Whale Panic: PEPE Investor Dumps $5M Worth, Triggers Market Shock

0

0

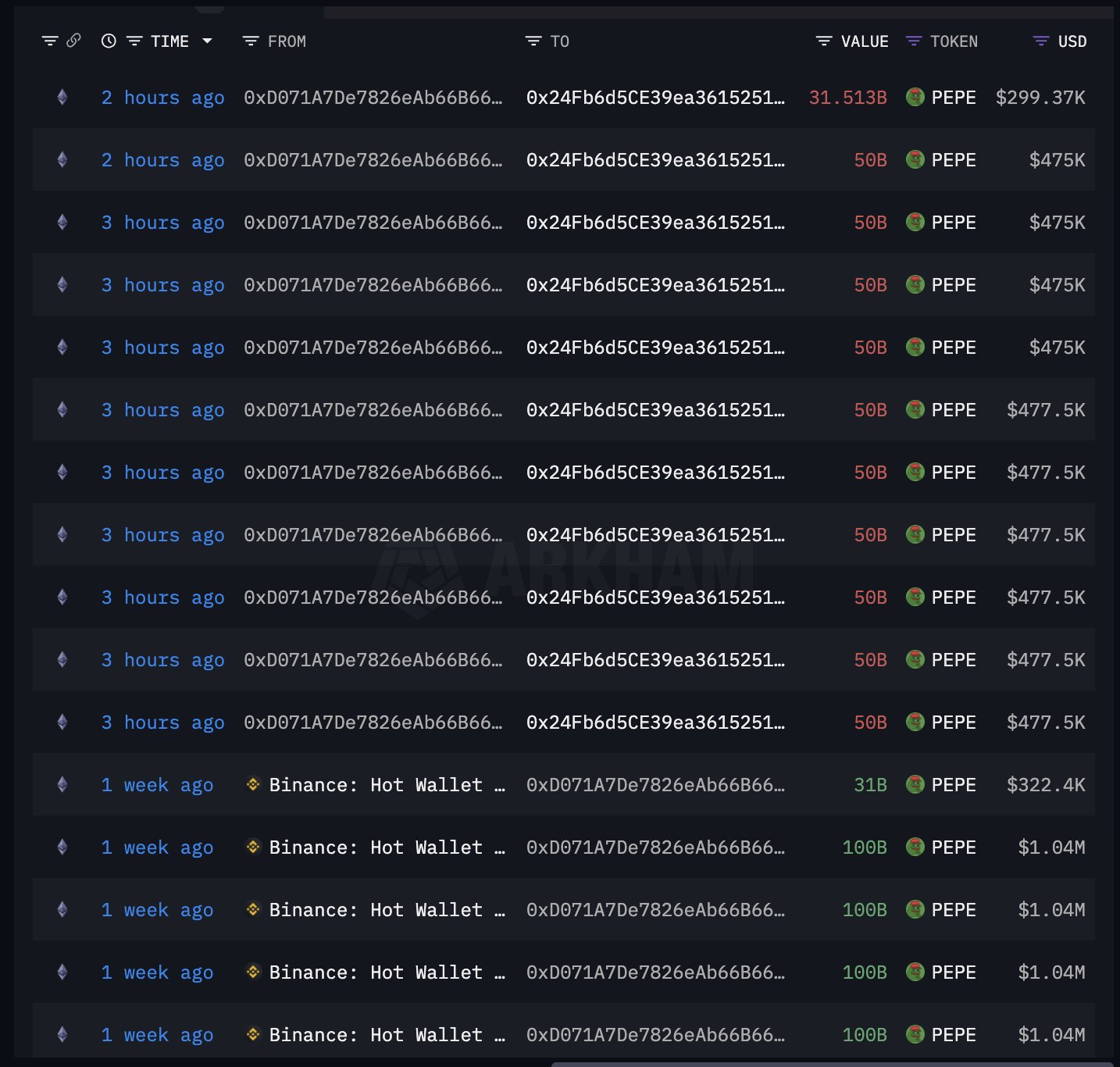

In a surprising move that rippled across the memecoin market, a prominent PEPE whale has sold off a staggering 531 billion tokens — at a loss. The whale offloaded the holdings for $5.06 million, incurring a $465,000 deficit, according to on-chain analytics platform Spot On Chain. What makes the situation even more baffling is the extremely short holding period: just seven days.

Such a dramatic exit, especially at a loss, reflects the fragility of investor psychology in volatile markets. It highlights how even high-stake players are not immune to emotional decision-making, particularly during uncertain price action.

What Prompted the Whale’s Panic?

While the exact motivation remains speculative, analysts point to a combination of impatience and market volatility. The investor may have entered PEPE with the expectation of a rapid surge, only to exit hastily after a minor correction. This behavior underscores how thin the line can be between strategic profit-taking and panic-driven exits in the crypto space.

Importantly, this sell-off was not merely a personal misstep — it triggered broader market reactions. PEPE’s price dropped by nearly 7% in the last 24 hours and is now down over 11% on the week.

Why This Event Matters

This event offers several critical insights into the state of the PEPE ecosystem and the memecoin market at large:

-

Market Fragility: The fact that a single whale’s exit could trigger a multi-million-dollar sell-off and a double-digit weekly decline suggests structural weaknesses in liquidity and investor sentiment.

-

Community Sentiment Check: Events like this act as a psychological stress test for token holders. Some see it as a capitulation of weak hands, while others interpret it as a warning sign of deeper instability.

-

Possible Correction Ahead: Large sell-offs often precede broader market corrections. Whether this marks a temporary dip or the beginning of a larger trend is yet to be determined.

Golden Cross: A Technical Silver Lining

Despite the bearish pressure, technical indicators offer a glimmer of hope. A Golden Cross formation — where the 50-day moving average crosses above the 200-day moving average — has emerged on PEPE’s daily chart. Historically, this signal often precedes sustained uptrends and may reflect growing long-term interest in the token.

Conclusion: Emotions vs. Indicators

The current situation surrounding PEPE encapsulates the eternal tug-of-war between market sentiment and technical structure. While the whale’s sell-off ignited fear, the emergence of bullish indicators like the Golden Cross suggests that the story may not be over — and that the next chapter could still offer upside potential.

Investors should tread carefully, balancing caution with opportunity, and always back their decisions with sound research rather than emotion.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

References:

-

Spot On Chain, Whale Transaction Analysis (June 26, 2025). https://twitter.com/spotonchain

-

CoinGecko, PEPE Market Data: https://www.coingecko.com

-

TradingView, PEPE/USD Chart Analysis: https://www.tradingview.com

Read More: Whale Panic: PEPE Investor Dumps $5M Worth, Triggers Market Shock">Whale Panic: PEPE Investor Dumps $5M Worth, Triggers Market Shock

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.