Is Bitcoin Heading for New Highs? Risks Loom Over the Market

0

0

The crypto world is abuzz with speculation as Bitcoin (BTC) approaches the $100,000 milestone but struggles to break through this critical level. Despite strong demand from institutional investors, persistent selling pressure from long-term holders and increased short-term speculation are creating a volatile and uncertain market environment.

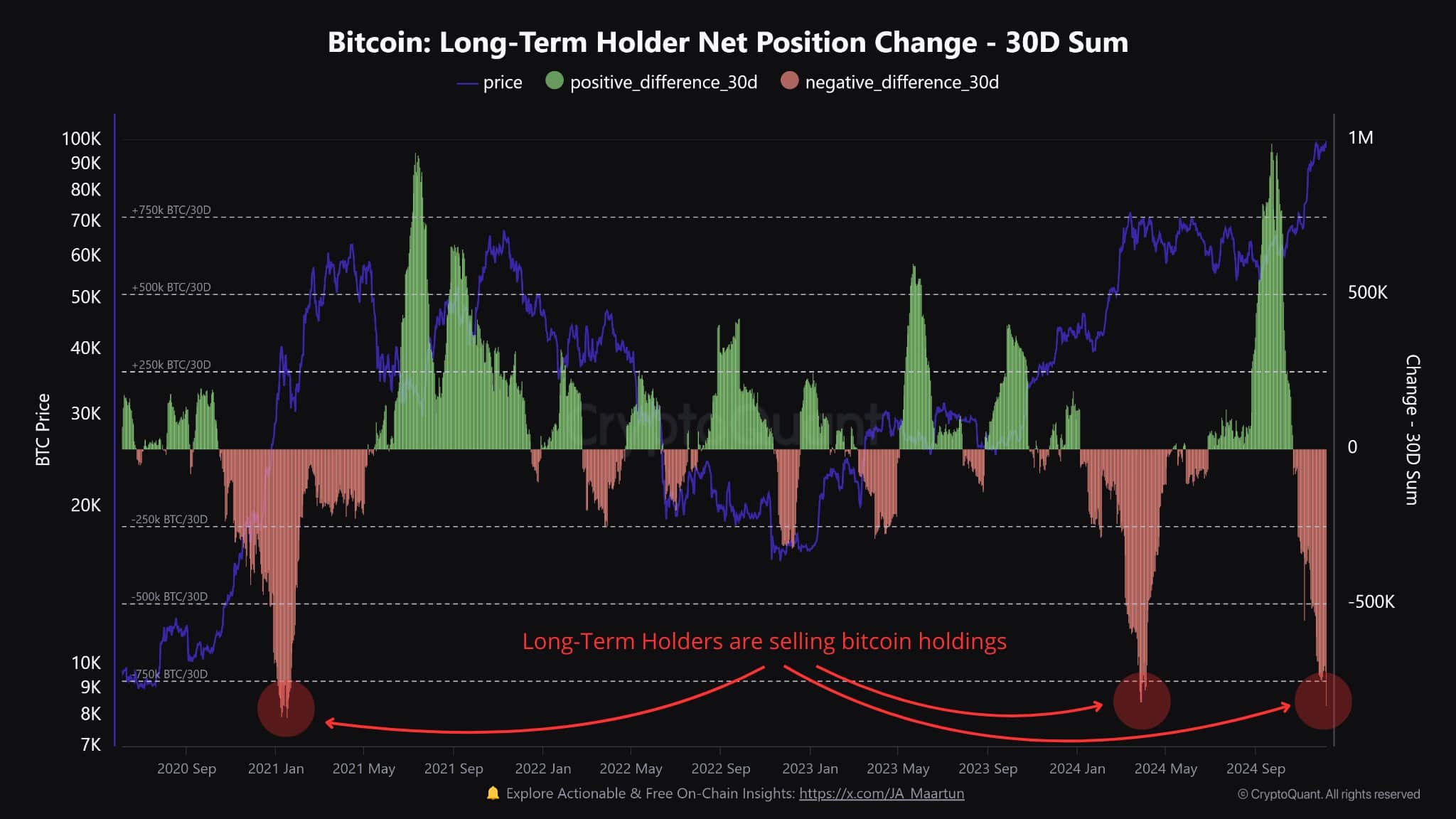

Long-Term Holders Apply Selling Pressure

Recent data shows that long-term holders have offloaded a staggering 827,783 BTC over the past month, intensifying the resistance against Bitcoin’s price rally. This significant sell-off is making it harder for the market to stabilize and climb further.

On the other hand, institutional investors are stepping up their game. Notable players like MicroStrategy added 149,880 BTC to their reserves during the same period, while spot Bitcoin ETFs saw inflows totaling 84,193 BTC. However, these acquisitions haven’t been sufficient to counterbalance the selling pressure, suggesting that further institutional support will be crucial for Bitcoin to sustain its upward momentum.

