Why These Altcoins Are Trending Today — March 12

1

0

The crypto market has continued its uptrend today, with total market capitalization rising by $89 billion in the past 24 hours.

This surge has prompted renewed interest in several altcoins, with Hyperliquid (HYPE), Berachain (BERA), and Uniswap (UNI) ranking as some of the most-searched assets today.

Hyperliquid (HYPE)

Hyperliquid’s native token HYPE is trending today due to the activity of a crypto whale. At 8:00 UTC on Wednesday, the whale deposited $5.22 million into Hyperliquid to open high-risk long positions on Ethereum (ETH) and Bitcoin (BTC).

On-chain data shows that the trade includes a 50x leveraged ETH long at $1,884.4, with liquidation at $1,838.2, and a 20x leveraged BTC long at $82,003.9, with liquidation at $61,182. This positioning suggests a strong bullish conviction despite market volatility.

HYPE trades at $13.41 at press time, bucking the broader market uptrend to record a 9% decline. With waning buying pressure, HYPE risks plummeting to its all-time low of $10.44.

HYPE Price Analysis. Source: TradingView

HYPE Price Analysis. Source: TradingView

On the other hand, a spike in buying activity could push HYPE’s price to $15.73.

Berachain (BERA)

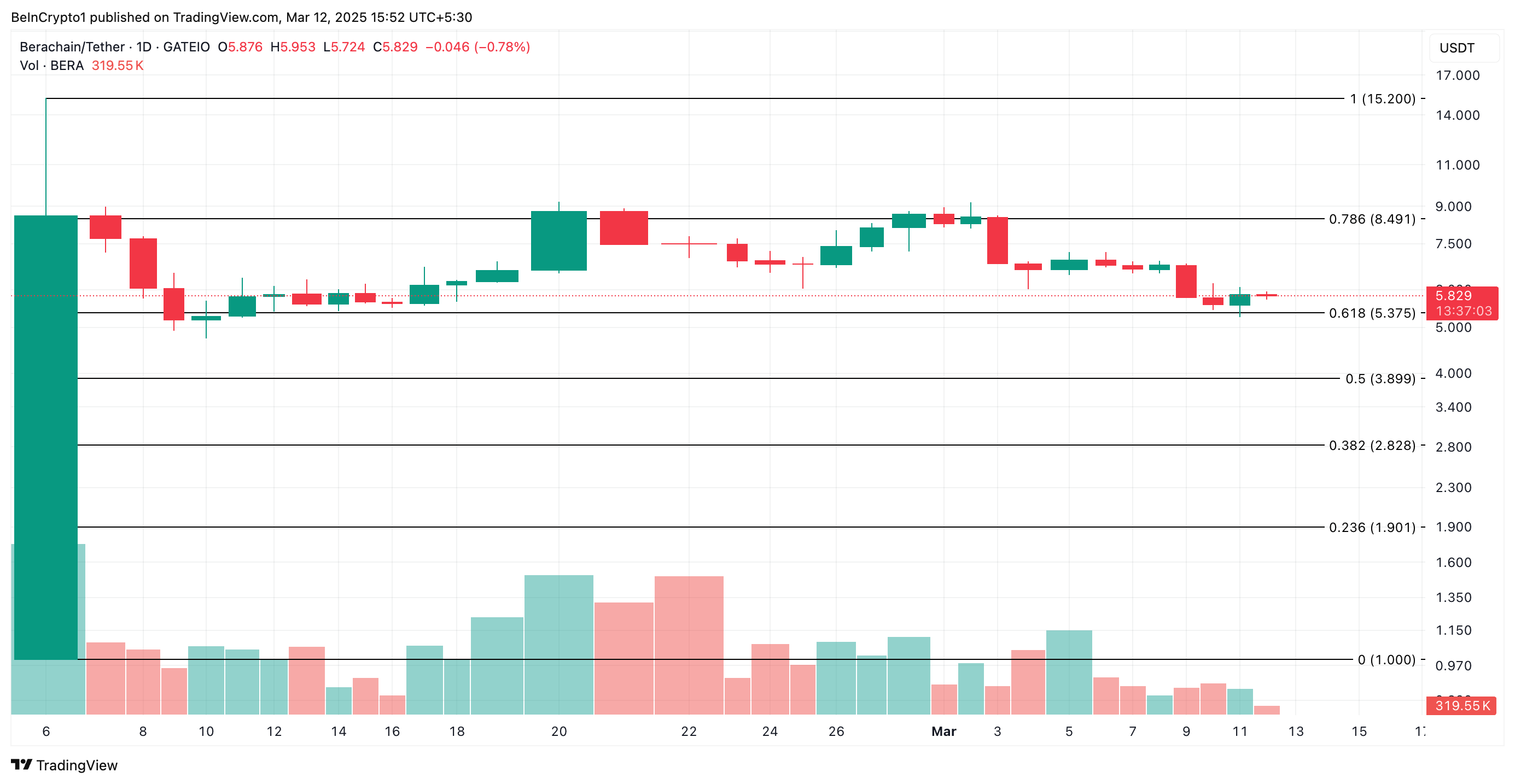

Layer-1 coin BERA is one of today’s trending coins. It currently trades at $5.82, climbing 1% in the past 24 hours.

However, the 50% drop in its trading volume signals that the rally merely mirrors the broader market uptrend and is not driven by actual demand for the altcoin.

This trend confirms the heightened selling pressure among BERA holders, with more participants offloading their holdings. If it persists, the coin’s price could plunge to $5.37.

Nevertheless, the price could decline further to $3.89 if the bulls fail to defend this key support.

BERA Price Analysis. Source: TradingView

BERA Price Analysis. Source: TradingView

Converesly, new demand for BERA could push its price to $8.49.

Uniswap (UNI)

DeFi token UNI is another altcoin that investors are looking at today. Its price is also up 1% over the past day as the broader market recovers from recent lows.

Readings from UNI’s daily chart suggest the altcoin might be gearing for a rebound. Its Relative Strength Index (RSI) is at 30, signaling seller exhaustion.

An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a decline. Conversely, values under 30 indicate that the asset is oversold and could witness a short-term rebound.

UNI’s RSI readings show it is nearing oversold territory, with intense selling pressure. This offers a potential buying opportunity, as prices may be undervalued and due for a rebound. If this happens, UNI could rally toward $6.57.

UNI Price Analysis. Source: TradingView

UNI Price Analysis. Source: TradingView

However, this is not always the case. Oftentimes, the RSI declines further, exacerbating the downward pressure on the asset’s price. If this happens, UNI’s price could drop to $4.70.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.