CRO price prediction 2025-2031: Will CRO reach $1?

0

0

Key takeaways

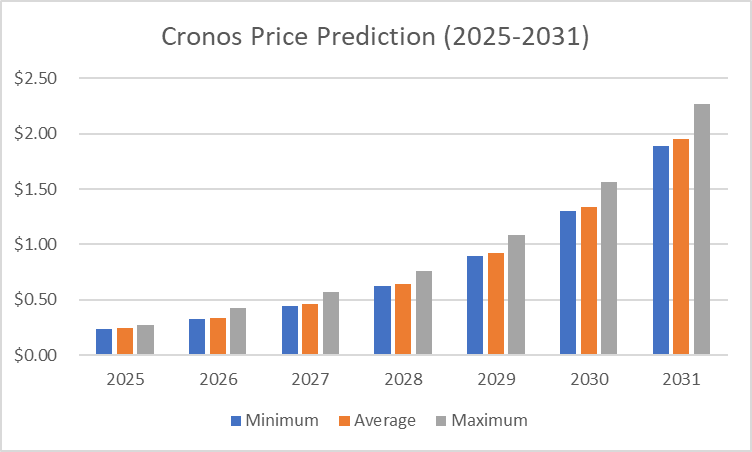

- The CRO price prediction for 2025 shows it will reach a maximum level of $0.2644 and an average price of $0.2338.

- By 2028, CRO could reach a maximum value of $0.8316, with an average trading price of $0.7314.

- Cronos is expected to reach a maximum level of $2.52 in 2031.

Cronos (CRO) is the native cryptocurrency token of the Crypto.com chain, a decentralized, open-source blockchain developed by the Crypto.com payment, trading, and financial services company. CRO aims to power the next generation of decentralized crypto assets and applications and enable real-time, low-cost transactions globally.

Cronos cross-bridge mainnet beta suggests a bright future for CRO. This feature aims to improve interoperability between significant blockchain ecosystems, potentially increasing CRO’s attractiveness to developers and users. CRO’s recent performance reflects robust market sentiment and confidence. These factors combined present Cronos as a compelling investment opportunity within the dynamic cryptocurrency market.

Eminem’s involvement comes when Crypto.com has been actively expanding its visibility through various high-profile partnerships, such as with actor Matt Damon and major sports teams.

The blend of celebrity influence, such as Eminem’s endorsement, with significant tech developments like the Cronos cross-bridge, creates a unique market positioning that could lead to favorable outcomes in its pricing dynamics.

Overview

| Cryptocurrency | Cronos |

| Token | CRO |

| Price | $0.1612 |

| Market Cap | $4.28B |

| Trading Volume | $38.98M |

| Circulating Supply | 26.57B CRO |

| All-time High | $0.9698 Nov 24, 2021 |

| All-time Low | $0.01149 Dec 17, 2018 |

| 24-h High | $0.1654 |

| 24-h Low | $0.1585 |

Cronos Price Prediction: Technical Analysis

| Metric | Value |

| Price Prediction | $ 0.216737 (34.85%) |

| Volatility | 10.77% |

| 50-Day SMA | $ 0.171093 |

| 14-Day RSI | 52.46 |

| Sentiment | Neutral |

| Fear & Greed Index | 73 ( Greed) |

| Green Days | 13/30 (43%) |

| 200-Day SMA | $ 0.110476 |

Cronos price analysis: Recovery amidst heightened trading activity

Key takeaways

- Cronos price analysis shows a downtrend

- CRO needs to break above the $0.140 resistance level

- If CRO drops below $0.1200, it could signal further downside toward $0.1100.

Cronos (CRO) is trading at $0.1354, reflecting a minor 0.26% decline over the past 24 hours. Its market capitalization stands at $3.59 billion, slightly down by 0.27%, while the 24-hour trading volume has surged by 80.56% to $38.99 million. This increase in trading activity and a volume-to-market cap ratio of 1.08% highlights growing interest in the token despite the marginal price drop.

From a technical perspective, the rebound in price indicates some accumulation activity, as traders capitalize on lower prices. The circulating supply of CRO is at 26.57 billion, out of 30 billion.

Cronos daily chart analysis: Bearish trend continues

Cronos (CRO) is currently trading at $0.1357, reflecting a 0.82% decline in its price for the day. The daily chart indicates a continuation of the bearish trend as the price remains below key Moving Averages (MAs). The 50-day Simple Moving Average (SMA) at $0.1385 and the 100-day SMA at $0.1474 act as immediate resistance levels, limiting upward momentum.

