Algorand Leads Real World Asset Market With 70% Share: Can ALGO Surge Push It Past $0.20?

0

0

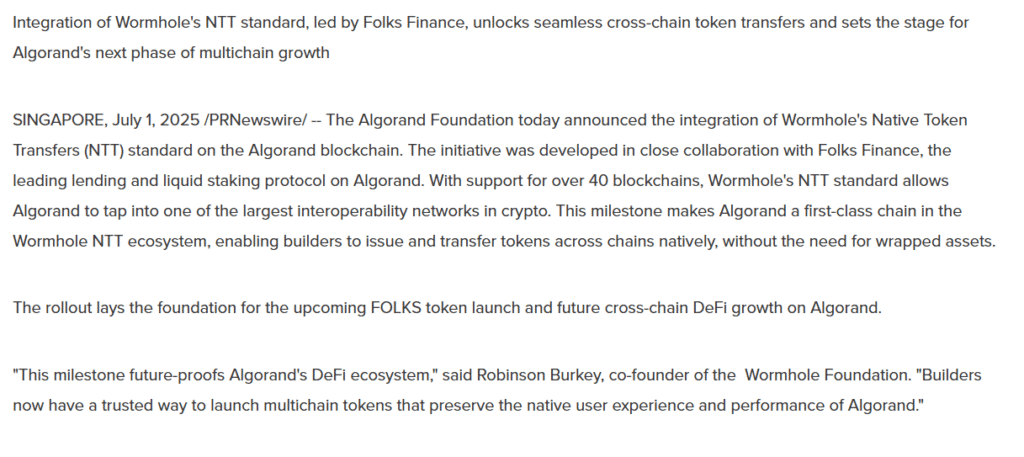

Algorand leads real world asset (RWA) tokenization, holding 70% market share. As institutional adoption increases, stablecoin supply increases, and new staking dynamics play out, its ecosystem further gains strength. The just-announced Wormhole NTT integration provides robust cross-chain abilities, allowing Algorand’s reach across 40+ blockchains.

A Leader in Real-World Assets

Algorand enjoys a commanding 70 percent market share of the tokenized real-world asset (RWA) market, with 268.2 million dollars in on-chain value. This is well ahead of its closest rivals: XRP Ledger (55.4 million), Gnosis (14.3 million), Ethereum (6.6 million), and Arbitrum (3.9 million). This leadership is a testament to Algorand’s clear adherence to the technical and regulatory demands required by traditional finance.

In contrast to general-purpose chains, Algorand’s design is specifically optimized for high-volume, high-assurance tokenization of assets. It enables instant finality, low transaction fees, and rigorous compliance adherence, well-suited for institutions tokenizing financial or physical assets.

Players like Mitsui O.S.K. Lines (123 Carbon tokens) and Lavazza Coffee are using Algorand for tokenized applications for supply chain, environmental credits, and payments. These applications show increasing institutional trust in Algorand’s infrastructure.

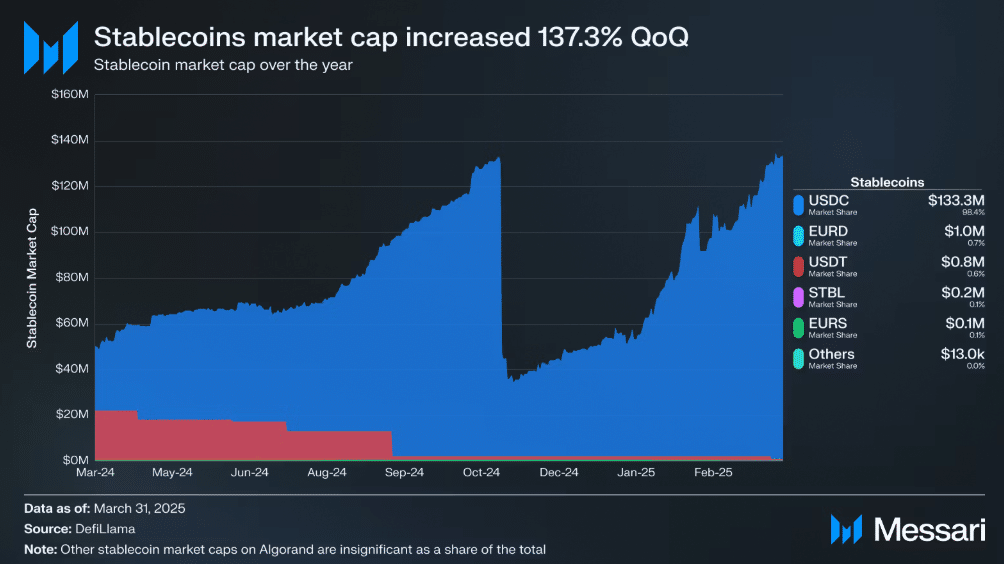

Stablecoin Growth Drives RWA Utility

Algorand leads real world asset, stablecoins experienced high growth in Q1 2025, with supply rising 137 percent quarter-on-quarter to 135 million dollars. Nearly all of this growth can be attributed to USDC, which expanded 150 percent to 133 million and now represents 98 percent of all stablecoins in the network.

Stablecoins play a critical role in enabling tokenized assets’ exchange, settlement, and yield generation. Algorand’s growing stablecoin volume reflects the network’s growing usage for real-world finance solutions.

