How Much Did Trump Family Make From The WLFI Token Launch?

0

0

According to reports, the Trump family’s net worth jumped by about $5 billion after the launch of the WLFI token through their World Liberty Financial venture.

The debut silently became one of their biggest milestones in decades. It pushed digital assets to the center of their portfolio and even outpaced real estate in value.

WLFI Token Launch Reshapes Trump Family Wealth

Donald Trump is listed as “Co-Founder Emeritus.” His three sons are official co-founders of World Liberty. The family holds less than 25% of WLFI tokens. Their allocations are still locked, but the trading debut gave them billions in paper wealth through market valuation.

WLFI’s launch worked like an initial public offering. Before trading, early investors could not resell their privately bought tokens. The debut opened secondary markets and locked in billions in paper gains.

Also, the Wall Street Journal noted that World Liberty raised $750 million last summer. A circular deal let the Trumps keep up to three-quarters of revenue from WLFI sales, adding as much as $500 million. The venture also bought a public company to strengthen its balance sheet before launch.

Alongside WLFI, World Liberty launched USD1, a stablecoin tied to the dollar and backed by US Treasuries and cash. It is already listed on major exchanges such as Binance and Upbit, as BeInCrypto reported.

In its first hour, WLFI hit about $1 billion in trading volume, according to CoinMarketCap.

Early Investors Score Massive Gains

Presale buyers got WLFI at $0.015 and $0.05. Once secondary trading began, they made returns of over 2,000%. The surge gave insiders huge windfalls and showed both the upside and risks of early crypto launches.

The Trump family’s crypto reach goes beyond WLFI. Entities linked to the family control about 80% of $TRUMP, a memecoin worth billions. Trump Media — the operator of Truth Social — is valued at around $2.5 billion and also holds crypto assets.

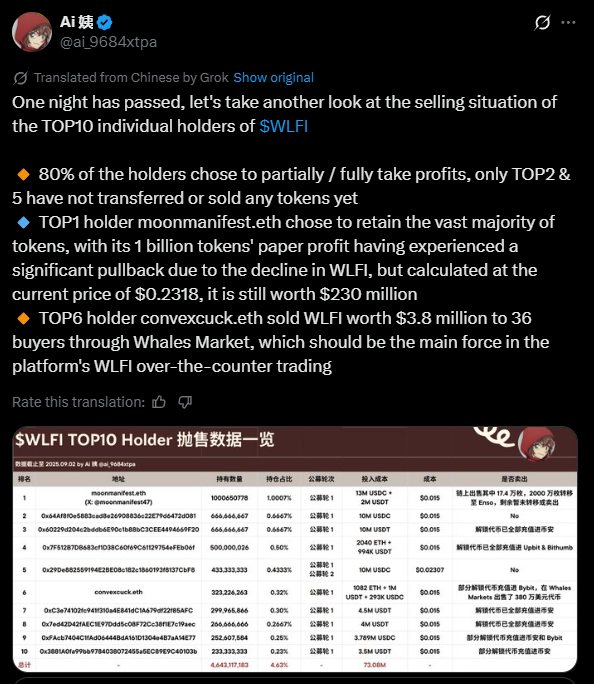

Still, many investors rushed to cash out after the launch. On-chain data posted on X shows that 80% of the top 10 WLFI wallets were either partly or fully sold. Only the second—and fifth-largest wallets stayed intact.

On-Chain Report on WLFI Profit Taking

On-Chain Report on WLFI Profit Taking

The top wallet, moonmanifest.eth, still holds most of its 1 billion tokens, yet its paper profits have fallen since the peak.

Another big holder, convexcuck.eth, sold $3.8 million worth of WLFI to 36 buyers through Whale Market, making it a major off-exchange seller. Such concentrated actions show how whale trades can spark volatility and shape sentiment in new token markets.

Buyback Plan Sparks Debate

To ease early selling pressure, the WLFI community proposed a buyback-and-burn plan. BeInCrypto reported that all protocol-owned liquidity fees would go toward buying tokens and sending them to a burn address. This would cut supply for good.

“This isn’t some meme coin,” Donald Trump Jr. tweeted after the launch. He presented WLFI as a governance token with bigger ambitions.

Supporters call the plan a deflationary tool to reward long-term holders. They also see it as a way to link protocol use with scarcity. Critics argue it could drain treasury funds, block reinvestment, and add volatility in thin markets. The collapse of Terra Luna 2.0 still serves as a warning.

Centralization Concerns

WLFI also faces questions over governance. In July, a BeInCrypto report flagged the “World Liberty paradox.” While marketed as decentralized, the token is still shaped by the Trump family and a small group of investors.

Donald Trump personally holds billions in WLFI governance tokens. Outside backers such as Justin Sun and Abu Dhabi’s Aqua 1 Foundation have invested tens of millions.

“In crypto markets, the ideals of decentralization often clash with the reality of capital concentration and brand-driven influence,” Erwin Voloder of the European Blockchain Association told BeInCrypto that WLFI reflects a wider tension

The Trump family’s move into crypto has already reshaped their wealth. However, WLFI’s long-term success will depend on more than early paper gains.

With whales selling, governance in elite hands, and political scrutiny rising, WLFI must show it can be more than just a speculative play.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.