The bearish alignment of the MAs, with the 200-day SMA significantly higher at $0.1679, signals that CRO is entrenched in a longer-term downtrend. Additionally, the price is approaching the support level at $0.1200, which aligns with the lower boundary of the previous consolidation phase.

The Relative Strength Index (RSI) is at 37.89, indicating that CRO is in bearish territory but not yet oversold. This suggests that further selling pressure is possible before a potential rebound. Traders should watch for a breakout above the 50-day SMA for signs of a trend reversal, while a drop below $0.1200 could signal further downside toward $0.1100.

Cronos 4-hour chart analysis: CRO attempts breakout above $0.136

The 4-hour chart for Cronos (CRO) shows a slight recovery in price, currently holding above $0.136.After a recent dip to the $0.130 level, the price has shown some bullish momentum, rebounding to test resistance around $0.136. However, the overall trend remains cautious, as the price struggles to break above its recent highs.

The Relative Strength Index (RSI) is currently at 46.39, suggesting that the market is moving towards the neutral zone. Although the RSI has risen from oversold conditions, it remains below 50, indicating that selling pressure has not entirely subsided.

The Moving Average Convergence Divergence (MACD) indicator shows a slight bullish crossover as the MACD line moves above the signal line. The histogram bars are turning green, reflecting a decrease in bearish momentum. However, the MACD remains close to the zero line, indicating that the market lacks a strong directional bias.

For continued upward momentum, CRO needs to break above the $0.140 resistance level. On the downside, immediate support lies near $0.130.

Cronos technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

| SMA 3 | $ 0.178561 | SELL |

| SMA 5 | $ 0.161558 | SELL |

| SMA 10 | $ 0.153218 | BUY |

| SMA 21 | $ 0.161784 | SELL |

| SMA 50 | $ 0.171093 | SELL |

| SMA 100 | $ 0.130843 | BUY |

| SMA 200 | $ 0.110476 | BUY |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA 3 | $ 0.162506 | SELL |

| EMA 5 | $ 0.16823 | SELL |

| EMA 10 | $ 0.175119 | SELL |

| EMA 21 | $ 0.178259 | SELL |

| EMA 50 | $ 0.162077 | SELL |

| EMA 100 | $ 0.138353 | BUY |

| EMA 200 | $ 0.120349 | BUY |

What to expect from Chainlink price analysis

The bearish trend is evident, with the cryptocurrency trading below key moving averages that signify resistance and potential reversal zones. CRO is hovering near $0.1357, with immediate resistance spotted at the 50-day and 100-day SMAs, positioned at approximately $0.1385 and $0.1474, respectively. These levels are critical for determining any potential upward movement.

Conversely, support is forming around $0.1200, a level that might test the strength of any bearish momentum. If this support fails, a further decline toward $0.1100 is plausible, especially if the selling pressure intensifies. Investors and traders should monitor these specific thresholds closely as breaking through either could signify a more decisive directional move for Cronos in the upcoming sessions.

Is Cronos a good investment?

Investing in Cronos offers a strategic opportunity in decentralized finance (DeFi) and digital assets. As the native token of the Crypto.com chain, Cronos supports DeFi, NFTs, and decentralized apps, benefiting from interoperability with ecosystems like Ethereum and Cosmos. Its energy efficiency, fast transactions, and low fees enhance its appeal. With a strong total value locked (TVL) and promising future growth projections, Cronos stands out as a compelling long-term investment in the blockchain space.

Will Cronos recover?

Cronos (CRO) shows potential for recovery, as Crypto.com aims to broaden its financial services with ambitious 2025 plans. The platform intends to launch its own stablecoin, introduce ETFs, and offer stock trading options, targeting a deeper integration with traditional finance and expanding its user base in the U.S. market.

Will Cronos reach $0.5?

Based on long-term forecasts, Cronos (CRO) is projected to reach $0.5 by 2027 as its ecosystem and user adoption continue to grow.

Will Cronos reach $1?

Projections for Cronos estimate it could reach $1 by 2029, driven by its expansion in DeFi, NFT integrations, and partnerships.

Will Cronos reach $100?

It is unlikely that Cronos’s price will reach $100, as this would require an extremely high market capitalization beyond the current Cro coin price prediction for the crypto sector.

Does Cronos have an excellent long-term future?