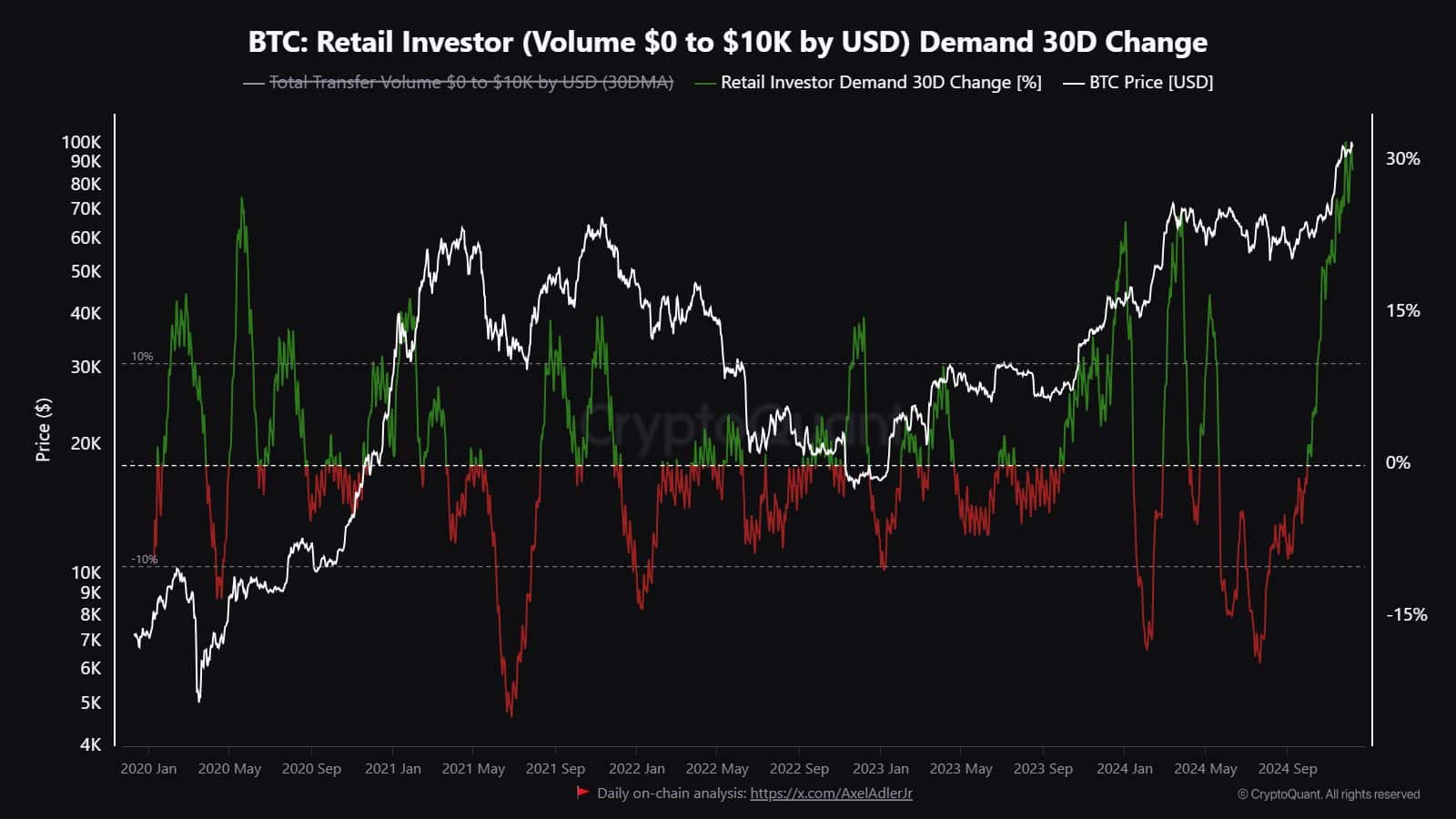

Investor Demand Fuels Bitcoin’s Price Growth

Bitcoin’s recent gains can largely be attributed to strong investor demand, which has hit a yearly peak over the past 30 days. Increased trading volume has provided some stability, helping Bitcoin maintain a key support level.

Short-term traders have also played a pivotal role, snapping up a significant portion of Bitcoin’s circulating supply. The growing interest in altcoins and Bitcoin futures, with open interest reaching $53.3 billion and $30.6 billion respectively, highlights the heightened market activity. However, this increased participation also brings greater volatility, suggesting that sharp price swings could be on the horizon.

Greed and Volatility Signal Potential Risks

The Crypto Fear & Greed Index recently climbed to 84, indicating a state of “extreme greed” in the market. Historically, such levels often precede sharp corrections, serving as a warning for traders to exercise caution.

Moreover, metrics like the Sell-Side Risk Ratio and Net Taker Volume suggest that Bitcoin’s price could be nearing a local peak. Adding to the uncertainty, upcoming economic data from the U.S., such as inflation figures and the Producer Price Index (PPI), could amplify market volatility and influence Bitcoin’s trajectory.

Investors should closely monitor macroeconomic indicators alongside market dynamics to navigate the risks and opportunities effectively. The Bit Journal recommends a cautious approach during periods of heightened volatility, ensuring that portfolios remain diversified and prepared for potential market shifts.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.