACD) may mean the price could now stabilize or decrease a bit before a possible rise.

Robust Derivatives Market Activity Signals Growing Trader Interest

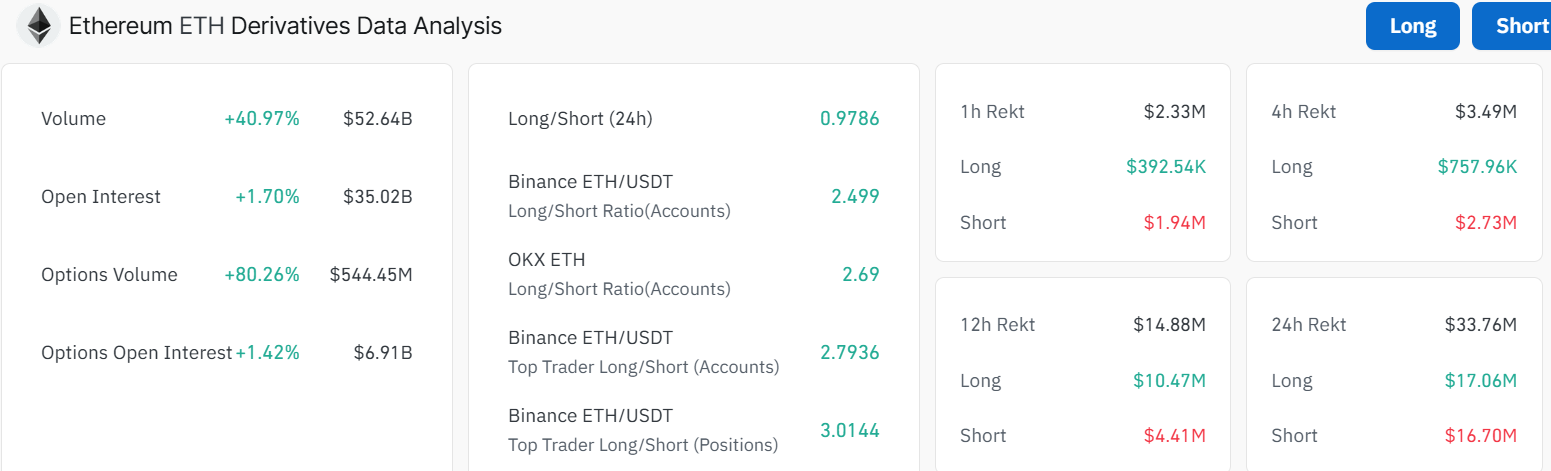

There is a lot of activity and increasing interest among traders in the Ethereum derivatives market. There has been a 40.97% rise in the 24-hour trading volume to $52.64 billion. This indicates stronger involvement from traders in futures and options trading. Sustained market participation is shown by the 1.7% rise in open interest to $35.02 billion.

Trading of options has seen a sharp rise of 80.26%, reaching $544.45 million, and the open positions rose by 1.42% to $6.91 billion. The rise suggests that people are using these contracts both for protection and for speculation.

A bullish sentiment among traders is shown by the long-short performance across major exchanges. The long-to-short ratio for ETH/USDT on Binance is 2.499, and the top trader’s ratio is 2.79. Even bigger position ratios are seen, with Binance’s top traders reaching 3.01, which means they believe prices are heading up strongly.

Recent hours have seen major amounts of liquidation, indicating that the market is still adjusting. Total liquidations in the past 24 hours came to $33.76 million, while long liquidations hit $17.06 million and short liquidations hit $16.7 million. This reflects traders rearranging their positions.

What’s Next for Ethereum?

With the Ethereum price nearing the bottom of the accumulation zone and traders becoming more active in derivatives markets, a breakout may happen. If the Ethereum price breaks through the current level of resistance, a rally to the $2,680 resistance zone may take place. In a highly bullish case, the ETH price could surge to $2,953, $2,910, and $3,175.

But according to the MACD, a temporary pullback or a prolonged consolidation may happen before prices can rise. In such a case, if the bears capitalize on the sell signal from the MACD indicator, the $2,445, 2,341, and $2,228 support zones will act as a caution against further downside.

Ethereum’s move in prices and patterns of derivatives trading indicates a hopeful view. A stronger rally might take place, though it will be important to watch for proof by price action and continued strength in the coming days.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.