Cronos CRO holds promising long-term potential due to Crypto.com’s ongoing innovations, such as DEX expansions, NFT integration, and metaverse applications, collectively enhancing CRO’s appeal and utility. These strategic initiatives, along with CRO’s liquidity and staking rewards, position it as a solid investment for those with a long-term perspective

Recent news/opinion on Cronos

Cronos Chain has announced the rescheduling of its zkEVM mainnet upgrade, originally planned for January 9, 2025, to incorporate the latest enhancements. The network will remain operational on the initial date, with a revised timeline to be announced soon.

CRO price prediction January 2025

For January, Cronos (CRO) is primed for notable growth. The minimum projected trading price is $0.1614, with an average of around $0.183. CRO is expected to attain a peak price of $0.237.

| Month | Potential Low | Potential Average | Potential High |

| January | $0.1614 | $0.183 | $0.237 |

CRO price prediction 2025

In 2025, experts suggest Cronos will trade at a minimum price of $0.2274 and a maximum price of $0.2644. The average trading price is expected to be around $0.2338.

| Cronos Price Prediction | Potential Low | Potential Average | Potential High |

| Cronos Price Prediction 2025 | $0.2274 | $0.2338 | $0.2644 |

CRO price prediction 2026-2031

| Year | Minimum Price | Average Price | Maximum Price |

| 2026 | $0.3314 | $0.3431 | $0.3974 |

| 2027 | $0.4847 | $0.4985 | $0.5592 |

| 2028 | $0.7065 | $0.7314 | $0.8316 |

| 2029 | $1.01 | $1.04 | $1.24 |

| 2030 | $1.46 | $1.50 | $1.74 |

| 2031 | $2.15 | $2.22 | $2.52 |

Cronos price prediction 2026

The Cronos price prediction for 2026 suggests a minimum of $0.3314, a maximum level of $0.33974, and an average price of $0.3431.

CRO price prediction 2027

In 2027, the price of Cronos is predicted to reach a minimum of $0.4847. CRO can reach a maximum level of $0.5592 with an average trading price of $0.4985.

CRO price prediction 2028

The Cronos price prediction for 2028 suggests a minimum value of $0.7065, a maximum value of $0.8316, and an average trading price of $0.7314.

CRO price prediction 2029

According to the findings, the CRO price could reach a minimum of $1.01 and a maximum of $1.24, with an average forecast price of $1.04.

CRO price prediction 2030

In 2030, the price of Cronos is predicted to reach a minimum of $1.46. CRO can reach a maximum price of $1.74 with an average trading price of $1.50.

Cronos CRO price prediction 2031

The price of CRO is predicted to reach a minimum of $2.15 in 2031. It can further reach a maximum price of $2.52 with an average price of $2.22.

Cryptopolitan’s Cronos CRO price prediction

According to our Cronos price forecast, the coin’s market price might reach a maximum value of $0.2644 by the end of 2025. By 2026, investors can anticipate an average price of $0.3431 and a maximum price of $0.3974, provided the market is bullish.

Cronos market price prediction: Analysts’ CRO price forecast

| Firm | 2025 | 2026 |

| Gov.Capital | $0.21 | $0.24 |

| DigitalCoinPrice | $0.45 | $0.53 |

| CryptoPredictions | $0.23 | $0.40 |

Cronos historic price sentiment

CRO price history | Coinmarketcap

- CRO launched at $0.01977 in December 2018 and saw early fluctuations, hitting $0.07344 by March 2019, but ended 2019 at $0.03358. In 2020, CRO rose steadily, reaching above $0.20 by August before dropping to $0.06 by year-end.

- In 2021, CRO followed the crypto bull run, surpassing previous highs and achieving an all-time high of $0.9698 on November 24, boosted by listings on Coinbase Pro and Bitrue.

- CRO opened 2022 at $0.5575 but fell to $0.4409, partially due to concerns over a potential security breach on the Crypto.com platform, which temporarily suspended withdrawals in January.

- In 2023, Cronos experienced a peak in mid-March near $0.80, followed by a steep decline and stabilization around $0.20 by mid-year. It maintained a slight oscillation around this range in the following months.

- CRO started 2024 at $0.10, rallied to a yearly high of $0.18 in March, and declined to $0.12 by June. It stabilized between $0.08–$0.10 from July to October, traded at $0.07193–$0.09521 in November, and ended the year in a range of $0.138–$0.234 in December.

- As of January 2025, Cronos is trading within the range of $0.1582 to $0.1637.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.