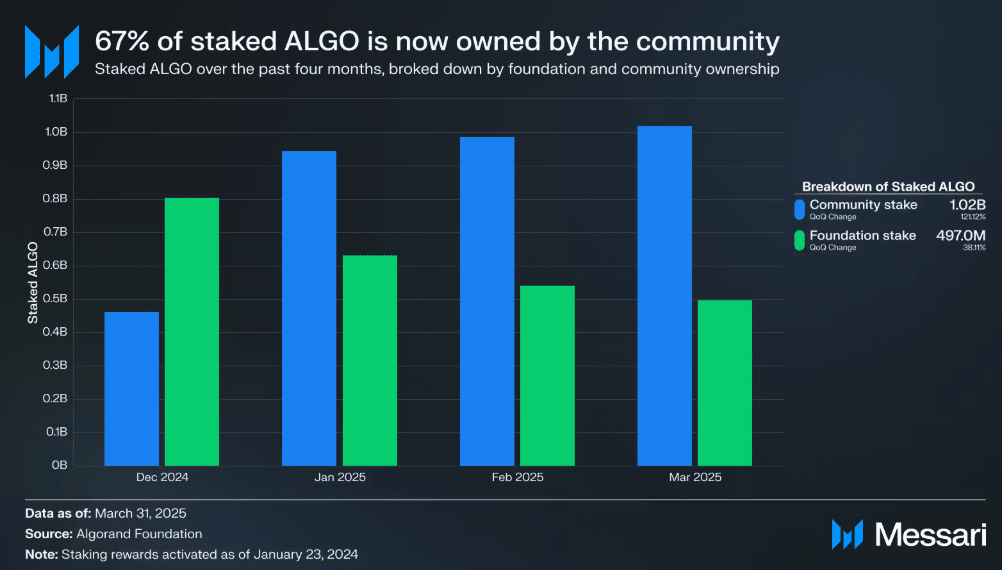

Staking Rewards Lock Supply

Last month’s Algorand 4.0 update unveiled permanent staking rewards, which supplanted the previous governance-based rewards. Since then, more than 2 billion ALGO tokens, around 25 percent of the outstanding supply, have been staked throughout the ecosystem.

Particularly, stake held by the community increased by 121 percent, while that of the Algorand Foundation fell by 38 percent, which indicates further decentralization. With less ALGO to trade, this has created supply constraints that can assist in backing price appreciation.

Large staking platforms such as Folks Finance and Kiln Finance have embraced the reward framework, facilitating greater access by institutional as well as retail investors.

Institutional Adoption Supports Market Position

Algorand leads real world asset usage with various enterprise integrations. Pera Wallet’s partnership with Immersve facilitates self-custodied USDC payments to over 100 million Mastercard merchants. Concurrently, Robinhood Europe and Nubank’s listing of ALGO have raised retail on-ramp access in the EU and Latin America.

Mitsui O.S.K. Lines has tokenized carbon credits on its international shipping fleet on the Algorand blockchain, and other companies are looking at asset issuance with real underlying economic value. These activities point to the attractiveness of Algorand as a platform for blockchain-based financial infrastructure.

Technical Patterns Suggest Price Breakout Potential

Chart technicians have identified bullish patterns for ALGO such as a falling wedge at the 0.1715 dollar support level and a double bottom at 0.16 dollars. These are generally regarded as reversal patterns with targets for the upside between 0.30 to 0.35 dollars if the resistance at 0.24 to 0.26 is broken.

A few Elliott Wave theorists believe that ALGO is potentially in the initial stage of an uptrend Wave 3, and long-term potential is to trend above 7 dollars. Meanwhile, the current RSI at around 45 indicates that ALGO is oversold, which is generally a prelude to price rallies.

Support levels still at 0.16 to 0.17 dollars. A break below this level could result in a short fall to 0.12 to 0.14 before a rebound.

Summary

Algorand leads real world asset field with a 70 percent market share backed by 268 million dollars in on-chain assets. Stablecoin expansion, staking-fueled supply shortages, and strong institutional support further prop up the platform’s power. Wormhole’s Native Token Transfers are integrated into the platform to provide genuine multichain engagement and access to liquidity on 40 blockchains. Coupled with positive technical patterns, Algorand seems well-poised to move through to higher price levels, as long as key support areas remain intact.

FAQs

1. Why is Algorand leading the RWA market?

Algorand’s high finality speed, regulatory fit, and minimal fees make it appealing to institutions. It has a structure that allows for large-scale tokenization of assets, and this has attracted large corporations into its fold.

2. What impact does staking have on ALGO’s price?

More than 2 billion ALGO staked reduces sellable supply by a substantial amount. Sell pressure is lowered, aiding in price stability, and rewards long-term holding.

3. What does Wormhole NTT integration do for Algorand?

NTT facilitates natively supported cross-chain token transfers with 40+ chains, enabling developers and users to access other ecosystems without wrapping tokens, enhancing liquidity and convenience.

Glossary

Real‑World Asset (RWA): Tokenized version of financial or physical assets such as carbon credits, real estate, or bonds, which allows them to be exchanged on blockchain platforms.

Pure Proof-of-Stake (Pure PoS): A consensus framework employed by Algorand to pick validators randomly according to stake weight, providing decentralization, efficiency, and low power consumption.

Native Token Transfers (NTT): An open standard of Wormhole that enables unwrapped, native token transfers between various blockchain networks with native functionality retained.

Sources

Read More: Algorand Leads Real World Asset Market With 70% Share: Can ALGO Surge Push It Past $0.20?">Algorand Leads Real World Asset Market With 70% Share: Can ALGO Surge Push It Past $0.20?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.