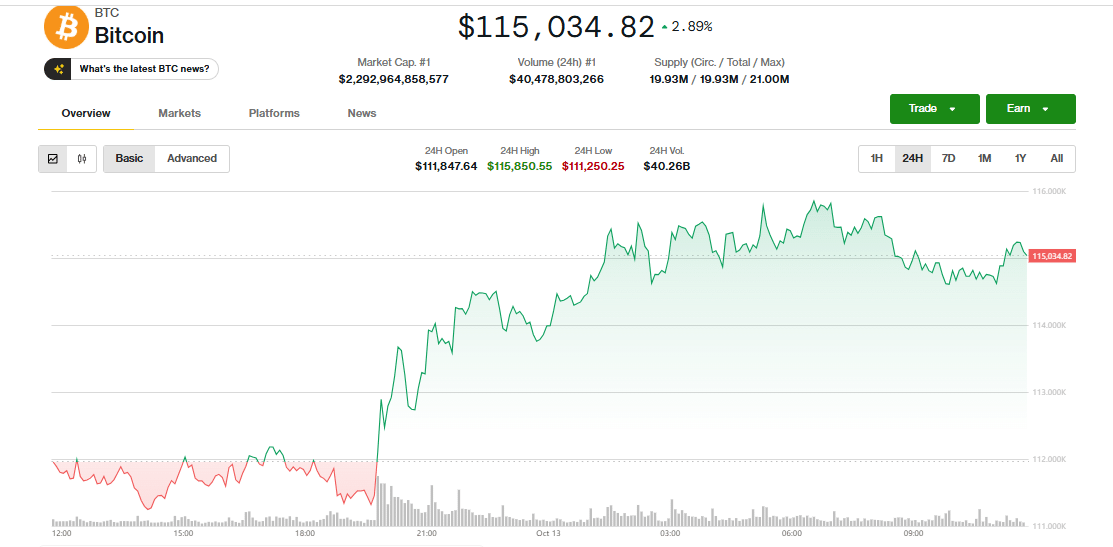

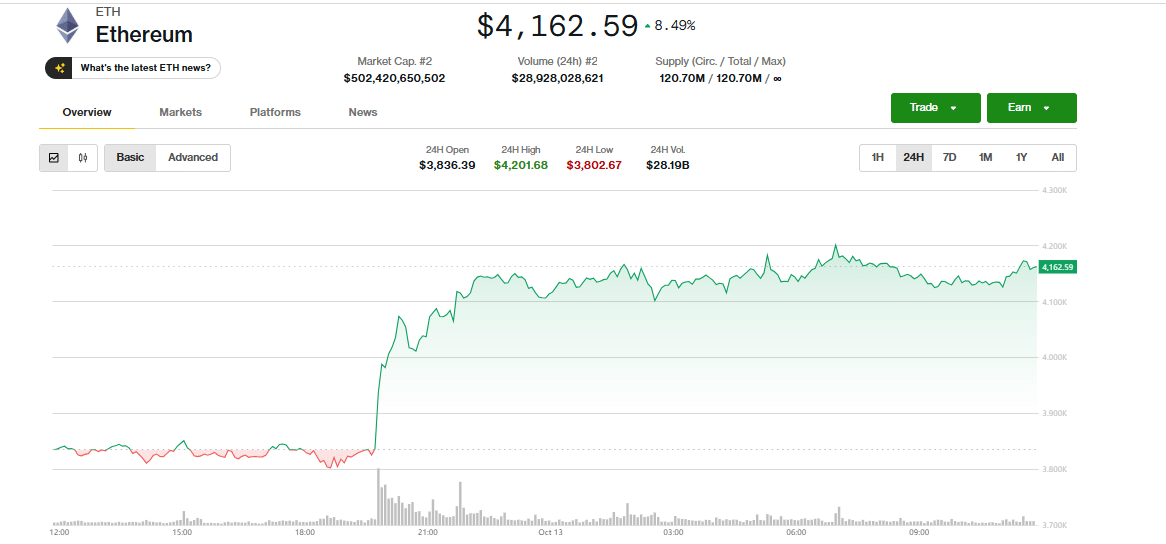

Bitcoin Hits $115K, Ethereum Breaks $4,100 as Altcoins Ignite Market-Wide Surge

1

0

According to market data, the surge in Bitcoin and Ethereum prices has lifted crypto sentiment after one of the toughest weeks traders have seen in months. Both coins rebounded over the weekend, recovering from a steep one-day drop that erased billions in value. The sharp comeback has given investors a sense that confidence might be slowly returning.

