Unexpected US ADP Non-Farm Employment Miss: What It Means for Markets

0

0

BitcoinWorld

Unexpected US ADP Non-Farm Employment Miss: What It Means for Markets

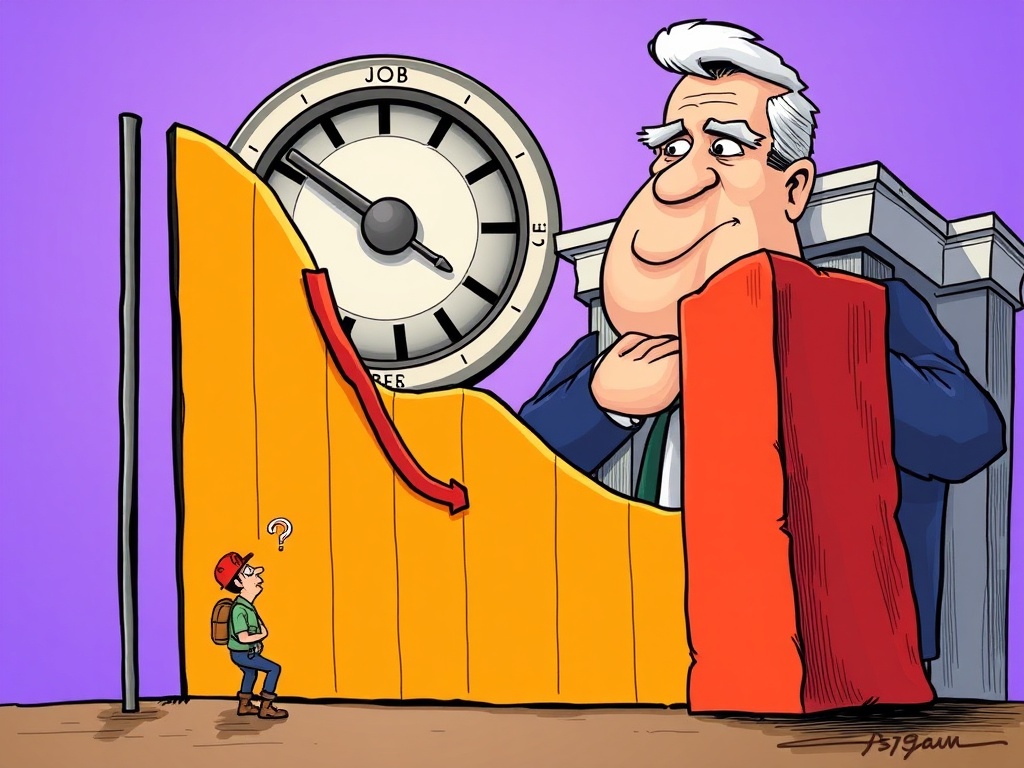

The latest economic data has sent ripples through financial circles, revealing a significant slowdown in job creation. The August US ADP non-farm employment report delivered an unexpected miss, raising questions about the health of the American economy. For anyone tracking market movements, especially in the volatile world of cryptocurrencies, understanding these shifts is absolutely crucial.

What Does the August US ADP Non-Farm Employment Report Reveal?

According to the Automatic Data Processing (ADP) National Employment Report, the U.S. private sector saw a modest increase of only 54,000 jobs in August. This figure fell notably short of the 73,000 jobs that economists had forecast, signaling a slower pace of hiring than anticipated.

- Key Data Point: Only 54,000 jobs added in August.

- Expectation vs. Reality: Missed the forecast of 73,000 jobs.

- Source: Based on payroll data from over 500,000 ADP corporate clients.

It’s important to remember that the ADP report serves as a precursor to the official jobs data released by the U.S. Department of Labor. While not the final word, it offers an early glimpse into the labor market’s condition, influencing initial market reactions and setting expectations.

Why is US ADP Non-Farm Employment Data So Important?

The health of the job market is a cornerstone of economic stability, and figures like the US ADP non-farm employment are closely watched by policymakers, particularly the Federal Reserve. The Fed uses these employment metrics as a key indicator when making its critical interest rate decisions.

Consider these points:

- Strong Employment: Often suggests a robust economy. This might prompt the Fed to raise or hold interest rates steady to prevent inflation and economic overheating.