Sharp Crash, Swift Recovery

On Friday, the crypto market shed about $19 billion within hours, triggering forced sell-offs and rattling traders worldwide. The whole crypto situation had turned around so quickly by Saturday night that the Bitcoin and Ethereum price surge had almost completely wiped out the slide.

Bitcoin was around $114,000, and Ethereum was rising to $4,100, thus getting back to the point where many were thinking that the levels were lost for good.

Also Read: Bitcoin Ethereum and XRP Price Prediction September outlook and what traders need to know

What Powered the Surge

Political Sentiment Shifted Overnight

A weekend statement easing U.S.–China trade tension fueled the recovery, calming traders who feared escalating tariffs. According to an official source, President Trump’s remarks that “The U.S.A. wants to help China, not hurt it” helped calm market fears. The timing of the post, released after Wall Street closed, left crypto markets to digest the news first, triggering a wave of buy orders.

Technical Rebound Took Hold

Once Bitcoin and Ethereum breached support levels, traders saw an opportunity. Dip-buying intensified as algorithms detected oversold conditions. Analysts say the sharp reversal was partly mechanical, amplified by liquidations of short positions and renewed accumulation by large holders.

Liquidity Cascades and Derivatives

The surge also ignited a liquidation wave in derivatives trading, as short positions were forced to close. Over $370 million worth of leveraged bets were wiped out, adding momentum to the upside.

Altcoins Join the Rally

The Bitcoin Ethereum price surge lifted the broader market. Solana, BNB, and Dogecoin gained between 10% and 15%. That kind of widespread movement suggests growing confidence beyond Bitcoin and Ethereum. Analysts will watch whether altcoins can maintain momentum if prices stabilize early this week.

| Coin | Approx Gain |

|---|---|

| Bitcoin | ~5 % |

| Ethereum | ~20 % |

| Solana | ~10 % |

| BNB | ~15 % |

| Dogecoin | ~11 % |

Risks and What to Watch

The rally is promising but still fragile. Policy changes, tariff threats, or macro shocks could quickly reverse the trend. Traders are watching whether the Bitcoin Ethereum price surge holds above resistance zones on daily closes. Sustained volume and consistent buying pressure remain essential for further upside.

Bitcoin trades near $115,000, and Ethereum stays around $4,162, both holding steady above their weekend support levels. If prices climb higher, the rebound remains intact. If they slip below those marks, it signals that sellers are taking back control.

Final Thought

The latest research points to the Bitcoin Ethereum price surge as a harbinger of a shift in crypto sentiment. The sudden turnaround of the market indicates that digital assets are still very much affected by the political signals and the changes in liquidity.

Sustained strength will depend on fresh inflows, stable macro data, and institutional confidence. For now, the recovery offers a reminder that crypto’s heart still beats strongest during volatility.

For expert insights and the latest crypto news, visit our platform.

Summary

After a huge market crash, Bitcoin and Ethereum prices saw a strong comeback, which was driven by political confidence and technical buying. The Bitcoin and Ethereum price rise also benefited altcoins and restored market optimism; however, analysts are still cautioning that the trend will rely on the volume’s strength and the economic and policy changes that are about to come.

Glossary of Key Terms

- Support / Resistance: Levels where price tends to pause or reverse.

- Liquidation: When leveraged trades close automatically after heavy losses.

- Altcoin: Any cryptocurrency other than Bitcoin.

- Volume: Total amount traded in a given period, indicating strength or weakness.

- Derivatives: Contracts based on the price of another financial asset.

FAQs About Bitcoin Ethereum Price Surge

Q: What triggered the Bitcoin Ethereum price surge?

A: Political reassurance on U.S.–China relations and technical rebounds after a resounding crash.

Q: Is the surge sustainable?

A: Only if volume stays strong and resistance breaks hold.

Q: Which altcoins gained the most?

A: Solana, BNB, and Dogecoin rallied alongside Bitcoin and Ethereum.

Q: Should traders buy now?

A: Entering mid-rally carries risk. Wait for confirmation of trend continuation.

Read More: Bitcoin Hits $115K, Ethereum Breaks $4,100 as Altcoins Ignite Market-Wide Surge">Bitcoin Hits $115K, Ethereum Breaks $4,100 as Altcoins Ignite Market-Wide Surge

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.