- Weak Employment: Can signal an economic slowdown or contraction. In such scenarios, the Fed might consider cutting rates to stimulate borrowing, spending, and investment, thereby boosting economic activity.

Therefore, an unexpected miss in job creation, as seen in the August US ADP non-farm employment, can hint at potential shifts in monetary policy, directly impacting everything from bond yields to stock market performance.

Broader Implications for the Economy and Your Investments

A softer job market, as indicated by the latest US ADP non-farm employment figures, can have a ripple effect across the entire economy. Fewer jobs and slower wage growth can lead to reduced consumer spending, which is a major driver of economic growth. Businesses, in turn, might scale back investments and hiring plans, creating a cycle of deceleration.

For investors, this economic uncertainty often translates into market volatility. Traditional assets like stocks can react negatively to fears of a slowdown or potential recession. The cryptocurrency market, while often marching to its own beat, is not immune to these macroeconomic currents.

- Risk Appetite: Higher interest rates or economic uncertainty can reduce investor appetite for riskier assets, including many cryptocurrencies.

- Capital Flows: Funds might shift from speculative assets to safer havens during periods of economic concern.

Understanding these broader economic signals, even if they don’t directly reference crypto, helps in anticipating potential market shifts and making informed decisions.

Navigating Economic Shifts: What Should Investors Consider?

In times when key economic indicators like the US ADP non-farm employment report present surprises, a thoughtful approach to investment becomes even more vital. Staying informed about economic trends and their potential impact is your best defense against market turbulence.

Here are some actionable insights:

- Stay Informed: Regularly review economic reports and expert analyses to understand the evolving landscape.

- Diversify: Don’t put all your eggs in one basket. A diversified portfolio can help mitigate risks during uncertain times.

- Long-Term Vision: Focus on your long-term investment goals rather than reacting to every short-term market fluctuation.

- Risk Assessment: Re-evaluate your risk tolerance in light of changing economic conditions.

While no one can predict the future with certainty, being prepared and adaptable is key to navigating the complexities of the global economy.

Conclusion

The August US ADP non-farm employment report serves as a powerful reminder that economic conditions are constantly evolving. The unexpected miss in job creation could signal a period of slower growth, potentially influencing the Federal Reserve’s future interest rate decisions. For market participants, especially those in the dynamic crypto space, paying close attention to these macroeconomic signals is essential for making strategic choices and staying ahead of the curve. Vigilance and adaptability will be your greatest allies.

Frequently Asked Questions (FAQs)

What is the US ADP non-farm employment report?

The US ADP non-farm employment report is a monthly measure of the change in private sector employment in the United States. It’s compiled by Automatic Data Processing (ADP) based on its extensive payroll data and is often seen as a precursor to the official government jobs report.

How does it differ from the official jobs report?

The ADP report focuses solely on private sector employment, whereas the official U.S. Department of Labor’s non-farm payrolls report includes both private and government employment. While both track job growth, they use different methodologies and often show slight variations.

Why does the Federal Reserve care about US ADP non-farm employment?

The Federal Reserve closely monitors employment data, including the US ADP non-farm employment, as a key indicator of economic health. Strong employment can signal inflation risks, while weak employment can indicate a slowdown, both of which influence the Fed’s decisions on interest rates.

What impact could this miss have on interest rates?

An unexpected miss in US ADP non-farm employment figures could suggest a weakening job market. This might lead the Federal Reserve to reconsider its monetary policy, potentially pausing or even cutting interest rates to stimulate the economy, rather than raising them.

How might this affect the cryptocurrency market?

While not a direct correlation, macroeconomic shifts indicated by reports like the US ADP non-farm employment can indirectly affect the crypto market. Economic uncertainty or changes in interest rates can influence investor sentiment and risk appetite, potentially leading to increased volatility or shifts in capital allocation from riskier assets like cryptocurrencies.

Did you find this analysis helpful? Share your thoughts and this article with your network to keep the conversation going about the latest economic trends and their market implications!

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

This post Unexpected US ADP Non-Farm Employment Miss: What It Means for Markets first appeared on BitcoinWorld and is written by Editorial Team

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.